Earthstone targets continued growth of operated asset base in the Permian basin

Earthstone Energy, Inc. (ticker: ESTE) and Bold Energy III LLC, a portfolio company of EnCap Investments L.P., have entered into a definitive contribution agreement under which Earthstone will acquire all of the outstanding membership interests of Bold, inclusive of producing assets and undeveloped acreage, in an “Up-C” transaction, Earthstone Energy said today in a press release.

Upon completion of the transaction, current Earthstone stockholders will own approximately 39% of the combined company, and Bold members will own the remaining 61% on a fully diluted basis.

Transforms focus to the Permian

The news represents a transformational shift for Earthstone to a high-growth, Midland Basin-focused operating company. Earthstone President and CEO Frank A. Lodzinski and the Earthstone management team will lead the combined company.

“The combination currently adds over 500 gross operated high potential proved and probable locations to our drilling inventory,” Lodzinski said in a statement. “We expect the number of locations to increase with further de-risking of Spraberry and Wolfcamp intervals [and] [w]e will immediately begin to integrate the operations and activities of the companies while we continue our pursuit of additional opportunities. We intend to continue our growth in the Permian basin via direct leasing, development, and M&A activities.

“With this combination, our strategic focus is clearly directed toward further building our operated asset base in the Permian Basin. Our Eagle Ford and Bakken assets provide a strong source of cash flow to support a significant combined borrowing base and to fund our acquisition and development activities. As we proceed to closing, we will further refine our capital allocation initiatives and advise the market appropriately.

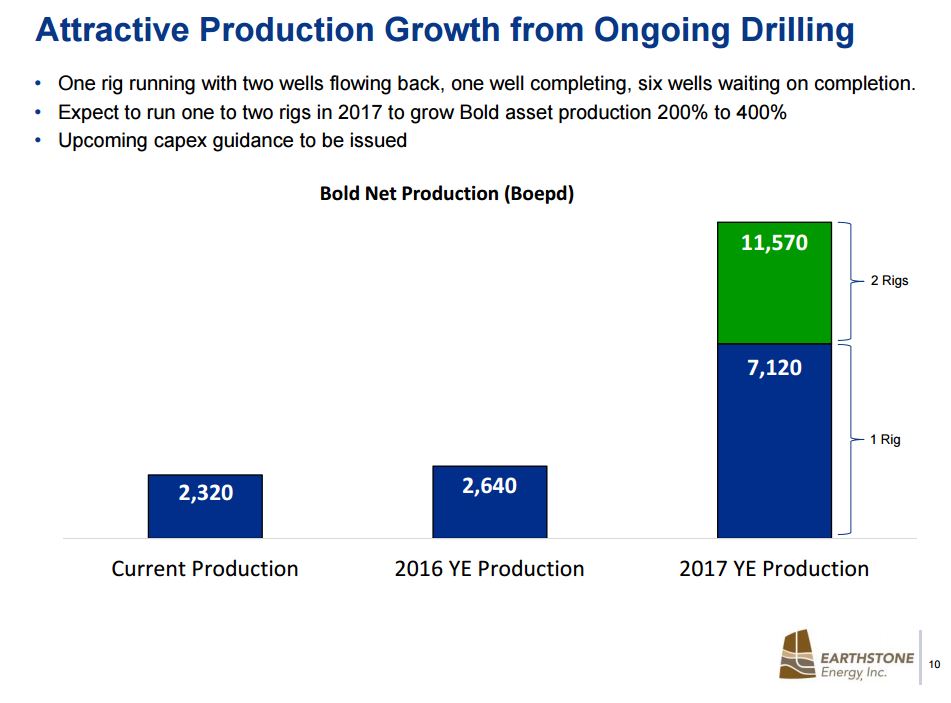

“We expect to issue 2017 company-wide guidance and a capital expenditure budget in early 2017 that will include significant capital devoted to the Midland Basin. Bold is currently running a one-rig program, and the combined company may add a second rig in the Midland Basin after the closing of this transaction, which is expected in the first quarter of 2017,” he said.

Core Midland basin asset base

By the combination with Bold, Earthstone investors gain:

- Approximately 20,900 net surface acres (62,500 net effective acres) in the core of the Midland Basin

- Approximately 16,000 net acres in Reagan County; 3,260 net acres in Upton County; 1,310 net acres in Midland County; and the remainder in Glasscock, Howard, and Martin Counties

- 99% operated, 85% average working interest on net operated acreage

- Approximately 500 gross highly prospective, largely de-risked operated horizontal drilling locations across multiple benches

- Vast majority in the Wolfcamp formation with remainder in the Lower Spraberry

- Further upside from future de-risking of additional Wolfcamp and Spraberry benches, increased drilling density, and potential acreage trades to create additional drilling locations

- EURs, normalized to 7,500 foot laterals, ranging from 700 MBoe to 1,000 MBoe (56% to 71% oil), with further upside from ongoing improvements in completion techniques

- Current net production of approximately 2,320 Boepd (63% oil) predominantly from 18 gross / 12.6 net horizontal operated Wolfcamp wells

- Expected 2016 exit rate of 2,640 Boepd (61% oil)

- Operating a one-rig drilling program, with two wells flowing back, one well being completed and six wells waiting on completion

- A one-rig program can satisfy all material leasehold obligations

Highlights of the combined companies

- Clean balance sheet and significant liquidity position: As of September 30, 2016, the combined company had approximately $24.0 million of cash on-hand and $17.0 million of bank debt drawn against a combined $102.0 million reserve-based loan facility

- Current production of approximately 7,400 Boepd (63% oil), consisting of 46% from the Midland basin, 38% from the Eagle Ford, and 16% from the Bakken and other areas

- Approximately 26,800 net surface acres (80,150 net effective acres) in the Midland basin and 18,600 net surface acres in the Eagle Ford

- Includes Earthstone’s strong non-operated position in the core of the Midland basin (Lynden Acquisition, closed May 2016) with 5,883 net acres (40% average working interest) in Howard, Glasscock, Martin, and Midland Counties with a prominent Permian Basin operator

- Approximately 715 gross drilling locations in the Midland basin

- Operated (Bold Transaction): 500 gross locations (85% average working interest)

- Non-Operated (primarily Lynden Acquisition): 215 gross (35% average working interest)

“We look forward to combining with Earthstone to continue the development of our acreage in Midland, Upton, and Reagan counties. Reagan County, in particular, has tremendous potential as we continue to drive down well costs and improve upon horizontal completion practices,” said Bold President Joseph L. Castillo.

Transaction

The Transaction has been organized in a manner commonly known as an “Up-C” structure. Under this structure and the agreement, Earthstone will recapitalize its common stock into two classes – Class A and Class B, and all its existing outstanding common stock will be converted into Class A common stock. Bold will purchase approximately 36.1 million shares of Earthstone’s Class B common stock for nominal consideration, with the Class B common stock having no economic rights in Earthstone other than voting rights on a pari passu basis with the Class A common stock.

In addition, Earthstone has formed Earthstone Energy Holdings, LLC, a Delaware limited liability company (“EEH”). At closing, EEH will issue approximately 22.3 million of its membership units to Earthstone and one of Earthstone’s wholly-owned subsidiaries, in the aggregate, and 36.1 million membership units to Bold in exchange for each of the parties transferring all their assets to EEH. Each membership unit in EEH held by Bold, together with one share of Bold’s Class B common stock, will be convertible into Class A common stock on a one-for-one basis. Therefore, upon the closing of the transaction, stockholders of Earthstone and unitholders of Bold are expected to own approximately 39% and 61%, respectively, of the combined company’s then outstanding Class A and Class B common stock on a fully diluted basis. After closing, Earthstone will conduct its activities through EEH and be its sole managing member. The transaction is expected to close in the first quarter of 2017.

The board of directors of Earthstone has unanimously approved the agreement. The transaction is further subject to the majority approval of Earthstone stockholders, including a majority of disinterested stockholders, as well as other customary approvals.

In connection with Earthstone’s third quarter 2016 conference call scheduled for Wednesday, November 9, at 10:00 a.m. Eastern, the Earthstone and Bold management teams will discuss the proposed transaction.

Stephens Inc. acted as independent financial advisor and provided a fairness opinion to the special committee of the board of directors of Earthstone. Tudor, Pickering, Holt & Co. acted as financial advisor to Bold. Legal advisors included Richards, Layton & Finger for the special committee of the board of directors of Earthstone, Jones & Keller, P.C. for Earthstone, and Latham & Watkins LLP for Bold.

The combined company will maintain its headquarters in The Woodlands, Texas, and maintain an office in Midland.

Access to the Earthstone presentation for the Bold transaction is here.