CARBO Ceramics (ticker: CRR), a production enhancement services provider based in Houston, Texas, is not immune from the recent commodity downswing. Even though United States production is expected to remain flat or even increase through 2015, the declining rig count will affect CARBO’s operations in the near-term. “This is pretty historic,” said Gary Kolstad, Chief Executive Officer of CARBO Ceramics, in the company’s Q4’14 conference call. “We’ve seen frac crews show up and the client will suddenly stop the operation, so don’t underestimate how fast the industry is slowing down.”

The industry has shown signs of the bottom recently, as oil prices have crawled above the $50/barrel mark. The United States rig count has fallen by nearly 25% since December 5, with the latest update consisting of 1,456 domestic rigs in operations. Kolstad said the turn of events is one of the many cycles in the industry, and CARBO is well positioned to emerge from the shifting environment. “The industry has been through this many cycles, for me it’s four pretty severe ones, and I think this one will be number two on the list,” Kolstad said.

CARBO Backed by KRYPTOSPHERE, Cost Versatility

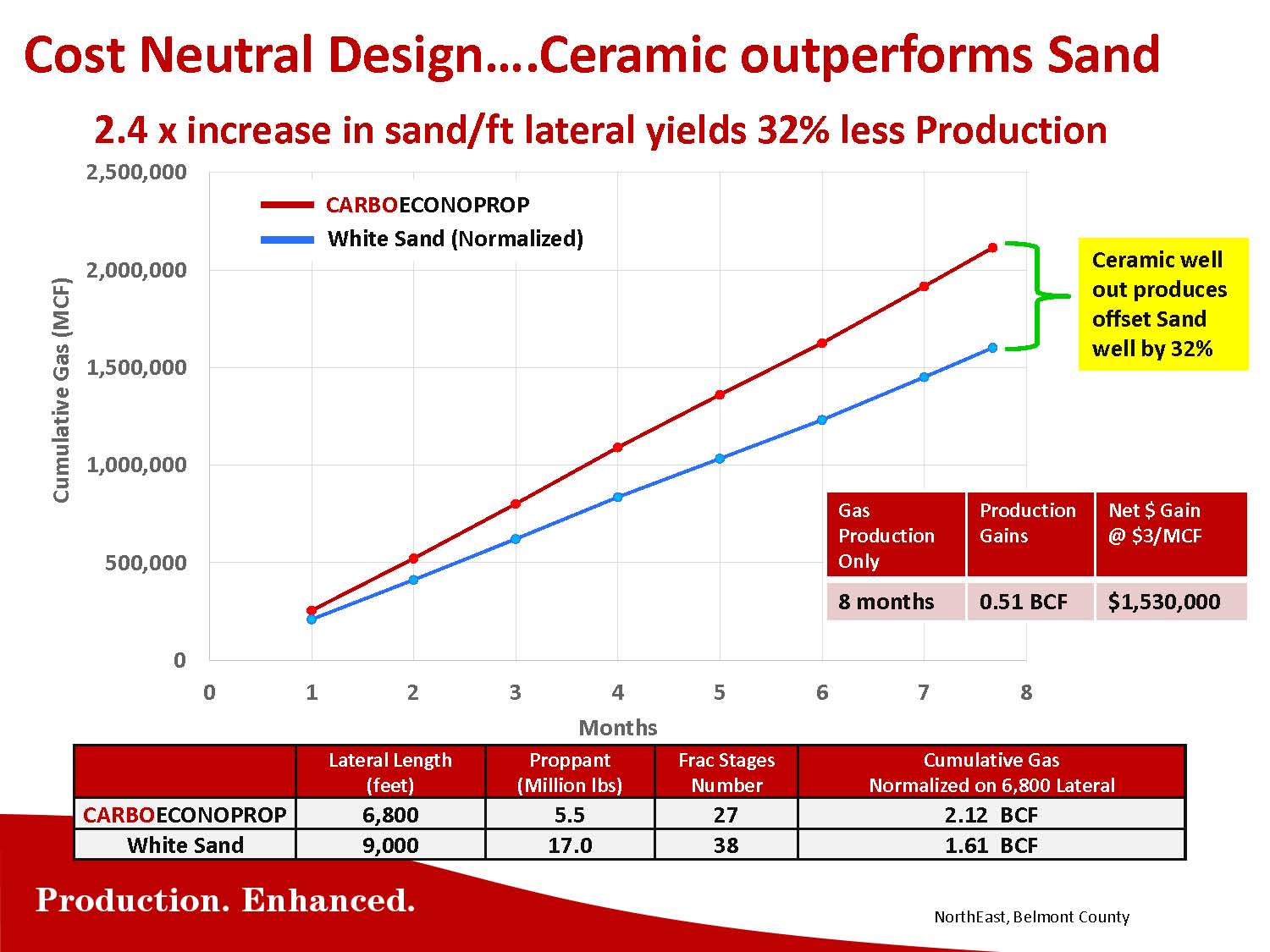

CARBO management acknowledged the fact that many producers are cutting costs, sometimes at the expense of production. CRR has established foresight to meet its clients’ needs by implementing cost-neutral and production-neutral designs, and details the benefits of using ceramic proppant as opposed to sand.

“We have completed numerous wells and have several other pending with our cost-neutral design,” Kolstad explained. “If you do cost-neutral you’re obviously going to get more production out of ceramic, so you’ll have improved production at the same cost. Now when we go into production-neutral, you’ll have lower costs with ceramic than sand. It’s just a way of working backwards.”

CRR’s KRYPTOSPHERE proppant, described as the company’s high-end product, does not fit into such neutral designs because of its superiority in the market, said company management. KRYPTOSPHERE was pumped into a deepwater well in the Gulf of Mexico in Q4’14 (its first), and management says final results, for comparisons sake, are not expected for up to six months. “We do know the operator was pleased,” said Kolstad.

Some E&Ps are still on somewhat of a proppant learning curve, but CRR says its products are particularly appealing to oil service providers because less proppant volumes are needed in comparison to sand, prolonging the life of service equipment and reducing the amount of disposed materials.

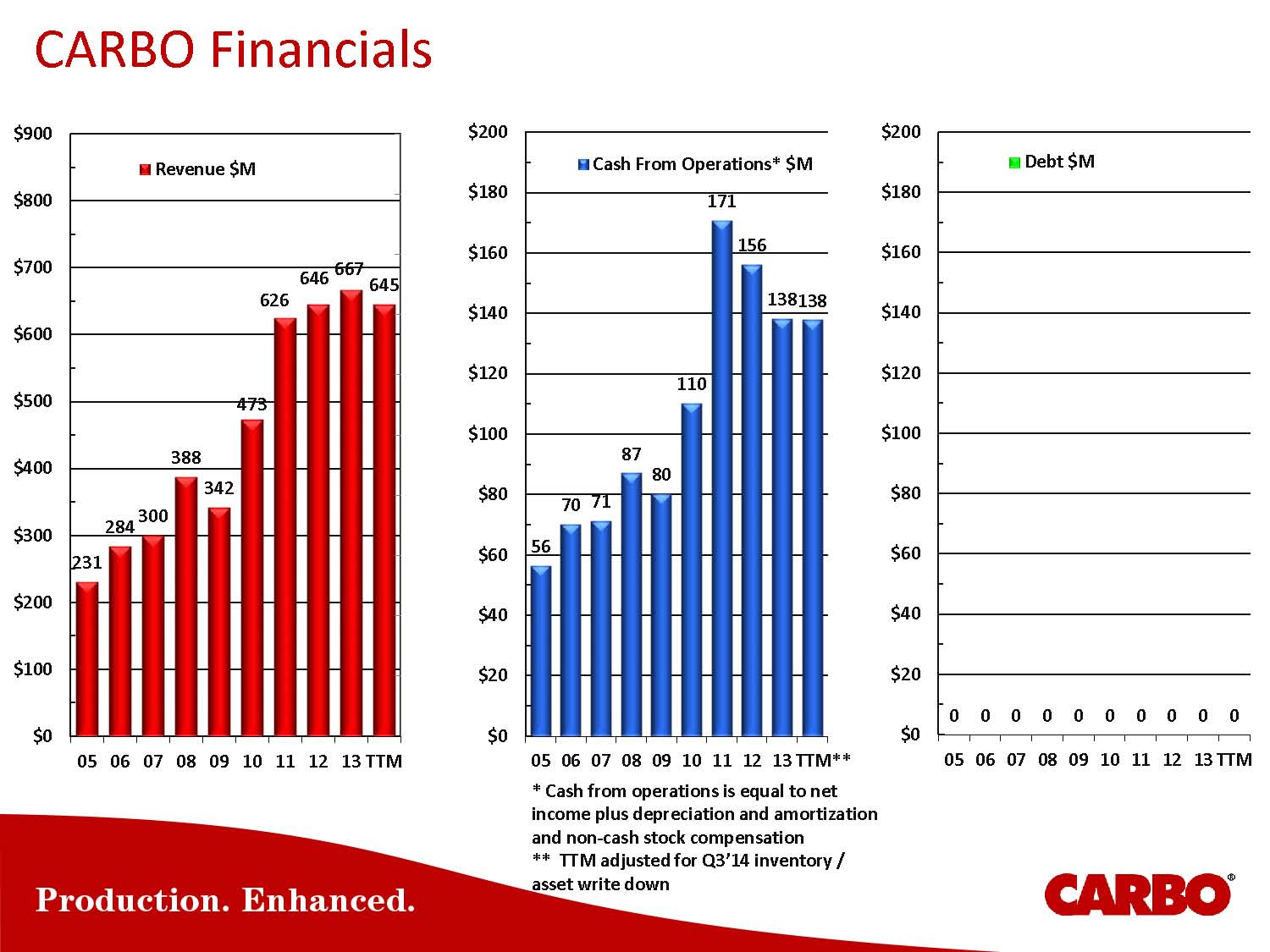

Financials are Solid

CARBO has no debt on its balance sheet and has a market capitalization of approximately $880 million. In EnerCom’s OilService Weekly report for the period ended February 6, 2015, only two of the 44 service companies have no debt. CRR’s operating profit percentage, based on Q3’14 numbers, is 17% – above the industry median of 7%. The results from Q4’14 will be updated once all companies have announced their respective results.

Management said capital adjustments are being made to keep pace with the decline in rig activity and expects capital expenditures for 2015 to be less than half of 2014 expenditures. “We have a strong balance sheet to weather the storm,” Kolstad said in the call. “Our frac platform differentiates ourselves from others, and our clients tell us we have the best distribution which allows the best service and saves them money.”

Part of the deferred expenses will be spent on repurchasing up to two million shares of common stock, as authorized by the Board of Directors last month. “This speaks to our confidence in our long-term business outlook,” said Kolstad. The company currently has roughly 23 million shares outstanding.

Turning the Page to 2015

On a full-year basis, the company increased its product sales by 41% in 2014 compared to 2013. Highlights from its CARBOLITE®, CARBOECONOPROP® and STRATAGEN technologies in Texas oil plays include respective cumulative oil production increases of 52% and 70% over 180 and 90 day periods, in comparison to the use of sand.

CARBO’s capital adjustments for 2015 include retrofitting a plant with its KRYPTOSPHERE technology while deferring the completion of its second ceramic proppant manufacturing line at its Georgia facility. Management said the adjustments were made accordingly based on reduced market demand for completion materials, and the possibility of revisions will depend on market clarity.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.