Devon targets 20 U.S. operated rigs by year-end

Devon Energy Corp. (ticker: DVN) reported stronger than expected production results Tuesday as the company’s U.S. resources outperformed its earlier guidance. Oil production averaged 261 MBOPD, up 7% sequentially, 5 MBOPD more than the top end of the company’s guidance.

The growth was driven entirely by Devon’s U.S. resource plays where the company is also seeing the highest margins in its portfolio, according to the DVN press release.

Eagle Ford, STACK completions add up

In total, U.S. oil production reached 123 MBOPD in the first quarter, a 17% increase from the previous quarter, thanks to higher completion activity across the company’s Eagle Ford and STACK operations. Including Eagle Ford partner activity, the company exited the first quarter with 15 rigs operating.

Plowing $2+ billion into U.S. plays in 2017

Devon’s full-year 2017 goals are to grow production 13% to 17%, which the company believes it can deliver by investing between $2.0 billion and $2.3 billion of E&P capital in 2017, with nearly 90% of the capital dedicated to U.S. resource plays.

The company plans to steadily increase drilling activity throughout the year to as many as 20 operated rigs by the end of the year.

Jackfish exceeding nameplate capacity by nearly 20%

Further north of Devon’s U.S. assets, its heavy-oil operations in Canada averaged 138 MBOPD in the first quarter, a 9% increase year-over-year. The growth was driven by its Jackfish complex, where gross production increased to a record 125.1 MBOPD during Q1, according to the company. The record production is exceeding the facility’s nameplate capacity by nearly 20%, Devon said in its earnings release.

Operating cash flow expands 54%

Devon’s reported net earnings totaled $565 million or $1.07 per diluted share in the first quarter. Adjusting for items securities analysts typically exclude from their published estimates, the company’s core earnings totaled $217 million or $0.41 per diluted share in the first quarter, exceeding consensus expectations.

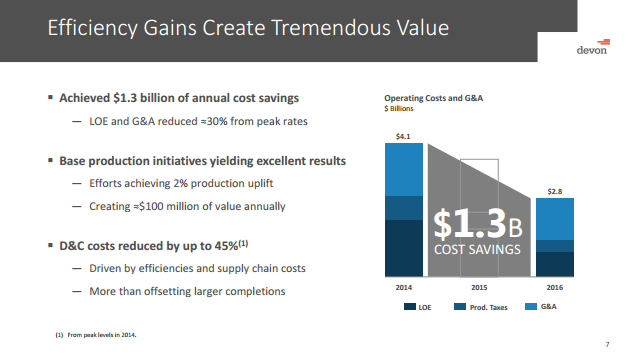

The company’s profitability in the first quarter was attributable to strong production growth, higher commodity prices and an improved cost structure, DVN said in the press release. These factors also strengthened Devon’s operating cash flow to $834 million, a 54 percent increase from the fourth quarter of 2016.

Devon reported $2.1 billion of cash on hand at the end of the quarter. The company paid off $2.5 billion of debt during the course of 2016, pushing any significant debt maturities out until mid-2021. DVN also reported that more than 50% of its estimated oil and gas production for this year is hedged, and that the company is currently working on accumulating additional hedges for 2018.