Eagle Rock Energy Partners, L.P. (ticker: EROC) is an exploration and production company focused on various onshore United States plays including the Permian Basin, MidContinent and Gulf Coast. The company utilizes a substantial hedging program on its 202,632 net acres, which produced an average of 79.7 MMcfe/d in its Q1’15 results. As of year-end 2014, EROC’s proved reserves of 318.2 Bcfe are expected to provide drilling inventory for the next 12 years.

Eagle Rock Primer

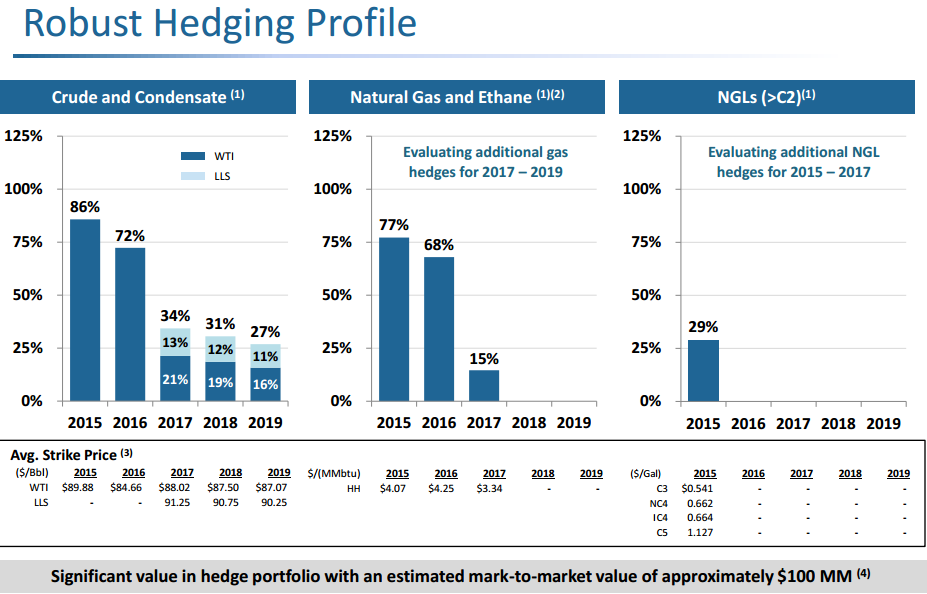

Eagle Rock’s game plan is focused on its balance sheet, which includes keeping low leverage and ample liquidity in preparation for potential asset purchases. The company’s acquisition strategy is designed to fuel its rising production rates and increase the lifespan of its reserves. Its near-term growth is backed by a hedging program that adds an estimated $100 million in mark-to-market value. Approximately 77% of its natural gas sales are hedged at an average Henry Hub strike price of $4.07/MMbtu for the remainder of 2015, and the number is in line to shift to 68% of volumes at $4.25/MMbtu in 2016.

The Midcontinent provides about two-thirds of EROC’s production and accounts for three-fourths of its total acreage. The Golden Trend and SCOOP plays of Oklahoma were highlighted in its latest quarterly results, and four wells recently turned in line generated average 30-day IP rates of 1,200 BOEPD. The wells were part of 20 gross wells turned to sales and helped increase sequential quarterly production by 6%.

The production growth has not come at the expense of its financials: EROC had $164 million in liquidity as of April 28, 2015, and plans on repurchasing up to $100 million in common units by March 2016. A total of $22 million units have been repurchased thus far. The company has also evaluated more than $1 billion worth of potential acquisitions that would benefit its MLP layout. In a conference call, Joe Mills, Chairman and Chief Executive Officer of Eagle Rock, said, “We continue to take a patient approach to acquisitions, and we expect to have an opportunity to utilize our liquidity to make a meaningful accretive acquisition in 2015 that will enable us to achieve greater scale and diversify our asset base while growing distributable cash flow.”

EROC’s debt to market cap percentage of 57% in the second-lowest among 12 MLP E&Ps in EnerCom’s MLP Weekly Benchmarking Report. The partnership expects distributable cash flow to be at or above 1.0x coverage for the remainder of 2015.

New Website

You can follow the story of Eagle Rock at the E&P’s new web site, www.eaglerockenergy.com. The site, created by the oil and gas-focused design professionals at EnerCom, Inc., features an up-to-date investor page, detailed information on hedging and dividend programs, a careers section and an in-depth look at the company’s ongoing operations. The site is uniquely designed to capture EROC’s brand as a growth oriented upstream MLP.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.