Oil sands to drive growth

The recent political fracas over pipelines like the Keystone XL and the Dakota Access Pipeline generated a significant amount of attention on pipelines from Canada. With the current administration’s approval or expected approval of both lines, one might assume that Canadian oil producers will have sufficient pipeline capacity for the future. However, according to a recent report by the Canadian Association of Petroleum Producers (CAPP), this is not the case.

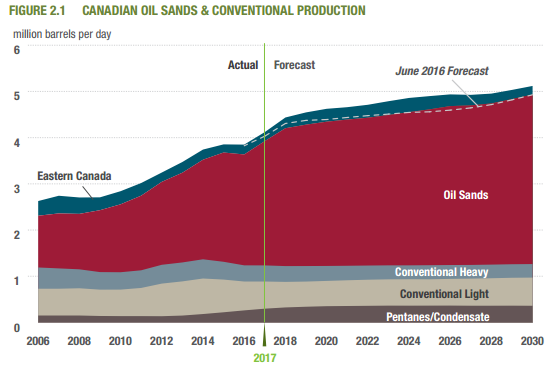

53% oil sands production growth predicted

According to CAPP, total Canadian oil production will grow by 1.3 MMBOPD through 2030, from current rates of 3.85 MMBOPD to 5.1 MMBOPD. This will primarily be driven by a 53% increase in oil sands production, which CAPP predicts will reach 3.7 MBOPD by 2030.

Conventional production of oil is expected to be essentially flat, producing an average of just under 900 MBOPD from now to 2030. Western Canada utterly dominates the Canadian oil production landscape, but Eastern Canadian production will increase in the next few years. The offshore Hebron project in Newfoundland is expected to begin production at the end of the year. This project will push Eastern Canadian oil output to peak at about 310 MBOPD in 2024, but a lack of major future projects means production will decline thereafter.

Oil sands production is predicted to increase despite continued decreases in oil sands CapEx. Like most other projects, companies operating in Canada’s oil sands pulled back spending in the wake of the downturn, and spending has not yet recovered. According to CAPP, $15 billion in capital will be spent in developing the oil sands this year. While certainly a large number, this is significantly lower than the $34 billion spent in 2014.

IHS makes similar growth predictions

IHS has similar predictions for growth in oil sands output. According to a recently-released blog article from the company, Canada will be the second-largest source of global oil supply growth after U.S. shale. IHS predicts that total oil sands production will grow by about 500 MBOPD in both 2017 and 2018. This massive growth is due to the completion of projects begun before the price downturn. After 2018, the decreased spending will begin to become noticeable in growth rates. However, even after 2019 IHS anticipates yearly growth around 100 MBOPD.

Need will exceed current pipeline infrastructure by 38%

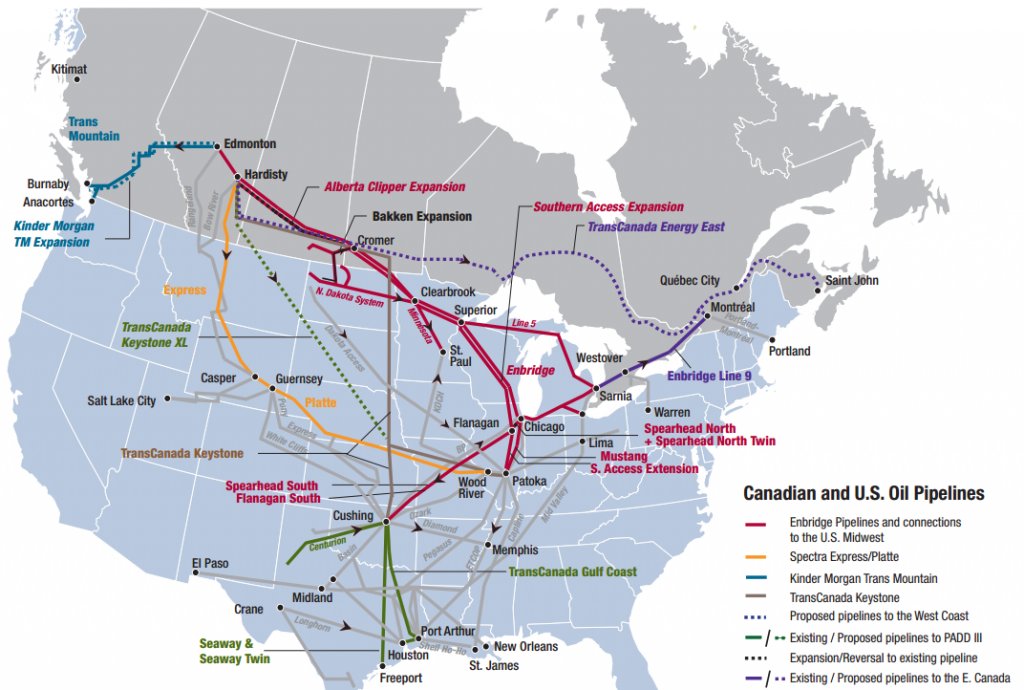

This growth will seriously exceed current pipeline transport capacity, which CAPP estimates totals 4 MMBOPD of oil and oil products. Future growth will require a total of 5.5 MMBOPD of capacity for oil and oil products, about 38% more than current infrastructure is capable of transporting.

TransCanada Energy East will send oil east, internationally

One of the most important planned pipeline expansions is the TransCanada Energy East. Canada generally lacks significant infrastructure to directly transport oil from the centers of production in Western Canada to the population centers in Eastern Canada. The proposed TransCanada Energy East would do much to solve this problem, as it would bring oil by Quebec City and Montreal, ending its route at Saint John. The pipeline has a planned capacity of 1.1 MMBOPD, and is targeting completion in 2021.

The TransCanada Energy East line would not only add significant oil takeaway capability, but could fundamentally change the Canadian oil export system. Currently 99% of all Canadian oil exports go to the United States. A major pipeline terminating at a port will allow the country to send its oil to international markets. This would likely have several implications for oil markets.

Additional oil from Canada would certainly not improve the current oil glut. While the potential exported oil does not itself represent new production, it would be oil moving directly to the international market instead of to the U.S. This could also have a positive impact however. Decreased oil to the U.S. could go a long way to decreasing the large current inventory surplus, which has weighed on prices for several months.

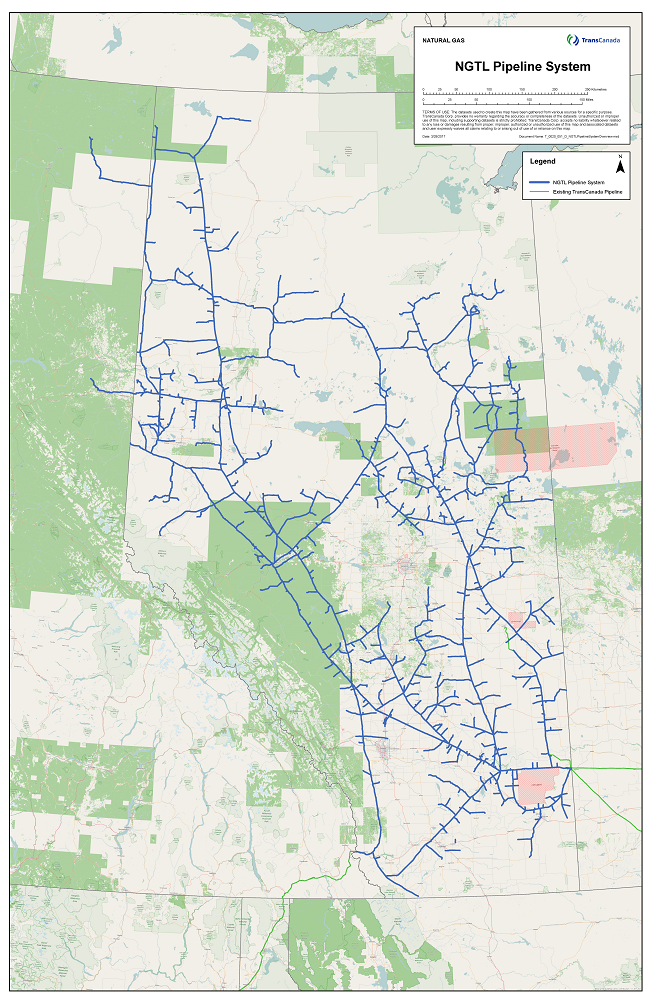

NOVA expansion improves Montney gas capacity

TransCanada also plans to invest $2 billion in expanding its NOVA gas transmission system, based on new demand for about 3 Bcf/d of gas. The NGTL system collects gas from producers in Alberta and Northeast British Columbia, connecting with several significant gas pipelines. This would help support the booming Montney, Duvernay and Deep Basin activity.