Utica production up 45% Q2 to Q3 2017

CONSOL Energy (ticker: CNX) released its Q3 financials today and announced its division into new subsidiary companies.

New companies, new names and ticker symbols

- The current parent, CONSOL Energy, will change its name to CNX Resources Corporation, and will retain its ticker symbol “CNX” on the NYSE

- CoalCo will change its name to CONSOL Energy Inc., and its common stock will trade on the NYSE under the ticker symbol “CEIX”

- CNX Coal Resources LP will change its name to CONSOL Coal Resources LP. CNX Coal Resources will change its NYSE ticker symbol to “CCR” from “CNXC.” Common units will continue to be listed on the NYSE

Additional details regarding trading of common stock and distribution ratios can be found here.

Share repurchase program

On Sept. 5, 2017, CONSOL’s board of directors approved a one-year share repurchase program of up to $200 million, under which approximately $81 million of its common stock had been repurchased as of October 30, 2017, at an average price of approximately $16 per share. The board also approved an increase in the aggregate amount of the repurchase plan to $450 million.

CONSOL Mining Corporation announces pricing of $300 million of senior secured second lien notes

CONSOL said the company was pricing $300 million of its 11.00% senior secured second lien notes due 2025 at a price of 100% of their face value in a private offering exempt from the registration requirements of the Securities Act of 1933. The notes will pay interest semi-annually in arrears. The expected offering date is Nov. 13, 2017.

Additional details can be found here.

Financial highlights and asset sales

- Net cash provided by operating activities in Q3 of $178 million, compared to $163 million in the year-earlier quarter, which included $5 million of net cash used in discontinued operating activities

- A net loss attributable to CONSOL Energy shareholders of $26 million, or a loss of ($0.11) per diluted share, compared to net income attributable to shareholders of $25 million, or earnings of $0.11 per diluted share, in Q3 2016

- Earnings before deducting net interest expense, income taxes and depreciation, depletion and amortization (EBITDA) from continuing operations were $190 million for Q3 2017, compared to $314 million in the year-earlier quarter

- $30 million in gains on assets sales (pre-tax, attributable to continuing operations)

- $2 million unrealized gain on commodity derivative instruments, related to changes in the fair market value of existing hedges on a mark-to-market basis (pre-tax, attributable to continuing operations)

Non-core Marcellus Shale acres in Allegheny, Westmoreland, Washington, and Greene counties, Pennsylvania, were sold for approximately $55 million. Surface acres and other miscellaneous non-core assets were sold for approximately $27 million. CONSOL has closed on asset sales totaling $427 million year-to-date. Planned non-core asset sales include the Virginia coalbed methane project area and scattered Marcellus and Utica acres.

E&P division

- 101 Bcfe sold, an increase of 5% from the 96.4 Bcfe sold in the year-earlier quarter, primarily from Marcellus Shale volumes

- Total quarterly production costs decreased to $2.26 per Mcfe, compared to the year-earlier quarter of $2.36 per Mcfe

- Capital expenditures increased to $148 million, compared to $49 million spent in year-earlier quarter

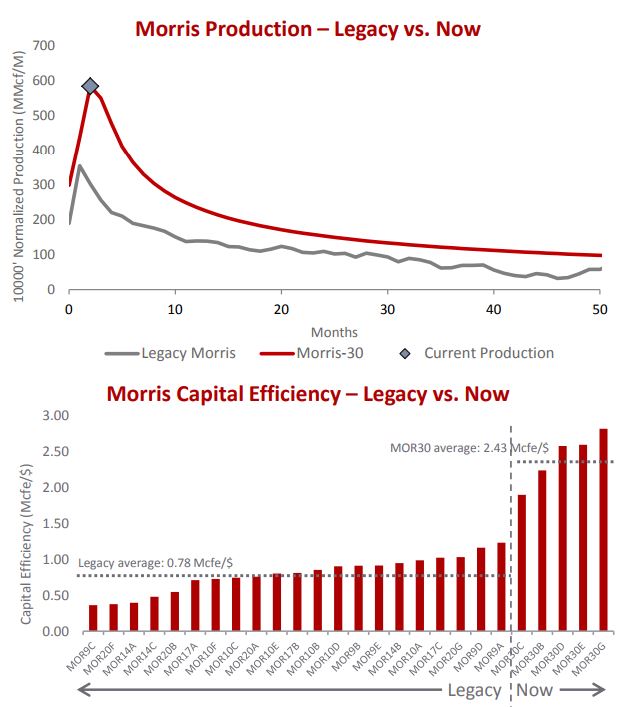

CNX: Legacy Morris comprised of 21 wells TIL March 2012-June 2013; Morris 30 comprised of 5 wells TIL mid-2017

Q3 Marcellus Shale production volumes, including liquids, were 60.4 Bcfe, approximately 17% higher than the 51.8 Bcfe produced in Q3 2016. The increased production is due to 16 new Marcellus Shale wells coming on line during Q3 2017. Marcellus total production costs were $2.20 per Mcfe, which is a $0.13 per Mcfe improvement from Q3 2016 of $2.33 per Mcfe.

Utica Shale production volumes, including liquids, were 20.1 Bcfe, down approximately 11% from 22.5 Bcfe in the year-earlier quarter. Natural production declines in the Ohio wet Utica Shale area caused lower production volumes. Utica Shale total production costs were $1.91 per Mcfe, which is a $0.10 per Mcfe increase from Q3 2016 total production costs of $1.81 per Mcfe. The cost increase was driven by lower Utica Shale volumes, resulting in increased lease operating expense.

CONSOL commented, “Despite the year-over-year production decline, quarterly Utica Shale volumes grew 45% from the second quarter of 2017. This quarter-over-quarter growth was driven by Monroe County, Ohio, dry Utica Shale volumes, which grew 476% in the third quarter to 9.8 Bcf, compared to 1.7 Bcf from the second quarter of 2017.”

For Q4 2017, the company expects growth in Utica Shale volumes to be approximately 33.4 Bcfe, or an increase of approximately 66%, compared to Q3 2017. Monroe County, Ohio, dry Utica Shale volumes are expected to increase approximately 125% to approximately 22.0 Bcfe. Production costs are projected to be $1.70 per Mcfe.

CONSOL Energy President and CEO Nicholas J. DeIuliis said, “We expect fourth quarter volumes to be a little over 120 Bcfe based on the midpoint of our full year 2017 production guidance range of 405-415 Bcfe. This will help drive an estimated exit rate for the year of around 1.4 Bcfe per day, which will set us up to achieve our 2018 production guidance of 520-550 Bcfe.”

Q3 Operations

CONSOL operated two horizontal rigs and drilled six Greene County, Pennsylvania, Marcellus Shale wells and four Monroe County, Ohio, dry Utica Shale wells. The Marcellus and Utica Shale laterals averaged 9,576 feet and 9,007 feet, respectively. The company averaged 17 days to drill the Marcellus Shale wells, which included two wells that the company drilled in less than 14 days. For the Utica Shale wells, the company averaged 17.4 drilling days.

CONSOL utilized three frac crews and completed 21 wells in Q3: five Marcellus Shale wells located in Tyler County, West Virginia; seven Marcellus Shale wells located in Ritchie County, West Virginia; and nine dry Utica Shale wells located in Monroe County, Ohio.

CONSOL turned-in-line 29 wells: seven Marcellus Shale wells located in Ritchie County, West Virginia; four Marcellus Shale wells located in Tyler County, West Virginia; five Marcellus Shale wells and one Burkett Shale well located in Washington County, Pennsylvania; and 12 dry Utica Shale wells in Monroe County, Ohio. The company is on schedule to TIL 15 wells in Q4 2017, including its Aikens 5J and 5M dry Utica Shale wells in Westmoreland County, Pennsylvania.

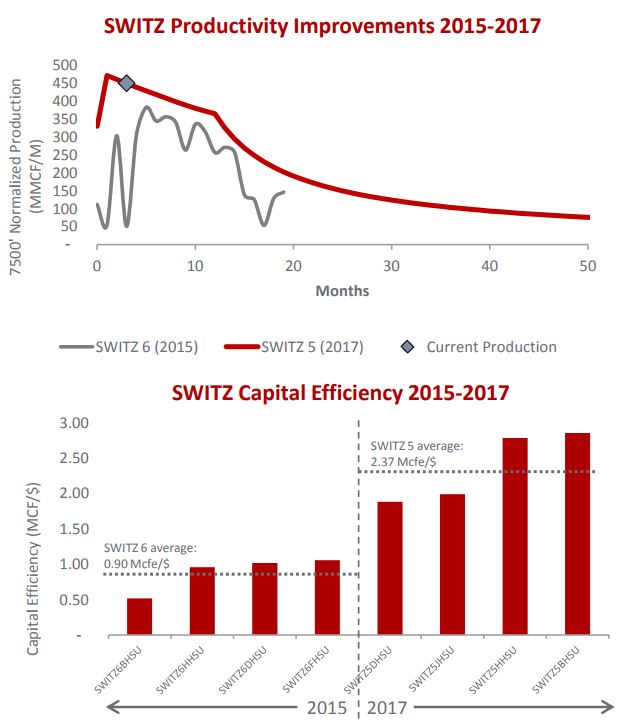

CONSOL Energy increased the estimated ultimate recovery and capital efficiency in the Morris Marcellus Shale field by 77% and 311%, respectively. CONSOL recorded better results in the Switz Utica Shale field by increasing EURs and capital efficiency by 38% and 258%, respectively. The company delivered these results through drilling and completion advancements and reservoir optimization initiatives. Reservoir modeling advancements have driven increased sand loading in each area by 40%-150%, compared to previous designs. Extended laterals combined with increased proppant loading, azimuth optimization, diversion technology, and perforation efficiency have yielded better results.

CNX: As a result of the overhauled pad layout and

completion designs, capital efficiency (Mcfe/$)

on the SWITZ 5 pad increased more than 160%

Conference call Q&A

Q: Regarding West Virginia, there is actually a lot of completion activity there, and should we think of that as cleaning up assets from the former JV, or is there any potential for that area to maybe attract a rig at some point in future?

CONSOL Energy COO Tim Dugan: There is potential there to attract a rig, but there were DUCs that were drilled back in 2014 and 2015. Our well results down there have been very good. We have applied the same completion technology and methodology that we’ve applied in Monroe County, Ohio and in the Morris Field that we talked about in Southwest PA, and we’re seeing similar improvements.

CNX: Improved completion designs, along with increased drilling and completion efficiencies, should show rates of return that are competitive with Monroe in the Utica or Southwest PA in the Marcellus.