New Canadian oil sands projects are more costly to shut down than continue running

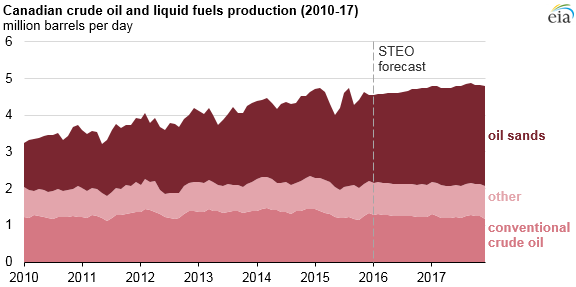

Despite lower oil prices, Canadian oil sands production is expected to continue growing, and be the main driver behind increased Canadian production as a whole, in the short-term. A number of projects which were already under construction in 2014 when crude oil prices collapsed will begin production in the next two years, making up most of the increases, the EIA said in a report Thursday.

Production of petroleum and other liquids in Canada, which totaled 4.5 MMBOPD in 2015, is expected to average 4.6 MMBOPD in 2016 and 4.8 MMBOPD in 2017. Oil sands production is expected to increase 300 MBOPD by the end of that time period, offsetting declines in conventional oil production.

The average price of Western Canadian Select in January was just $18.42 per barrel, about $15 less than U.S. benchmark WTI due to transportation costs and differences in quality. Despite the price differential, many oil sands projects are expected to continue operating. The projects’ 30-40 year lifespans, along with shutdown costs of $0.5-$1.0 billion, could make continued operations more profitable in the long-run than shutting down and waiting for prices to come back up.