Additional capital heading to Uinta and Williston

Q3 Key highlights

- Achieved Q3 2017 average production growth of 10 percent year-over-year

- Increased 2017 average production guidance to 175,500 BOEPD from 174,500 BOEPD based on positive operating results

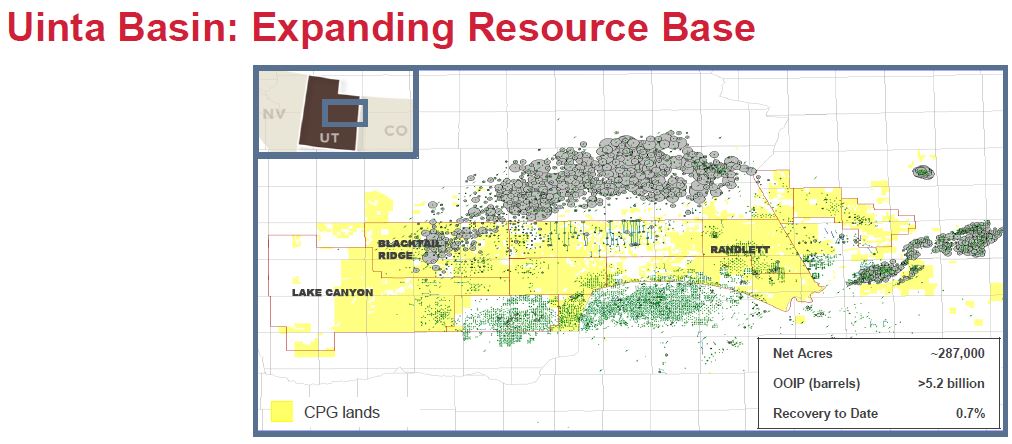

- Advanced new play development in Uinta and Williston basins, organically expanding resource base and inventory

- Transacted over $190 million of non-core dispositions at an accretive metric of approximately $64,000 per flowing Boe

Crescent Point Energy (ticker: CPG) reported Q3 yesterday, saying “Our progress in Uinta has led to new horizontal drilling locations, potentially doubling the productive capacity of our total corporate inventory.”

CPG’s exit guidance remains unchanged at 183,000 BOEPD, as it is in the process of disposing additional non-core assets. Year-to-date, CPG has now sold or reached agreements to dispose of approximately $280 million of non-core assets and will direct proceeds toward debt reduction, increased capital program, and additional growth opportunities. CPG expects to release its 2018 guidance in late Q4 2017 or early January 2018.

Q3 dispositions and agreements entered into subsequent to the quarter will fund a planned increase to CPG’s total 2017 capital expenditures budget of $100 million. This increased budget primarily reflects capital allocated toward new play development in the Uinta and Williston basins, including a new zone within the Flat Lake resource play.

Operational highlights

- Average production of 176,069 BOEPD. This increase of over 15,000 BOEPD since Q3 2016 is driven by growth in each of CPG core resource plays

- In the Uinta Basin, CPG advanced horizontal development across multiple zones. CPG’s previously reported one-mile Wasatch well continues to flow at approximately 1,000 BOEPD and has produced over 200 Mboe in only 125 days. CPG also recently completed a successful one-mile Uteland Butte well with a 60-day flow rate of approximately 640 BOEPD. Initial production rates for the Wasatch and Uteland Butte wells were comprised of over 90 percent oil and liquids, similar to results from the Castle Peak program. CPG plans to complete vertically stacked two-mile horizontals targeting each of the Castle Peak, Wasatch, and Uteland Butte zones in Q4 2017

- During 2017, CPG added approximately 500 net sections in the Flat Lake resource play, targeting multiple zones, including a new large developing resource in the Lodgepole zone. Cost of entry into this larger resource play was less than CAD $40 per acre

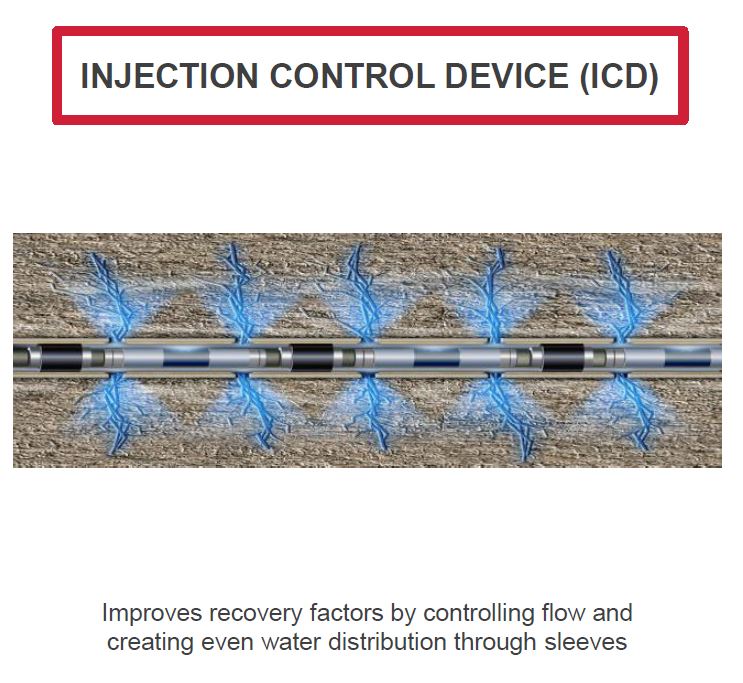

- CPG is improving capital efficiencies and ultimate recoveries by advancing new technologies such as its Injection Control Device (ICD) waterflood systems. CPG currently has 46 ICD waterflood systems in place and remains on track to have a total of 50 ICD systems installed by the year’s end

- As part of its operations improvement program, CPG continued the implementation of remote field monitoring and automation pilots in its core areas to reduce downtime, optimize wellbores and increase staff efficiency. CPG also recently initiated a solar power pilot in Saskatchewan supporting its climate change initiatives

Financial highlights*

- Funds flow from operations totaled $389.0 million or $0.71 per share diluted. CPG achieved a payout ratio of 13 percent based on cash dividends paid of $0.09 per share during the quarter

- CPG spent $423.7 million on drilling and development activities during third Q3, drilling 201 net wells. Total capital expenditures, including land, seismic, and facilities were $505.7 million

- During Q3 2017, CPG completed or entered into agreements to dispose of over $190 million of noncore assets. CPG expects the majority of these transactions to close during Q4 2017 and continues to market additional non-core assets

- CPG continued to add oil hedges during Q3 2017 as part of its risk management program. As of October 23, 2017, 48 percent of Q4 2017 oil production, net of royalty interest, and 25 percent of first half 2018 oil production, net of royalty interest, are hedged at a weighted average market value price of approximately CDN $70.00/bbl. CPG has also recently added oil hedges through to Q2 2019 and continues to have a significant amount of natural gas production hedged through 2019 at a weighted average price of CDN$2.82/GJ

- CPG retains a significant amount of liquidity with no material near-term debt maturities. As of September 30, 2017, CPG’s cash and unutilized credit capacity was approximately $1.5 billion

*All financial figures are approximate and in Canadian dollars unless otherwise noted. This press release contains forward-looking information and references to non-GAAP financial measures. Significant related assumptions and risk factors, and reconciliations are described under the Non-GAAP Financial Measures and the Forward-Looking Statements and Reserves Data sections of this press release, respectively.

Q3 Conference call Q&A

Q: In the context of the shape of the forward curve, largely from an oil perspective, and spending through 2017, can you give us any line-of-sight to what next year could look like in terms of growth perspective and what that means for capital?

Crescent Point Energy President and CEO Scott Saxberg: We’re in the midst of our 2018 budget program. I would say, at these price levels, our CapEx program would be in the similar range as this year, probably the CAD $1.6 billion-ish range is slightly higher just because we’ve grown production. We would probably stick to that level, with the high end being probably CAD $1.8 billion, with an increase in commodity prices here over the next few months we may bump that up. But we’re trying to stay within cash flow and within our budget heading into the new year.

Q: What’s happening in your waterflood initiatives in terms of ameliorating some of the decline rates? And then my second question is on the Uinta Wells, what is your average working interest?

CEO Saxberg: So on the waterflood side, we’ve had some great success with our ICDs. We see that immediate six-month response time. So in the past, with our older water injection schematics on the wells, they were like a year to 18 months to two-year waterflood response. And now with the ICDs, we’re seeing a shorter response time, six to 12 months. That technology continues to move forward.

On the working interest for the Uinta, we’re effectively 100% on the wells that we’ve been drilling out there. So when we talk to 1,000 barrels a day IPs, those are gross. But also, basically, we’re 100% in majority of the stuff we’re drilling.