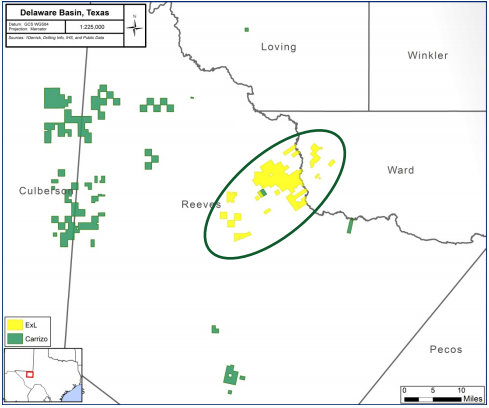

$648 million pushes Carrizo’s Delaware acreage to 42,600 acres

Carrizo Oil & Gas (ticker: CRZO) announced the acquisition of Delaware Basin acreage, the latest in a series of Permian transactions.

Carrizo will acquire 23,656 gross (16,488 net) acres in Reeves and Ward counties for $648 million in cash from ExL Petroleum Management. Current net production from the acreage is about 8,000 BOEPD from eleven producing wells. Seven additional wells are in the process of drilling, completion or flowback.

Based on the current wells on the acquired acreage, Carrizo believes the Wolfcamp A, Upper Wolfcamp B and Lower Wolfcamp B are each target zones. These targets mean the acquired properties represent more than 350 net drilling locations. The Avalon, 1st Bone Spring, 2nd Bone Spring, 3rd Bone Spring, Wolfcamp X/Y, Wolfcamp C and Wolfcamp D zones are all potential future targets.

The acreage is mostly contiguous, which will allow longer laterals during development. Carrizo estimates that the average lateral length of future wells on the property will be 7,300 feet, with more than 40% of the acreage able to support 10,000 foot lateral wells.

Based on the results of the wells drilled by ExL and nearby operators, Carrizo predicts that most wells in the acreage will have EURS of 1,300-1,500 MBOE, with breakevens below $35/bbl.

Crude oil production to grow 39% in 2017

This acquisition significantly increases Carrizo’s stake in the Delaware Basin, from a net position of 26,100 acres to a current 42,600 acres. To account for this additional acreage, Carrizo is changing its expected capital spending program. The company will spend more money to allow it to drill more Delaware Basin wells, with CapEx increasing from around $540 million to $630 million. Carrizo will drill 17 Delaware Basin wells, up from previous estimates of six. However, drilled Eagle Ford wells will decrease from 91 to 75. Crude oil production guidance increases to about 36,000 BOPD, representing 39% growth in 2017.

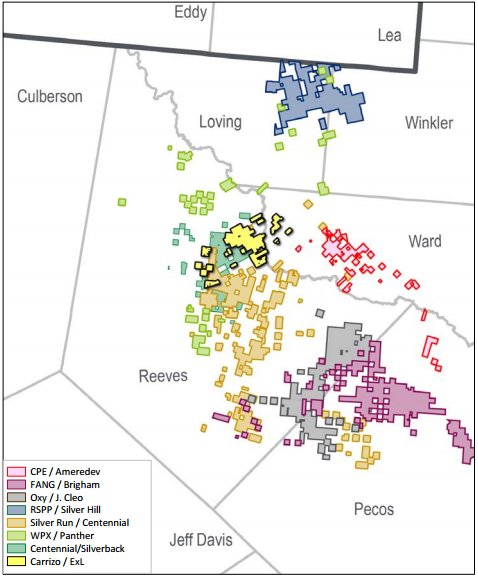

Cost analysis: acreage cost second-lowest among recent nearby deals

ExL Petroleum Management, the current owner of the properties, is a portfolio company of Quantum Energy Partners. Carrizo has agreed to pay ExL $648 million in cash, with an additional contingent payment of $50 million per year if WTI averages more than $50/bbl in any year during 2018-2021, up to $125 million. The acquisition is expected to close in mid-August.

According to Carrizo, after adjusting for current production, this purchase has an acreage valuation of about $22,300 per net acre. Seven other acquisitions have recently occurred near these properties, allowing comparisons between acreage valuations. For example, WPX’s acquisition of Panther Energy, Diamondback’s purchase of Brigham Resources and RSP Permian’s purchase of Silver Hill Energy Partners each involved transactions near this area. If each flowing BOEPD is valued at $35,000, acreage valuations range from $20,900/acre to $45,700/acre, averaging just over $32,000/acre.

Multiple sources will provide funding

Carrizo will use several sources to fund this acquisition. The company has agreed to issue $250 million in redeemable preferred stock to funds managed by GSO Capital Partners. Carrizo also announced the public offering of 15,600,000 shares of common stock, priced at $14.60/share. At the time of writing, Carrizo stock is trading at $16.16. Furthermore, the company announced the offering of $250 million in senior notes due 2025. Finally, Carrizo intends to sell its Appalachian assets and other non-core properties. The company looks to receive $300 million from these divestitures.