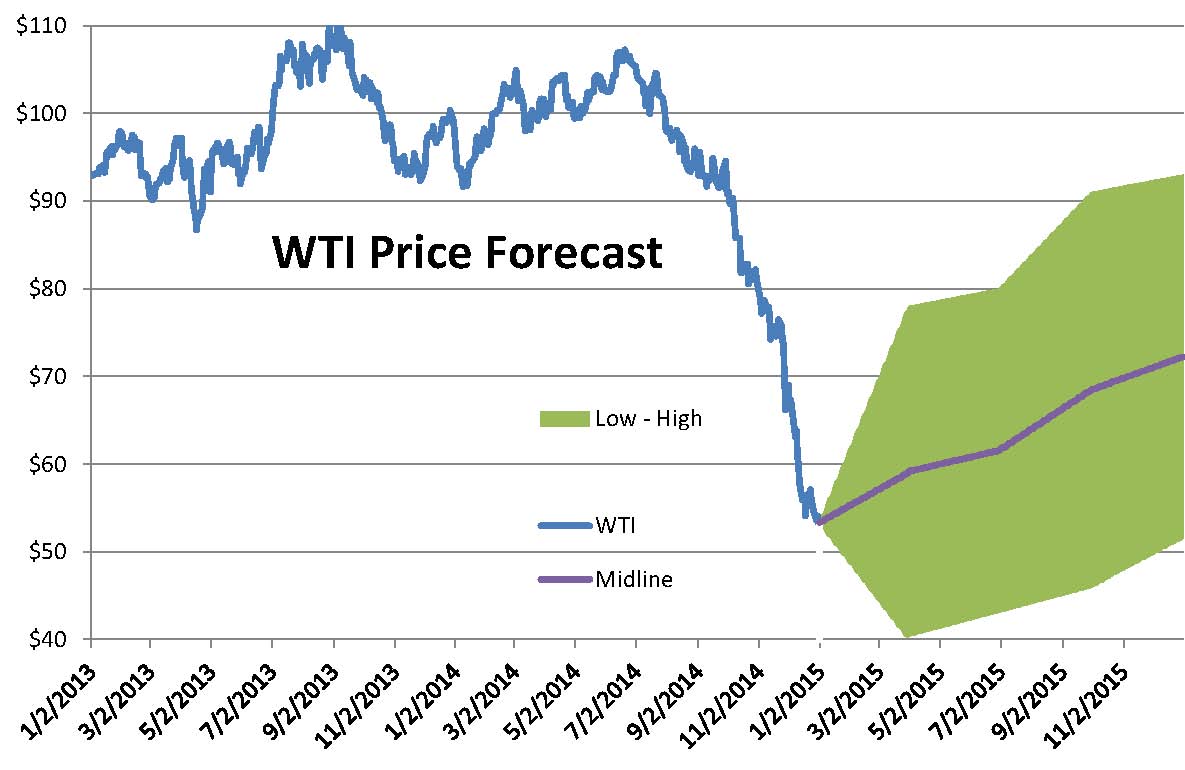

The price of West Texas Intermediate (WTI) crude has taken the oil and gas industry for a wild ride since June. From north of $105, so far we’ve rocketed down the first hill of the rollercoaster and we’re still screaming with our eyes closed.

But if you go by the published WTI price forecasts of 32 large banks, crude is about to bottom out. The bank estimates, supplied by Bloomberg, cover the banks’ average price forecasts on a quarterly basis. Individual estimates can be seen in the table below.

Of the 32 banks, only five have an average Q1’15 estimate below the $45.00 threshold. Already today, WTI has traded between $46.92 and $51.27 and it’s just prior to lunch time. That may be the 2015 definition of volatility. For the quarter we’re in, 14 banks have set their estimates above the $60.00 mark. According to all of the banks, the price is expected to consistently rise throughout 2015, and nobody has oil in the $40’s by Q3’15. Nine expect WTI to climb back into the $90’s range by the fourth quarter. Following the trend line, the midpoint of the spot price is projected to pass the $80/barrel mark by year-end.

WTI prices have experienced a slight relief in recent trading. Yesterday WTI traded higher than Brent for the first time since July 2013, but Brent has since established its dominant position, and at this moment Brent, at $48.99, is trading at a $1.81 premium to WTI. The majority of analysts are predicting a Brent-weighted differential of roughly $5 in their near-term forecasts, indicating how closely the two will be linked in the revamped market. The average spread on a trailing twelve months basis was nearly $9.

| Firm | Q1 15 | Q2 15 | Q3 15 | Q4 15 |

| Nomura International Hong Kong Ltd | 40.00 | 50.00 | 60.00 | 70.00 |

| Itau Unibanco Holding SA | 47.00 | 51.30 | 56.60 | 64.70 |

| Raiffeisen Bank International AG | 47.00 | 51.00 | 57.00 | 64.00 |

| DZ Bank AG Deutsche Zentral- | 50.00 | 57.50 | 65.00 | 75.00 |

| Santander UK PLC | 47.19 | 47.19 | 50.00 | 55.62 |

| Norddeutsche Landesbank Girozentrale | 48.00 | 53.00 | 61.00 | 73.00 |

| LBBW | 45.00 | 50.00 | 55.00 | 60.00 |

| Intesa Sanpaolo SpA | 45.00 | 53.00 | 58.00 | 62.00 |

| Societe Generale SA | 42.00 | 47.00 | 56.00 | 60.00 |

| Deutsche Bank AG | 52.50 | 52.50 | 55.00 | 57.50 |

| BNP Paribas SA | 50.00 | 48.00 | 58.00 | 62.00 |

| Bank of America Merrill Lynch | 64.00 | 68.00 | 74.00 | 82.00 |

| Commerzbank AG | 41.00 | 52.00 | 62.00 | 72.00 |

| Citigroup Inc | 52.00 | 47.00 | 58.00 | 61.00 |

| Prestige Economics LLC | 50.00 | 58.00 | 65.00 | 72.00 |

| RBC Capital Markets | 58.00 | 62.25 | 67.30 | 72.28 |

| Danske Bank A/S | 54.00 | 58.00 | 66.00 | 74.00 |

| Oversea-Chinese Banking Corp Ltd | 60.00 | 65.00 | 70.00 | 75.00 |

| Capital Economics Ltd | 61.00 | 62.00 | 63.00 | 65.00 |

| Natixis SA | 55.00 | 60.00 | 70.00 | 75.00 |

| CIBC World Markets Corp | 58.00 | 67.00 | 82.00 | 85.00 |

| Incrementum AG | 68.00 | 71.00 | 74.00 | 80.00 |

| Lloyds Bank PLC | 69.00 | 72.00 | 79.00 | 82.00 |

| Westpac Banking Corp | 68.00 | 67.00 | 69.00 | 80.00 |

| National Australia Bank Ltd | 72.00 | 75.00 | 80.00 | 82.00 |

| Standard Chartered Bank | 64.00 | 78.00 | 89.00 | 93.00 |

| UniCredit Markets & Investment Banking | 66.00 | 66.00 | 76.00 | 76.00 |

| Toronto-Dominion Bank/Toronto | 65.00 | 68.00 | 70.00 | 75.00 |

| Australia & New Zealand Banking Group Lt | 63.50 | 66.30 | 68.80 | 71.50 |

| Jefferies LLC | 64.00 | 65.00 | 69.00 | 72.00 |

| Macquarie Capital USA Inc | 65.00 | 61.00 | 67.00 | 81.00 |

| Barclays PLC | 78.00 | 80.00 | 91.00 | 91.00 |

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.