6,031 wells awaiting completion: a lot of untapped horsepower demand waiting in the wings

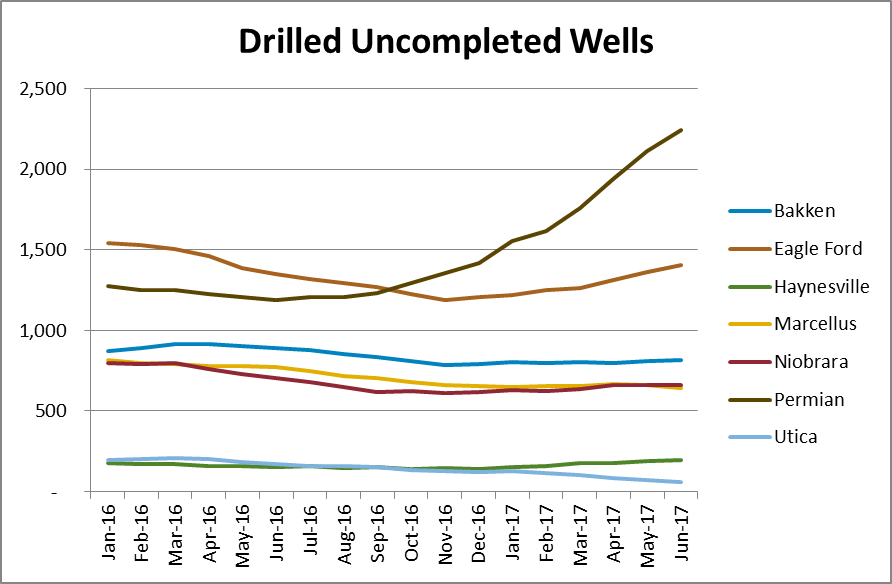

While drilling activity has risen sharply in recent months, completions work has not quite kept up. The number of drilled uncompleted wells in the U.S. has been rising since November, and is now at record levels, according to the EIA.

In total, there are just over 6,000 drilled uncompleted wells in the major U.S. shale basins, up from less than 4,900 in November 2016.

Unsurprisingly, the Permian, the heart of current U.S. oil and gas activity, represents the largest amount of drilled uncompleted wells in the U.S., with an estimated 2,244 wells waiting for fracturing. Drilling has been outpaced by completions in the Permian since June, and has grown by 88% since then.

Until October, however, the Eagle Ford had the highest amount of uncompleted wells, and still ranks second in amount of DUCs. Of the seven major basins tracked by the EIA, only the Utica has seen significant decreases in DUC inventory in 2017.

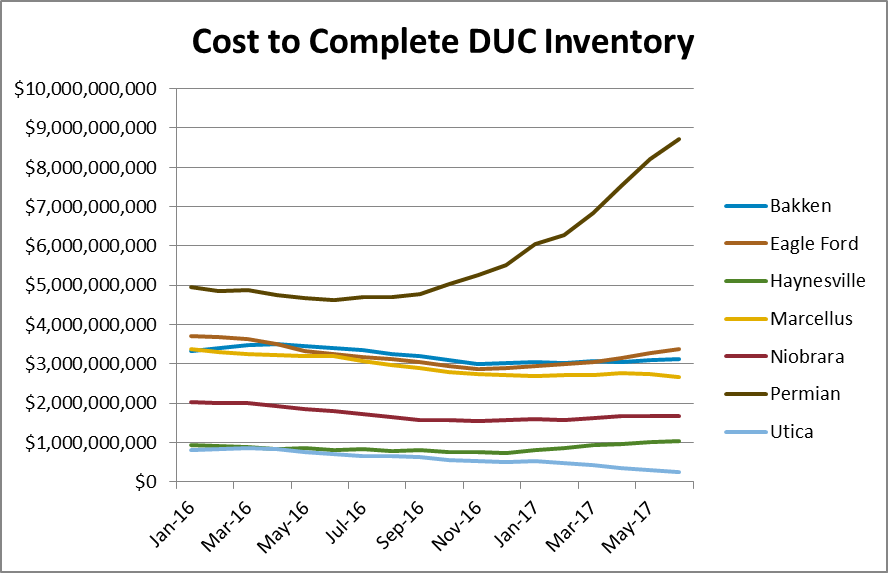

It’s a large future investment: Permian DUCs alone will cost $8.7 billion to complete

Completing all these wells is far from a minimal exercise, however.

Completions—fracs—are typically the more expensive step in drilling an oil and gas well, representing more than half of the cost of most modern wells. And completing the DUC inventory will require significant expenditure by oil and gas companies for frac services, pressure pumping and related completion activities.

In total, completing all the drilled uncompleted wells in the country in June would require over $20.8 billion in capital spending, EnerCom Analytics has calculated. Like the outright numbers, the Permian ranks first in cost of completion, with about $8.7 billion needed to complete the current inventory. The Eagle Ford, Bakken and Marcellus will all cost around $3 billion to complete, while the inventories in the Niobrara, Haynesville and Utica each represent less than $3 billion in spending.

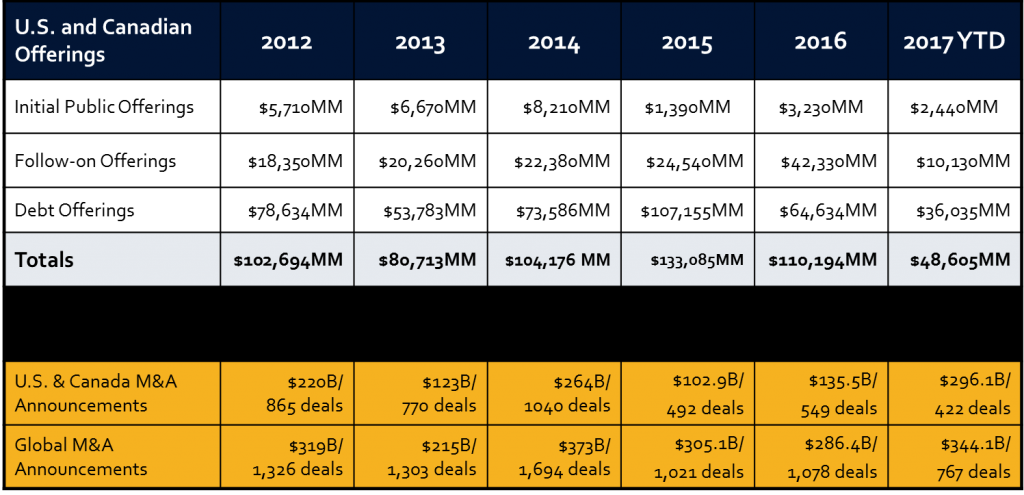

For reference, $20.8 billion is about one-third of all debt offerings made by all U.S. and Canadian E&P and service companies in 2016.

7.5 billion barrels awaiting completion

Drilled uncompleted wells do represent a significant amount of waiting production and cash flow. Based on the average well results of each basin, there is nearly 7.5 billion BOE in total production just waiting to be brought online. Again, the Permian currently ranks first in this metric, with DUCs expected to produce a combined 2.7 billion barrels equivalent over their lifetimes. Modern Marcellus wells are very productive on a BOE basis, meaning the 643 Marcellus wells awaiting completion make the basin rank second in EUR.