Higher-than-expected Delaware production is both a blessing and curse

Carrizo Oil & Gas (ticker: CRZO) reported fourth quarter results and reserves today, announcing a net loss of $23.4 million, or ($0.29) per share. Carrizo earned a total of $78.5 million in 2017, far above the company’s net loss of $675.5 million in 2016.

Carrizo produced 62.4 MBOEPD this quarter, above the high end of the company’s guidance. This represents year-over-year growth of 39%, as Carrizo produced 44.8 MBOEPD in Q4 2016. The vast majority of this growth is due to the company’s Delaware Basin assets, which saw production grow more than fivefold this year. Carrizo also reported significant growth in the Eagle Ford, some of which will be canceled out by the company’s sale of about 24,500 acres in the play in December.

Pro forma growth of 30% expected

Carrizo expects to spend about $775 million in 2018, a projection that assumes double-digit increases in service costs. The company has been able to fix pricing on about half of its services for 2018, and expects to partially offset the remaining cost increases with efficiency gains.

The company expects to drill about 87 net wells and complete 100 net wells in 2018, using two rigs in the Eagle Ford and three or four rigs in the Delaware Basin, as well as two or three completions crews. All this activity is expected to give Carrizo production of about 59.5 MBOEPD, which represents pro forma growth of more than 30%.

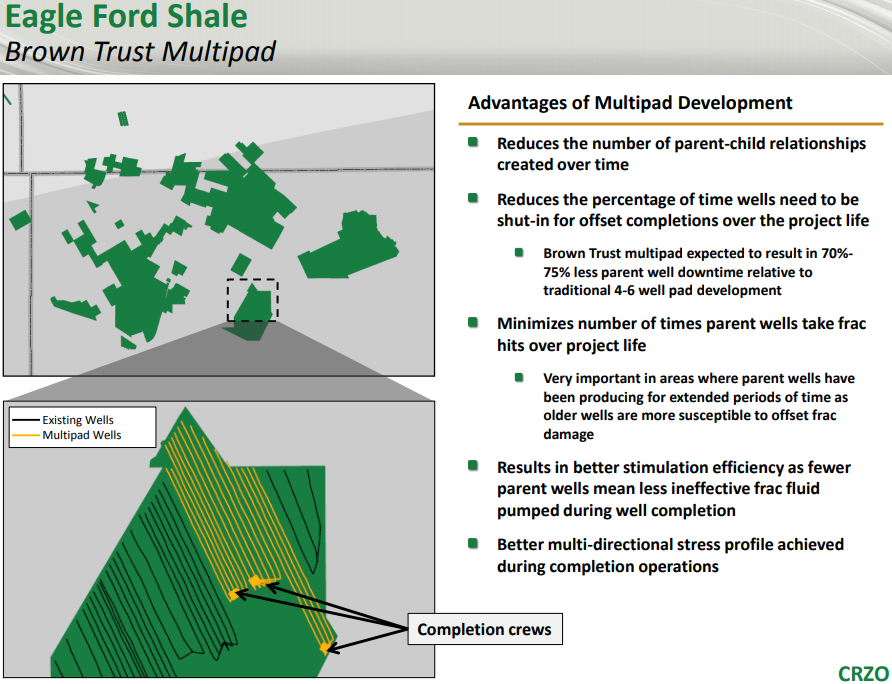

Multipad development minimizes disruptions, well interference

Carrizo reports it will use “multipad” completions wherever possible in the Eagle Ford, using multiple completions crews simultaneously to fill in undeveloped areas. The company plans to complete a 16-well mulitpad utilizing three completions crews in Q1 2018. While this strategy should give improved project returns, it will give more uneven production growth.

This is necessary, as a larger percentage of the company’s new wells are drilled in areas with significant existing production. This means these new wells see decreased production due to parent-child interference. In addition, larger numbers of offset wells must be shut in during completions operations. To minimize these effects, Carrizo reported that it is simultaneously completing wells.

Delaware wells have higher pressure than expected-but also higher water volumes

In the Delaware Basin, Carrizo is primarily focusing on assessing the productivity of the Wolfcamp B. So far, the company has been very pleased with the results it has seen. Wolfcamp B wells have shown higher-than-expected flowing pressures, which Carrizo believes could lead to a shallower decline than anticipated.

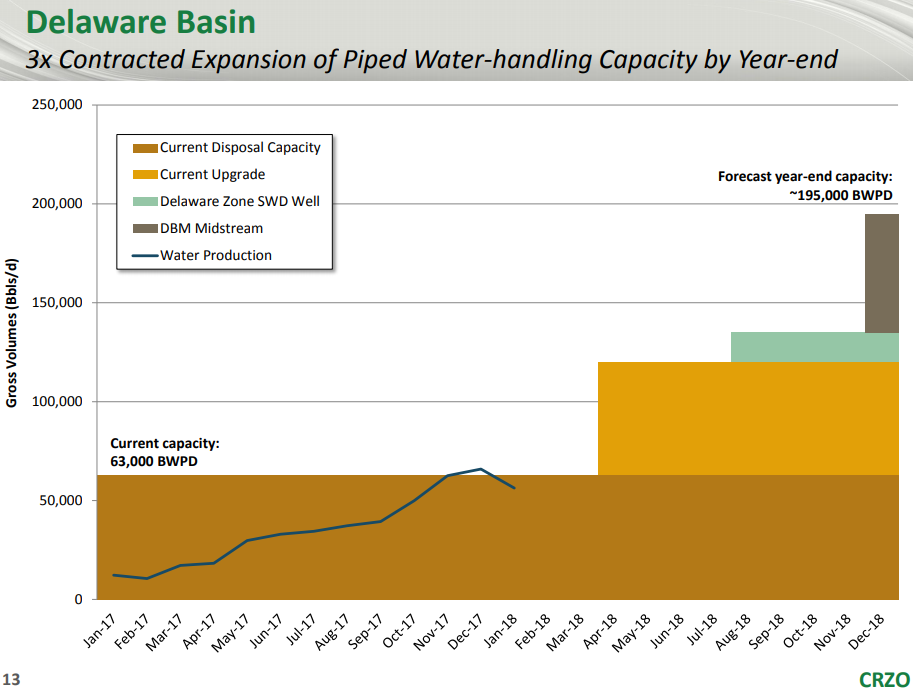

However, while these wells have produced at stronger rates than expected, they have also shown higher water-oil ratios than the Wolfcamp A. This meant the company’s produced water volumes were briefly above its takeaway capacity. Delays in forecasted upgrade projects to third-party disposal systems combined with these higher volumes mean Carrizo’s production is currently constrained by the available water takeaway infrastructure. Carrizo could meet current production by trucking away the additional water, but trucking water costs six times what the company pays for piped water disposal. This cost is deemed too high, and so production is currently constrained.

The company has responded to this problem by negotiating additional agreements and installing its own water management system, which will more than triple the company’s water capacity by the end of the year. This problem has delayed Carrizo’s production ramp by a quarter, but these new agreements will give more than enough room for development in the second half of the year.

S.P. “Chip” Johnson, IV, Carrizo’s President and CEO, commented on the results, “The Eagle Ford Shale is currently free cash flow positive at the field level, and we are able to use this excess cash flow to help fund the strong growth we expect to deliver from the Delaware Basin. At the corporate level, we remain committed to achieving cash flow neutrality and expect to be able to deliver this by the fourth quarter of 2018 at an oil price of $55-$60/Bbl, while still generating strong production growth.”

“We remain pleased with the results we have seen from our Phantom area acreage in the Delaware Basin. During the fourth quarter, we continued to deliver strong results from both the Wolfcamp A and Wolfcamp B, with multiple wells delivering peak three-stream 90-day rates in excess of 1,500 Boe/d. Our production from the area is currently constrained by water takeaway capacity via pipeline, but we expect this to be remedied by next quarter, and expect significant growth after that. While our 2018 development program is expected to remain focused on the Wolfcamp A and B, we also plan to test the Wolfcamp C during the year.”

Q&A from CRZO conference call

Q: on the Wolfcamp B, when you all cite you’ve had much harder wellhead pressures than you all had I guess expected at the time of acquisition, can you just give any specifics on that specifically what those have been?

S.P. Johnson: I think, we might have talked about the percentage increase, but I can’t remember at what conference we did that. We’re seeing higher wellhead pressures despite higher water cuts which is kind of even better. I mean, they have higher wellhead pressures with higher water cuts. We don’t like higher water cuts. They appear to be about two extra barrels of water per barrel of oil, maybe going from six – five or six to seven to eight. So, it’s not a major impact in terms of economics, probably less than $1 per barrel of oil on the margin and $0.50 on a BOE, but it’s a lot of volumes that we have to deal with. So, that’s why we’re expanding our system.

Q: on the Eagle Ford as you think about the multi-pad plans for the year, obviously much more of a developed area on the midstream infrastructure side. In facilities across your acreage handle, the big waves of production that will come as you turn on the different multi-pads throughout the year or is it something that you have to kind of manage as you plan the program in terms of spacing and mapping out where those multi-pads will be?

S.P. Johnson: In general, it shouldn’t be a problem because the leases where you have enough room to do multi-well pads are the ones with the biggest facilities and the most takeaway capacity. And one of the good things about the Eagle Ford is that it’s kind of overbuilt in terms of oil and gas pipelines, and it just doesn’t make that much water and there are plenty of saltwater disposal wells and pipe systems that can handle them.

Q: Good morning, guys. Chip, you kind of highlighted getting to a free cash flow neutral or better type of level as you guys are exiting the year. Can you just talk maybe high level to be looking into 2019 and beyond?

You guys have maybe a bias either way, does incremental free cash flow get put back into the ground to accelerate the growth in Delaware or Eagle Ford, or do you guys maybe look to stay neutralist and maybe stack cash relative to further debt repayment? How are you kind of, I guess, managing those two potential uses?

S.P. Johnson: I guess right now we’d say spare cash would go to debt reduction. We have to maintain some level of growth. A company our size has to do that. And so, we’ll have growth targets, but I don’t think we’re going to raise our CapEx budget just because we have the money. I think, we still need to de-lever further.