Alaska’s LNG “gigaproject” moving forward despite low prices

While many liquid natural gas (LNG) projects are being put on the back burner due to the low oil price environment, the Alaska LNG project continues to march on.

The project, which is being developed by a partnership including energy majors BP (ticker: BP), ExxonMobil (ticker: XOM), ConocoPhillips (ticker: COP) and TransCanada (ticker: TRP) with the state of Alaska and the Alaska Gasline Development Corporation (AGDC), still plans to move forward, even as prices continue their downward spiral. Officials with each of the equity partners for Alaska LNG (AKLNG) said they are still committed to the project as they were before, reports Alaska Dispatch News.

With some of the largest oil and gas companies in the world as equity partners, some have referred to the Alaska LNG project as a “gigaproject,” including Steve Butt, senior manager for Alaska LNG. Butt said the ambitious project has an estimated price tag of $45 billion to $65 billion.

Other projects have much more uncertain futures, most notably Excelerate Energy’s floating LNG project off the Texas coast and the Pacific Northwest LNG project in British Columbia,. Excelerate filed a motion with the Federal Energy Regulatory Commission (FERC) on December 23, 2014, to hold off processing the company’s application until April 2015 because of the “[r]ecent global economic conditions – including … a steep decrease in the price of oil.” The B.C. LNG project, headed by Petronas, has also run into funding problems, with the Malaysian state-owned company saying it cannot justify the price tag with falling oil prices. Apache Corp. (ticker: APA) sold its 50% stake in another B.C. LNG project last month, citing the rising costs.

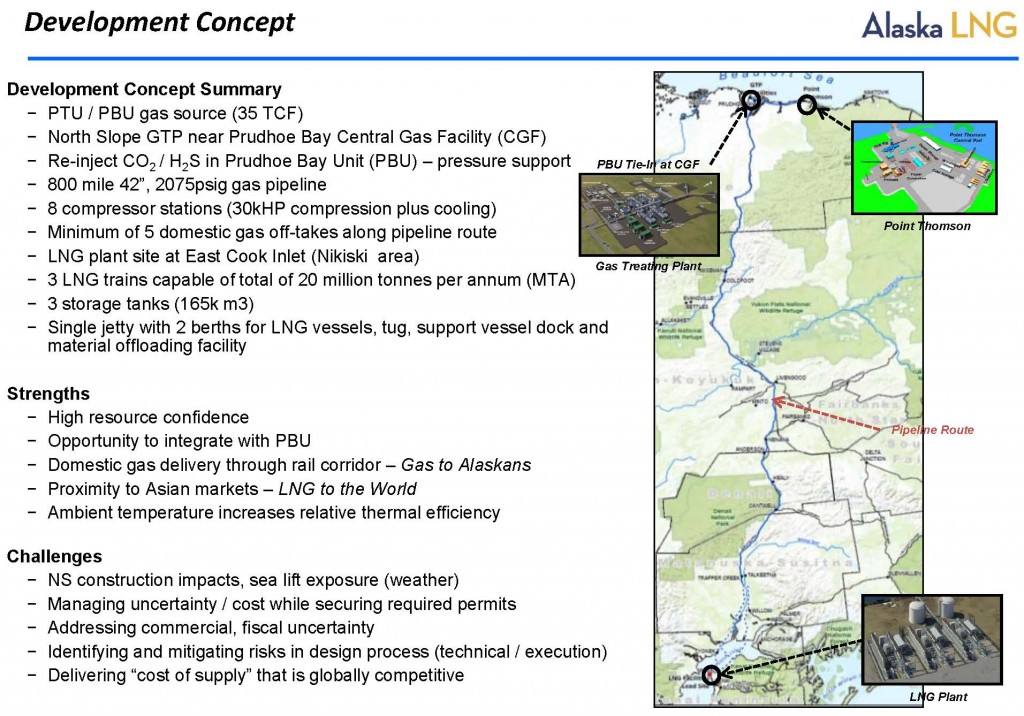

AKLNG has been able to avoid the chopping block so far because of the sheer size of the project. Once complete, AKLNG will include a three-train, 6 million tons per annum (approximately 246 Bcf per annum) LNG plant and a gas treatment plant with expected capacity of 3.7 Bcf/d, connected by an 800 mile 42” pipeline with a minimum of five domestic gas off-takes along the pipeline route, according to an AKLNG presentation. Because the project is expected to have a production life between 30 and 50 years, and not expected to start production for at least another seven to nine years, it is not as affected by the current price of gas.

Another major advantage of the AKLNG project is its confirmed resource base, meaning there are no additional exploration risks or expenses. The North Slope resources were discovered in the 1960’s and 1970’s with 35 Tcf of natural gas confirmed and an additional 221 Tcf of technically recoverable gas, according to COP.

The large reserves in the North Slope, along with the project’s long production life and the tremendous financial backing that the equity partners can provide have shielded the AKLNG project from falling oil prices while other LNG projects have been put on hold.

Although it is still several years out into the future, the AKLNG project is believed to be the beneficiary of a long and productive operational life. Given that the project is closer to Asia than others (like those being planned in Texas), it can access the fastest growing market for LNG for less cost than similar projects, leaving the project in a good position despite the current commodity environment.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.