Cabot will be the exclusive provider for the 1,500 megawatt Lackawanna Energy Center

Cabot Oil & Gas (ticker: COG) announced today that the company has signed a 10-year sales agreement to be the exclusive provider of natural gas supplies to Invenergy LLC’s Lackawanna Energy Center power plant.

The proposed facility is a natural-gas fueled 1,500 megawatt combined-cycle generating station located in Lackawanna County, Pennsylvania, which is expected to commence commercial operations in mid-2018 and reach full-scale operations by year-end 2018, according to the company’s press release. Once it reaches maximum capacity, the plant is expected to burn up to 240,000 dekatherms of natural gas per day.

The Lackawanna Energy Center will be one of the most efficient power plants in the United States, Invenergy said in a press release that announced the combined-cycle plant’s groundbreaking on April 25, 2016. The company said the plant will be equipped with three of GE’s highest efficiency gas-powered combustion turbines, three heat recovery steam generators, and a steam turbine. The company said the plant will use less fuel and generate fewer emissions.

Pricing for Cabot tied to the price of electricity, not natural gas – Cabot Treasurer Matt Kerin discusses the deal with OAG360®

The pricing terms for the natural gas supplied by Cabot is confidential, the company said, but pricing will be tied to power prices, rather than natural gas prices. COG’s press release said this decision “[eliminates] risks for each of the parties involved in the transaction.”

When asked about the choice to go with a contracted linked to electricity prices, Cabot Treasurer Matt Kerin said the contract offers robust rates of return for the company while still reducing the risk of pricing spikes for end-users, making it a win-win situation.

“There are some floors and caps in the deal,” Kerin told Oil & Gas 360®. “Obviously, if natural gas prices went to $10, it wouldn’t be as attractive, but there are strong rates of return for Cabot in the contract.”

KLR Group’s Head of Research John Gerdes commented that “power and gas prices correlate rather tightly.”

Natural gas supplied by Cabot to the Caithness Moxie Freedom project, also in Pennsylvania, is under a similar agreement, Cabot’s Kerin added. Between the two projects, Cabot will be providing more than 400,000 dekatherms of natural gas per day directly to power plants in the Northeast. One dekatherm is the approximate energy equivalent to 1 Mcf of natural gas or one million Btu, according to FERC.

Finding outlets for natural gas in the Northeast

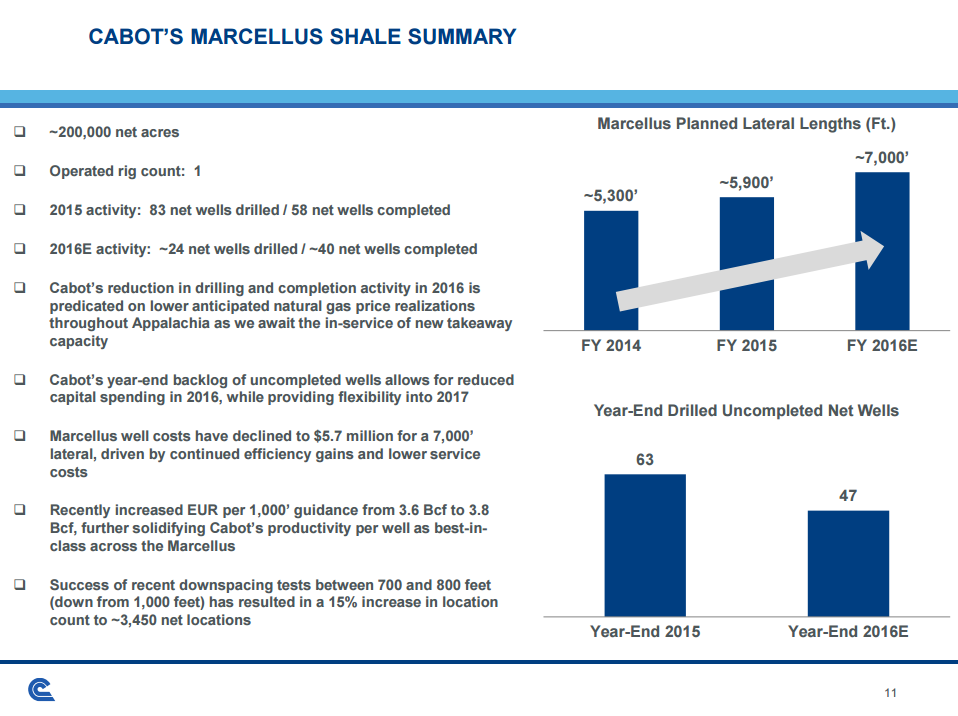

Cabot’s acreage is located primarily in the Marcellus Shale, which faces infrastructure limitations. COG’s deals to supply roughly 400 MMcf/d directly to power generators who are “in our backyard,” as Cabot Chairman, President and CEO Dan Dinges put it, will allow the company to offload some of the production that has been trapped in the North East United States from infrastructure limitations.

A note from Johnson Rice & Company this morning said it expects the Federal Energy Regulatory Commission to approve the Atlantic Sunrise pipeline project later this year, which should move 850 MMcf/d gross to Cabot south to mid-Atlantic markets as well.

Cabot Oil & Gas will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver, Colorado, on August 15, 2016, at 10:50 a.m. EST. To learn more about Cabot and other companies presenting at this year’s The Oil & Gas Conference®, click here.