Oil and gas investment in politically risky British Columbia

Just a few days before Kinder Morgan Canada said it would halt investment and construction on the Trans Mountain pipeline expansion due to political risk in British Columbia, ConocoPhillips (ticker: COP) announced an acreage buy in British Columbia’s Montney play.

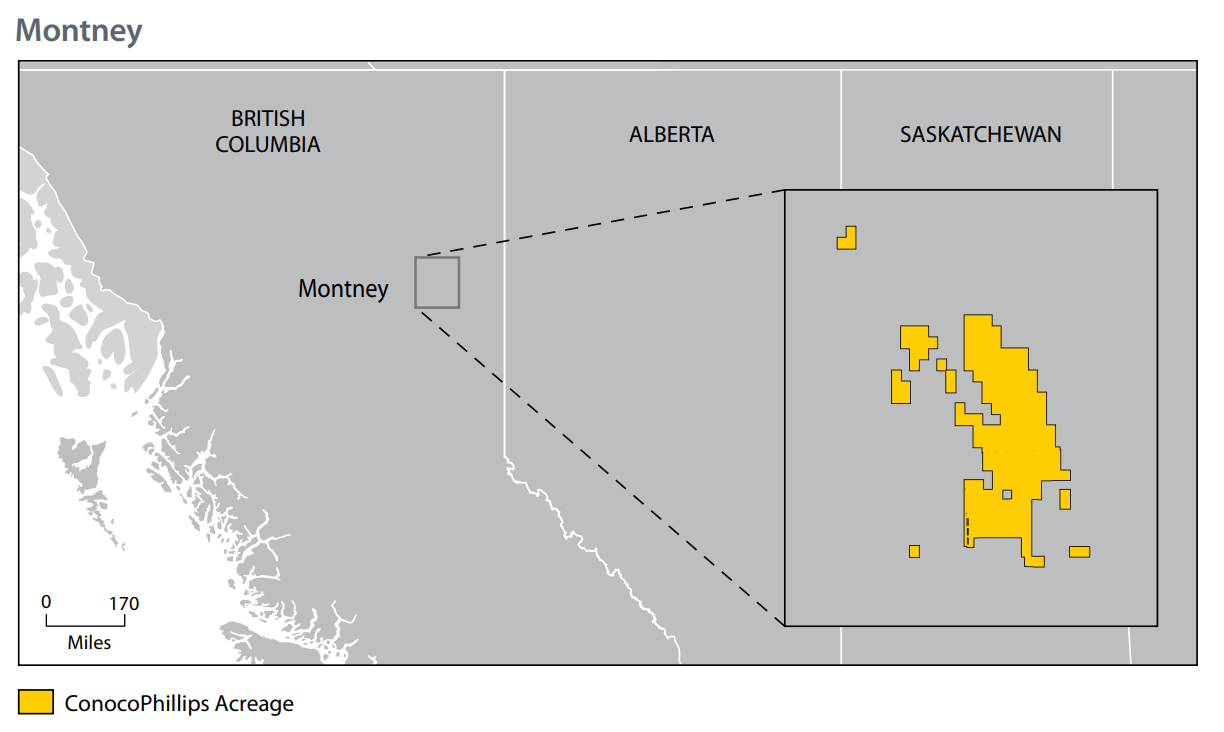

ConocoPhillips Company acquired about 35,000 net acres in the Montney play for approximately $120 million. This additional acreage is adjacent to the company’s existing position in the liquids-rich portion of the Montney. All of the acreage is located in British Columbia.

According to the seller, Calima Energy Limited (ticker: CE1), the acres were acquired by COP at an average cost of C$4,400/acre, and the purchased lands basically had no production, with just two Upper Montney wells drilled. Only one has been completed.

ConocoPhillips now holds approximately 140 thousand net acres in the liquids-rich Montney play, with appraisal underway. Exploration and appraisal activity in the Montney will be funded within the existing exploration budget, ConocoPhillips said.

“We have been laser focused on strengthening our portfolio by divesting non-core properties, while adding high-value resource opportunities for future investment,” said Matt Fox, EVP of strategy, exploration and technology.

“The acreage we’ve acquired in Louisiana and the Montney has the potential to add to our low cost of supply resource base without requiring significant near-term capital commitments. We have been able to fund these acquisitions with proceeds from asset dispositions, while reducing debt, accelerating share repurchases, maintaining capital discipline and retaining cash on the balance sheet,” Fox said.

Political change pushes B.C. to bottom

According to the 2017 Fraser Institute Global Petroleum Survey, British Columbia has dropped down to the least-attractive Canadian jurisdiction for oil and gas investment.

In 2017 B.C. ranked 76th out of 97 jurisdictions. However, in 2016 B.C. was ranked 39th out of 96 jurisdictions. The survey was conducted after the B.C. election and oil and gas executives gave the province low marks for political stability and high regulatory compliance costs.

“Investor confidence matters, and having a government that’s openly hostile to resource development has apparently sent a chill throughout the oil and gas industry,” said Kenneth Green, the Fraser Institute’s senior director of natural resource studies and co-author of the 2017 Global Petroleum Survey.

Legal battles, more politics and Trudeau’s hard choice

Alberta and British Columbia have been trading jabs, initiating a miniature trade-war – B.C. produces wine and Alberta produces oil and gas. Since British Columbia won’t allow Alberta’s energy products to pass through its borders (see: Kinder Morgan Pipeline suspended), Alberta has decided to ban wine imports from B.C.

Canada is a country of the rule of law, and the federal government will act in the national interest. Access to world markets for Canadian resources is a core national interest. The Trans Mountain expansion will be built. https://t.co/97vvScpvOo

— Justin Trudeau (@JustinTrudeau) April 9, 2018

Canada’s federal government could override a provincial government

Due to the federal jurisdiction of the pipeline, Trudeau’s office has constitutional power to override British Columbia. However, as The Wall Street Journal notes, the eco-voters in B.C. may turn against Trudeau in the 2019 Canadian election. As the country’s 3rd largest voting province with Liberal Party leaning, Trudeau will have to tread carefully on these issues or risk alienating a significant chunk of the voters who elected him.

The Kinder Morgan Trans Mountain pipeline expansion would have more than doubled Canada’s capacity to ship heavy oil from oil sands mining operations in Alberta, through the anti-fossil fuel province, to Canada’s west coast for export to growing demand in Asia.