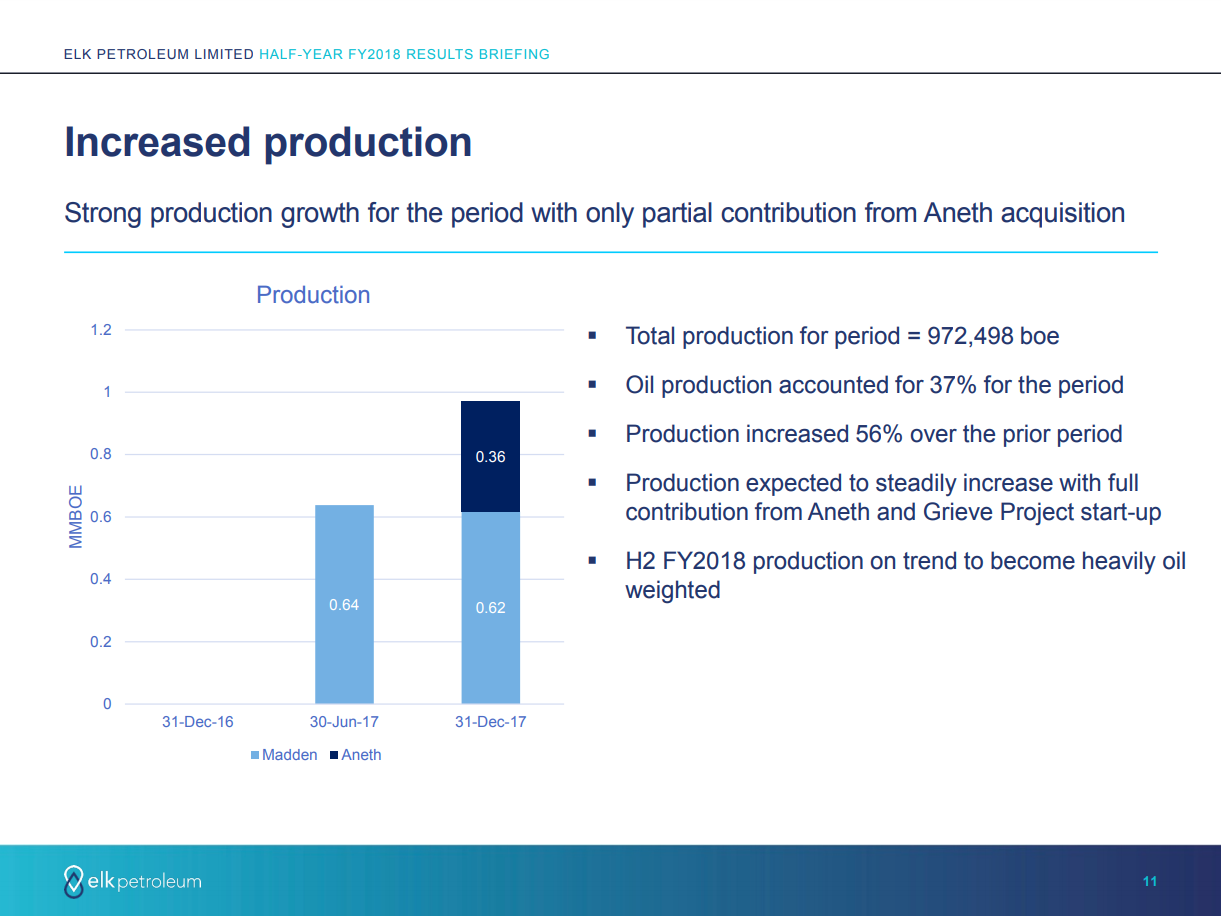

Australia’s Elk Petroleum Limited (ticker: ELK) recently released its half-year results and guidance update. The company reported a 44% increase in share price to A$0.095 (March 2018) – this is up from A$0.066 (June 2017). The company reported production of 972,498 BOE, with 1P reserves of 47.5 MMBOE and 2P reserves of 84.2 MMBOE.

Elk’s operations are all in the United States and the company now is an operator in Utah’s Aneth Field.

So far, H1 FY2018 has been driven by the Grieve Project and the Aneth Field acquisition. Both are CO2 EOR projects.

Elk said that the Grieve Project is “substantially complete,” and that facility testing/commissioning has begun.

The company has completed the Aneth acquisition from Resolute Energy (ticker: REN) and is now a field operator. The company described its transformation from a junior non-operator to a full-fledged operating company with CO2 EOR capability.

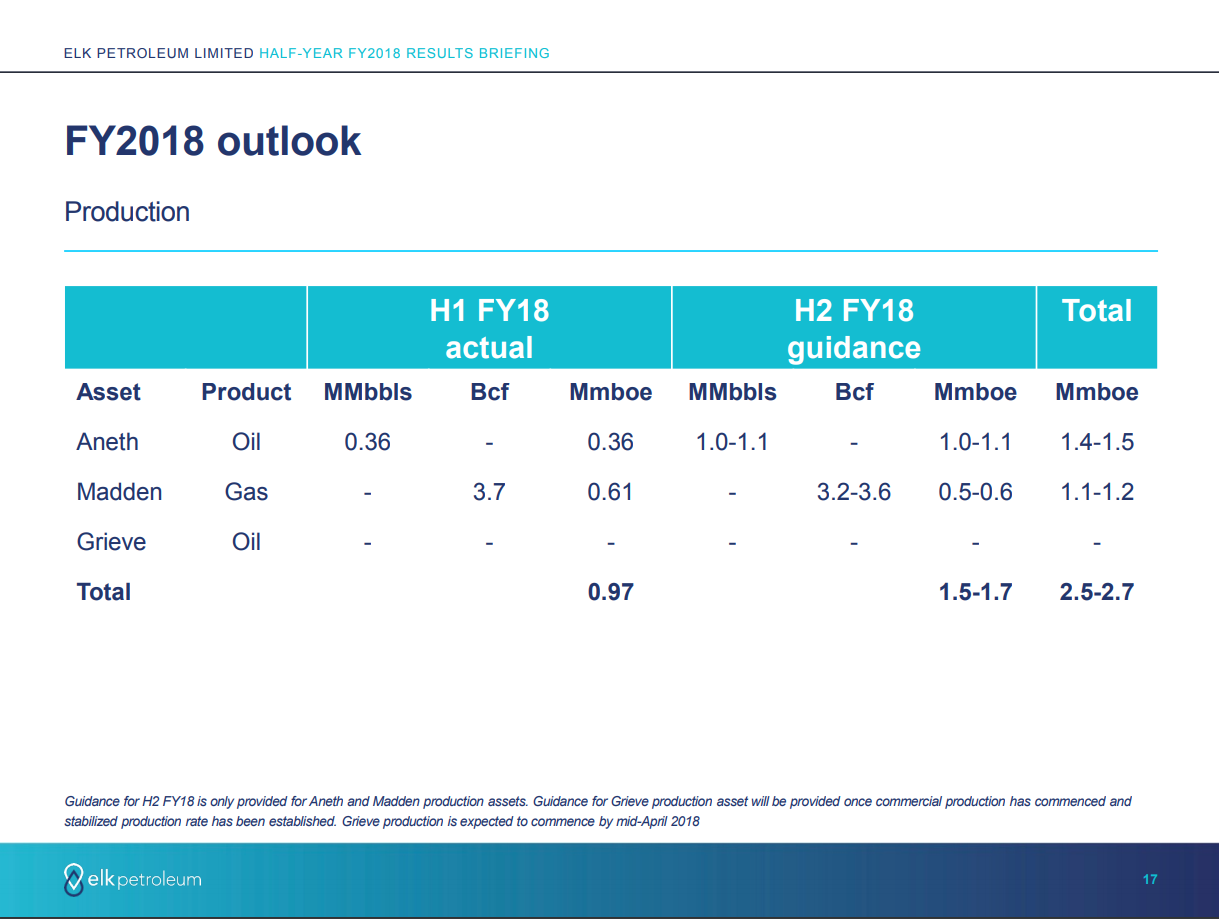

The first Grieve oil production test was completed with 250 Bbls fluid to surface (oil and water), with strong associated CO2 flows, Elk said. Commercial production start-up is expected in mid-April of 2018. As for Aneth, the company is preparing production increase projects.

The company has been growing institutional investor support, raising approximately US$160 million in debt capital and US$65 million in preferred equity.

2018

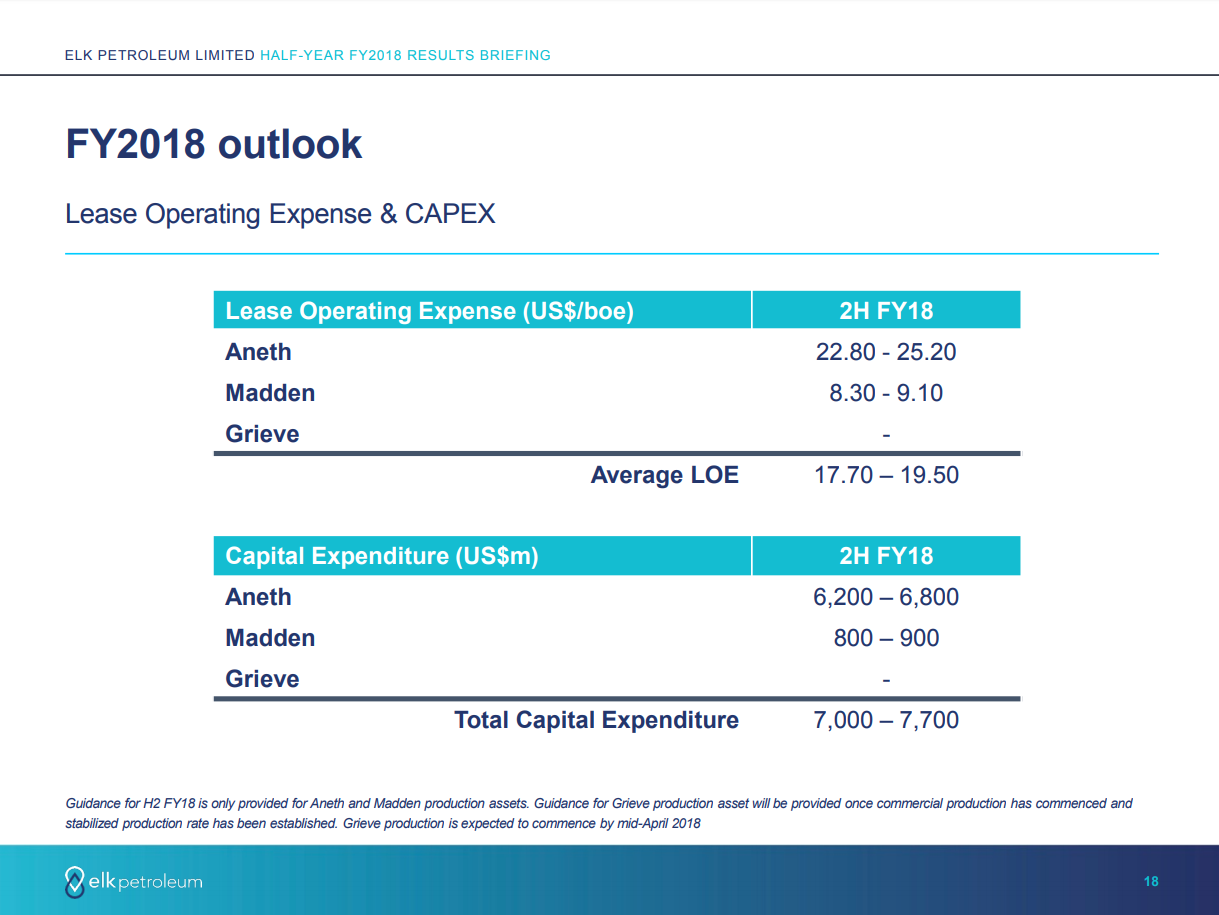

Elk said that additional guidance for production, CapEx and LOE for the Grieve Project would be provided after the production ramp-up is completed, and stabilized production rates were recorded.