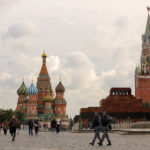

Oil rises on supply concerns as market awaits clarity on sanctions

(Investing) – NEW YORK – Oil prices rose about 1% to a one-week high on Wednesday on worries about supply disruptions in Russia and the U.S., while the market awaits clarity on sanctions as the U.S. attempts to broker a deal to end the war in Ukraine. Brent futures were up 65 cents, or 0.9%, at $76.49 a barrel by 10:38 a.m.