U.S. shale plays are expected to produce 7.34 MMBOPD and 69.76 Bcf/d this July, a new record for overall output: EIA

EnerCom has released the latest Effective Rig Count, examining the state of drilling activity in major shale basins.

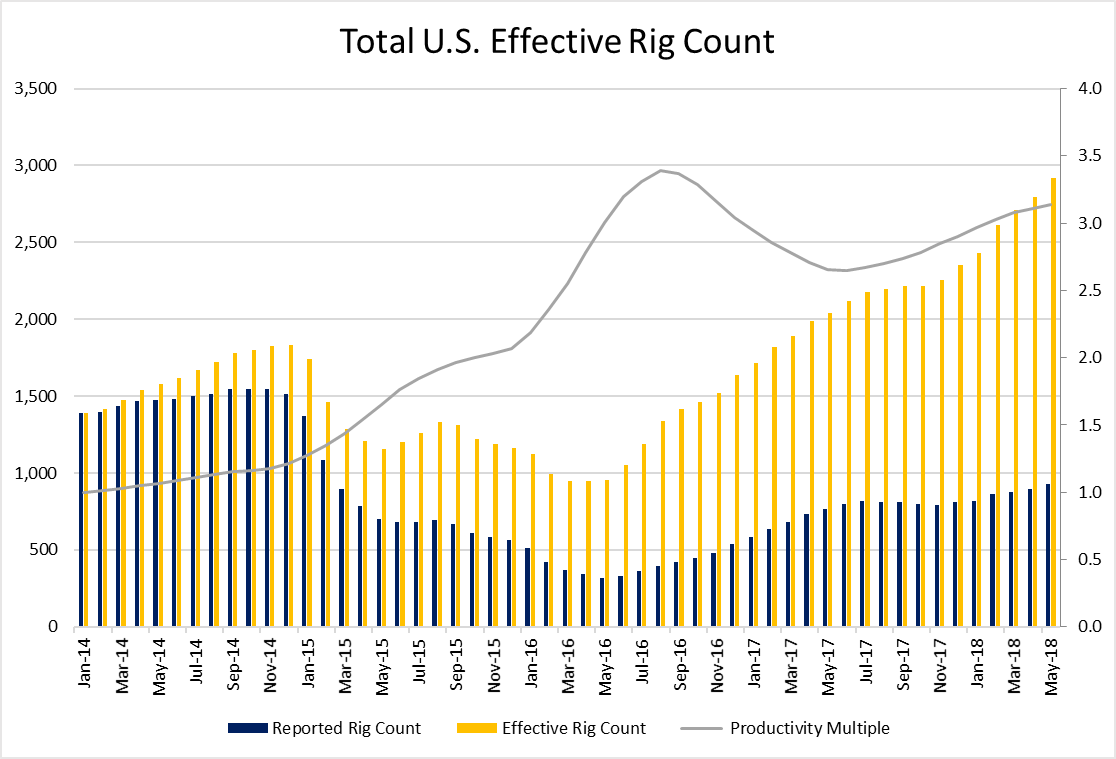

The EERC reached 2,919 in May, rising for the seventh month in a row. An Effective Rig Count of 2,919 means it would take 2,919 rigs from January 2014 to achieve the productivity and growth currently seen in the major basins in the U.S. Improved technologies and techniques have combined with more optimal drilling locations and targets to produce significant improvements in efficiency over the past four years.

Modern rigs yield 3.14 times as much production as the average January 2014 rig. This is how the U.S. can grow production at the current rate with only 931 rigs operating in major basins. Productivity levels continue to approach the 2016 peak, showing that even as operators have shifted focus more toward production growth, they have not forgone continuing efforts to improve their drilling and extraction processes.

The growth in the Effective Rig Count has been primarily driven by increasing reported rig count over the past few months, as productivity growth has slowed. This is primarily due to the Permian, where drilling continues to outpace completions. This holds down per-rig productivity, because the wells drilled by rigs in the basin do not immediately translate into improved production. Nevertheless, the EERC in the Permian rose by 57 last month.

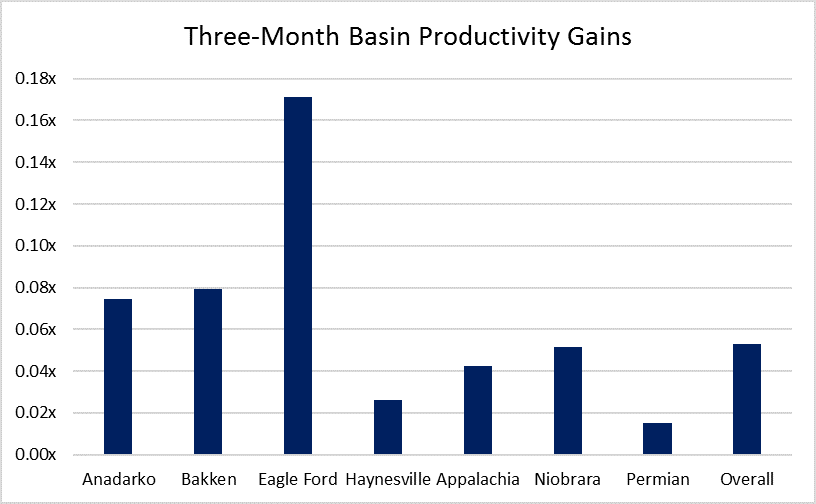

The Eagle Ford has seen significant improvements in efficiency in the past three months. Productivity in the Eagle Ford rose by more than double the next-most-improved basin, the Bakken.

Shale basins add 331 MBOEPD

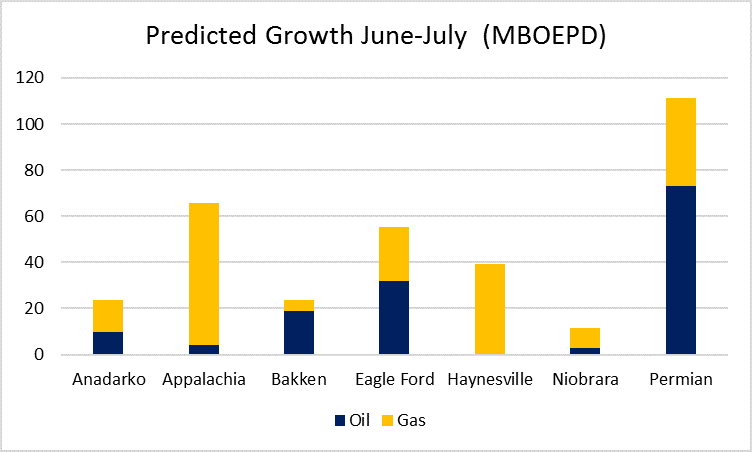

The EIA predicts the 2,919 Effective Rigs in the major basin will produce major increases in U.S. production in the next month, with the total output from major basins rising by 331 MBOEPD. U.S. shale plays are expected to produce 7.34 MMBOPD and 69.76 Bcf/d this July, a new record for overall output.

The Permian accounts for most of the growth in oil output, with an expected 73 MBOPD coming online. The Eagle Ford and Bakken are also expected to grow oil production significantly, adding a combined 51 MBOPD.

Growth in natural gas is driven by Appalachia, as usual. The Marcellus and Utica are predicted to grow by 371 MMcf/d from June to July. Appalachia will continue to show the largest growth in gas production in the coming months, as other basins would have to accelerate rapidly to catch up to the Marcellus and Utica. Growth in the Permian and the Haynesville would have to accelerate by 60% for either basin to rival Appalachia in gas output.

Niobrara DUC count keeps falling: now less than 12 months’ inventory

Completions have begun to catch up with drilling in the U.S., and growth in the DUC count is slowing. The EIA estimates the DUC count is now 7,772, up 31 from last month. This is the smallest increase since November 2016.

In the Permian, where drilling continually exceeds completions, the DUC count increased by 100. This is a large increase by any measure, but is the second-smallest jump in the basin in the past year. Most other basins saw DUC counts fall, with completions exceeding drilling in the Anadarko, Appalachia, Haynesville and Niobrara.

Like in the past two months, the Niobrara saw a significant decrease in DUC count, with a drop of 48 this month. The basin’s DUC count has fallen by an average of 42 over the past three months. This suggests companies may eventually work through the completions backlog in the Niobrara, as the region’s 491 DUCs would all be completed in less than a year at current rates. Working through the DUC count is not likely in any other major basin, as most have only seen small decreases in DUC count. At current rates, Appalachia would work through its completions backlog in just under three years, all other basins would take much longer at current rates.

In practice, the DUC count will never reach zero in an active basin, even if completions perfectly match drilling. The very intense process of completing a modern well takes time to set up, and wells must wait for drilling rigs to tear down and completions fleets to set up before fracturing can begin. There will always be some wells that are waiting on completions, though the current DUC count in each basin is certainly higher than this theoretical “structural DUC count.”