800,000 acres and 24,000 BOEPD sold

Cenovus Energy (ticker: CVE) announced the sale of its Suffield assets today, in a deal worth more than half a billion dollars.

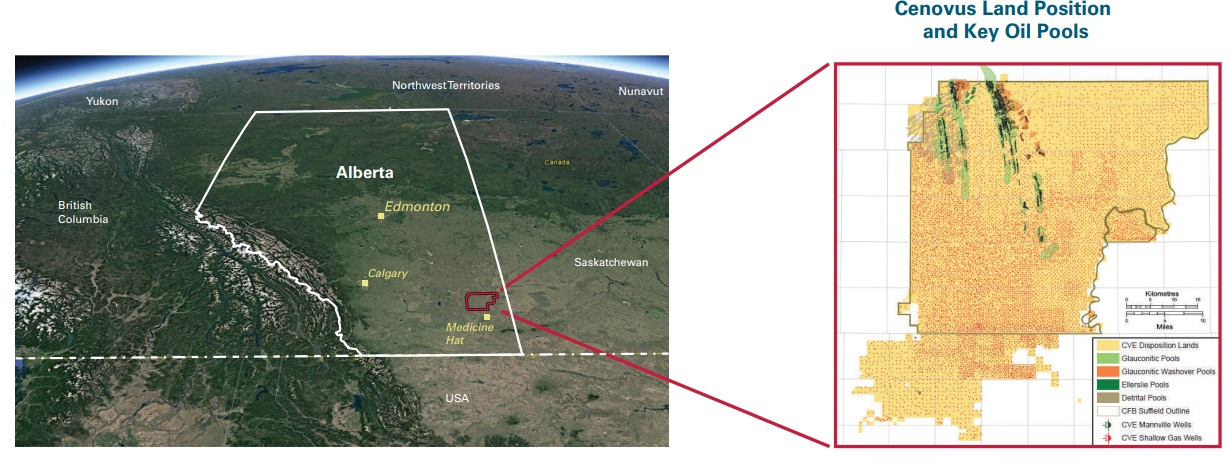

International Petroleum Corporation (ticker: IPCO) will pay Cenovus C$512 million for its assets near Suffield, Alberta. These properties consist of over 800,000 net acres of shallow natural gas rights and 100,000 net acres of oil rights in a large, contiguous position. According to IPC, these properties are currently producing about 24,000 BOEPD, split between 29% oil and 71% gas.

IPC reports that the area has nearly 100 MMBOE of gross 2P reserves, which is enough to quadruple the company’s holdings. Similarly, adding 24,000 BOEPD of production means IPC’s production will more than triple.

IPC believes several development opportunities exist

IPC believes that oil development in Suffield has been undercapitalized. Encana, the previous owner, had a company focus on gas development and therefore did not focus on developing the oil opportunities available. Cenovus primarily focuses on oil sands growth, and only ran a modest drilling program from 2010 to 2013. Since then, there has been minimal drilling and production has declined. Shallow gas development has also been undercapitalized, with virtually no drilling since 2010.

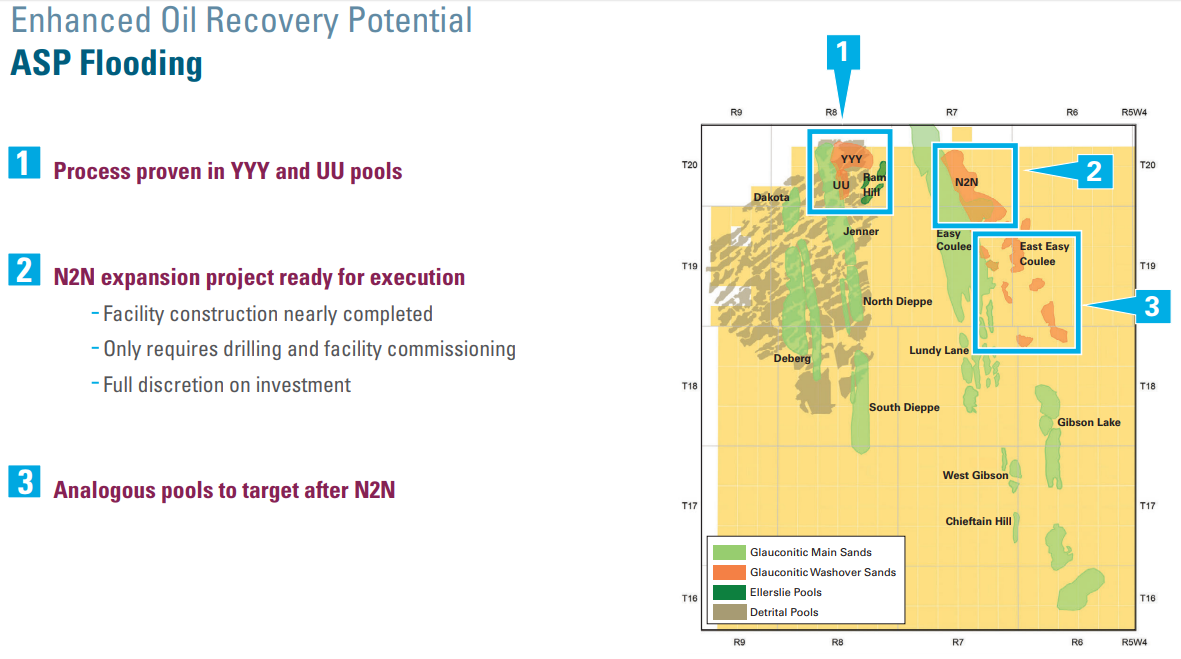

IPC believes several projects can remedy this and restore production to previous highs. Significant infill and step-out drilling is possible, and should be low risk. Enhanced oil recovery projects are also possible. Two small fields in the northern section of the acreage have already undergone alkaline-surfactant-polymer (ASP) flooding. This process is currently being expanded to a larger field, and much of the facility construction is already completed. IPC reports that expansion would only require drilling and commissioning, giving the company full discretion on the investment. If this project is successful, there are additional pools elsewhere in the acreage that could be targeted.

Cenovus will receive $512 million in cash, with $500 million paid upon closing and $12 million paid at the end of June 2018. In addition, IPC will make payments if the price of WTI rises above $55/bbl or the price of natural gas is above $3.50/MMBTU, with a maximum combined payment of $36 million. This means each BOEPD of expected production is valued at $21,600.

Cenovus will pay down debt

Cenovus will use the proceeds of the sale to pay down the debt it acquired in its March purchase from ConocoPhillips (ticker: COP). This $13.3 billion transaction instantly made Cenovus the largest thermal oil sands producer in Canada. The company has been selling other assets since making the purchase, allowing it to focus on its new properties. In the beginning of September, for example, Canadian Natural Resources (ticker: CNQ) purchased heavy oil assets from Cenovus for nearly $1 billion.

Mike Nicholson, CEO of IPC, commented on the transaction “We are very excited to enter into this transformational acquisition of high quality operated assets only five months after the launch of IPC. The Suffield and Alderson assets have been operated safely and efficiently by Cenovus and we are pleased to have reached this agreement to acquire these conventional producing assets as Cenovus focuses on its oil sands and Deep Basin assets. This acquisition fits perfectly with IPC’s strategy of leveraging our existing producing asset base as a platform for value accretive acquisitions of long-life, low-decline producing assets in stable jurisdictions with upside development potential.”