Kingdom Hikes Petrol Prices to Offset Record 15% Budget Deficit

Saudi Arabia knew there would be repercussions for its market-share-over-price strategy. The effects were apparent in its 2016 budget, released on December 28, 2015. In the first full year of sub-$50 oil prices in roughly a decade, Saudi posted a record deficit of approximately $98 billion (367 billion riyals) in 2015.

The Kingdom does not expect the depressed commodity environment to improve, and trimmed its 2016 budget by about 14% to about $225 billion overall (840 billion riyals, down from 975 billion). Even with the adjustments, Saudi expects to post a 2016 deficit of about $87 billion (325 billion riyals).

The Kingdom does not expect the depressed commodity environment to improve, and trimmed its 2016 budget by about 14% to about $225 billion overall (840 billion riyals, down from 975 billion). Even with the adjustments, Saudi expects to post a 2016 deficit of about $87 billion (325 billion riyals).

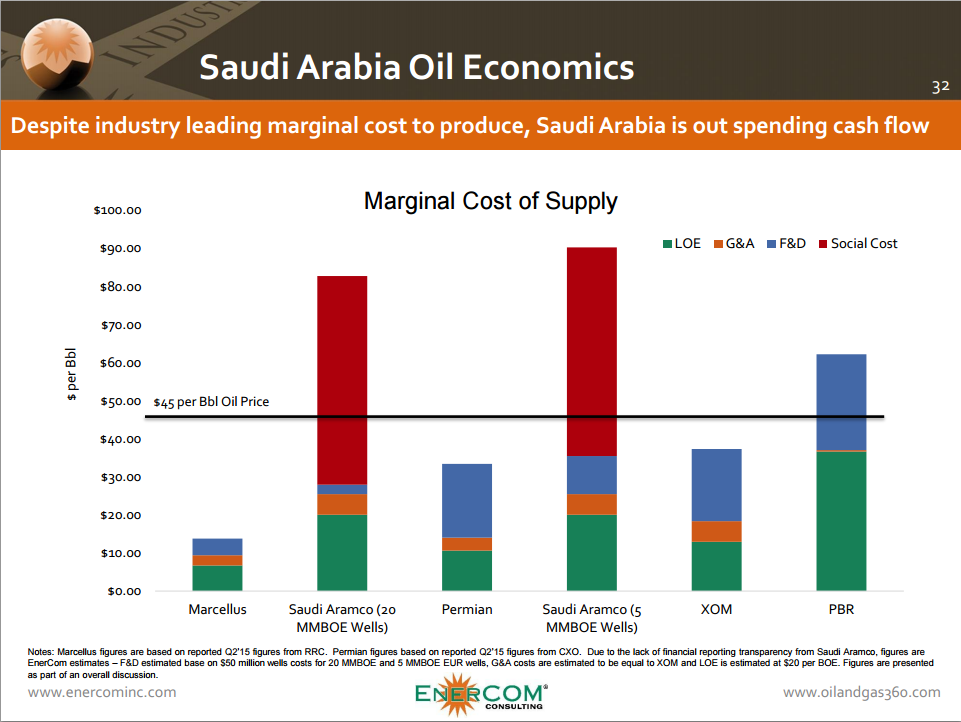

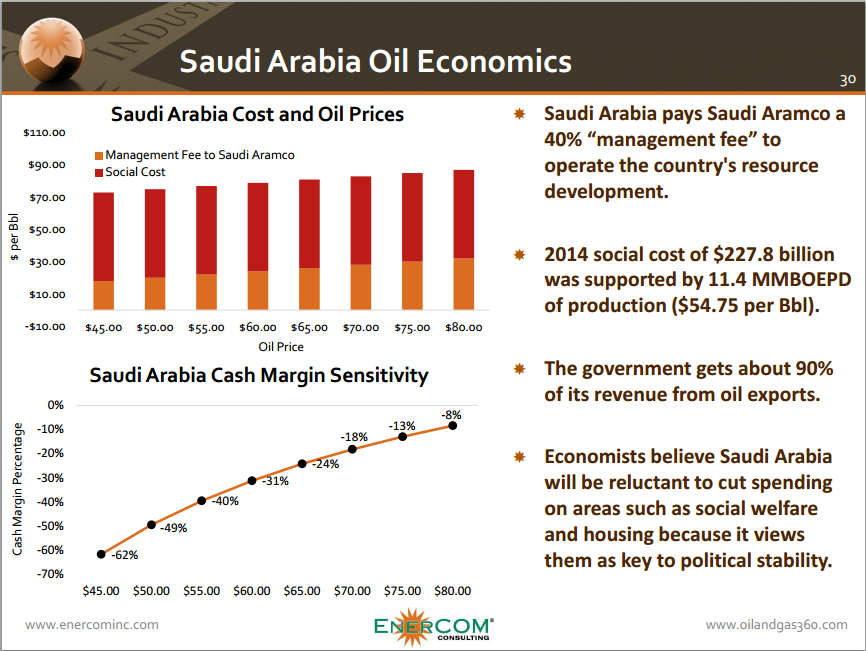

Oil exports account for about 90% of Saudi’s overall revenue, including roughly 40% of its gross domestic product. The 2015 outspend equates to a deficit of 15%.

But Wait, There’s More (Borrowing)

Saudi Arabia had previously been drawing from its sovereign wealth fund to cover the spending shortfalls, but the slippery slope of low oil prices have led to more pronounced measures in recent months. Rumors of creating a capital monitoring department were widespread in the second half of this year, and the government accessed the international bond markets for the first time in its history in November.

The latest budget-slashing measure comes at the expense of its citizens, as Saudi Arabia plans to hike the price of selected fuel grades by as much as 50%. The price rise is effective tomorrow. The Wall Street Journal says the news resulted in long gas station lines in several Saudi cities, a reminiscent image of the United States oil embargo of 1973. Based on previous estimates, the de facto leader of OPEC was spending as much as $12 billion per month to support social spending alone.

The latest budget-slashing measure comes at the expense of its citizens, as Saudi Arabia plans to hike the price of selected fuel grades by as much as 50%. The price rise is effective tomorrow. The Wall Street Journal says the news resulted in long gas station lines in several Saudi cities, a reminiscent image of the United States oil embargo of 1973. Based on previous estimates, the de facto leader of OPEC was spending as much as $12 billion per month to support social spending alone.

Although the country holds the largest amount of foreign reserves in the world, it ranks fourth among Gulf countries on a per-capita basis. “We are much more vulnerable [than our peers],” said Khalid Alsweilem, a former official at the Saudi central bank and now at Harvard University. “We cannot afford to lose our cushion over the next two years.”

That dwindling cushion has created a bigger buzz in the latest few months. In addition to bond sales and reigning in spending levels, trading amongst Saudi banks reached a seven-year high in November. Deposits in Saudi banks dropped by 4.7% in October, marking “probably the biggest [drop in absolute amount] since the 1990s,” said Murad Ansari, a bank analyst at EFG-Hermes Holding SAE, in an interview with Bloomberg.