$3.3 billion sale values assets at 12xEBITDA

Enbridge (ticker: ENB) continued its transformation yesterday, exiting the gas gathering business in Canada.

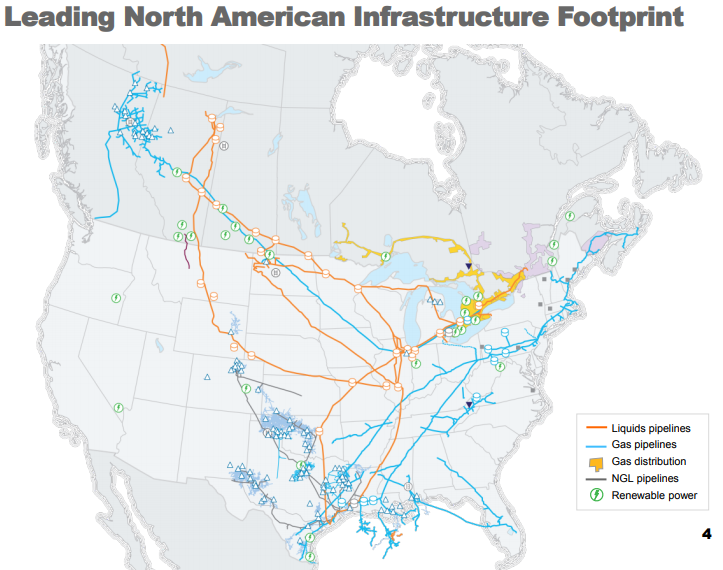

Enbridge will sell its Canadian natural gas gathering and processing infrastructure to Brookfield Infrastructure (ticker: BIP) and its institutional partners. The assets cover the heart of Canadian natural gas, including the Montney, Peace River Arch, Horn River and Liard basins in Alberta and British Columbia.

In total, Enbridge sold 19 gas processing plants and liquids handling facilities and 2,200 miles of gas gathering pipelines. The processing plants have a total capacity of 3.3 Bcf/d, or about one-fifth of total Canadian gas production. Brookfield will pay about $3.3 billion for the plants and gathering system, with most of the funds coming from Brookfield’s institutional partners.

Tudor Pickering & Holt estimates this sale values the assets at 12 to 13 times EBITDA, higher than expected. The transaction will close in two phases, depending on how each specific plant is regulated. Those under provincial authority are expected to close in 2018, while the assets regulated by the federal government are expected to close in mid-2019.

Enbridge has a target of CAD$10 billion in divestitures, has sold CAD$7.5 billion

This sale continued Enbridge’s shift in focus. The company intends to position itself as a pure play pipeline and utility, eliminating direct gas gathering and similar sectors. The company made several sales to this end in the past six months. In May Enbridge divested Midcoast Operating, its U.S. midstream business. This deal was significantly smaller than the Canadian sale yesterday, as an affiliate of ArcLight Capital paid $1.1 billion for the assets.

The same day Enbridge also sold 49% interests in several of its renewable power assets, divesting wind and solar in Colorado and Nevada, offshore wind projects in Europe and various renewable projects in Canada. These assets earned Enbridge roughly $1.3 billion.

Enbridge may continue this sale process, and identified CAD$10 billion in non-core assets that could be divested earlier this year. So far, the company has divested about CAD$7.5 billion in assets.

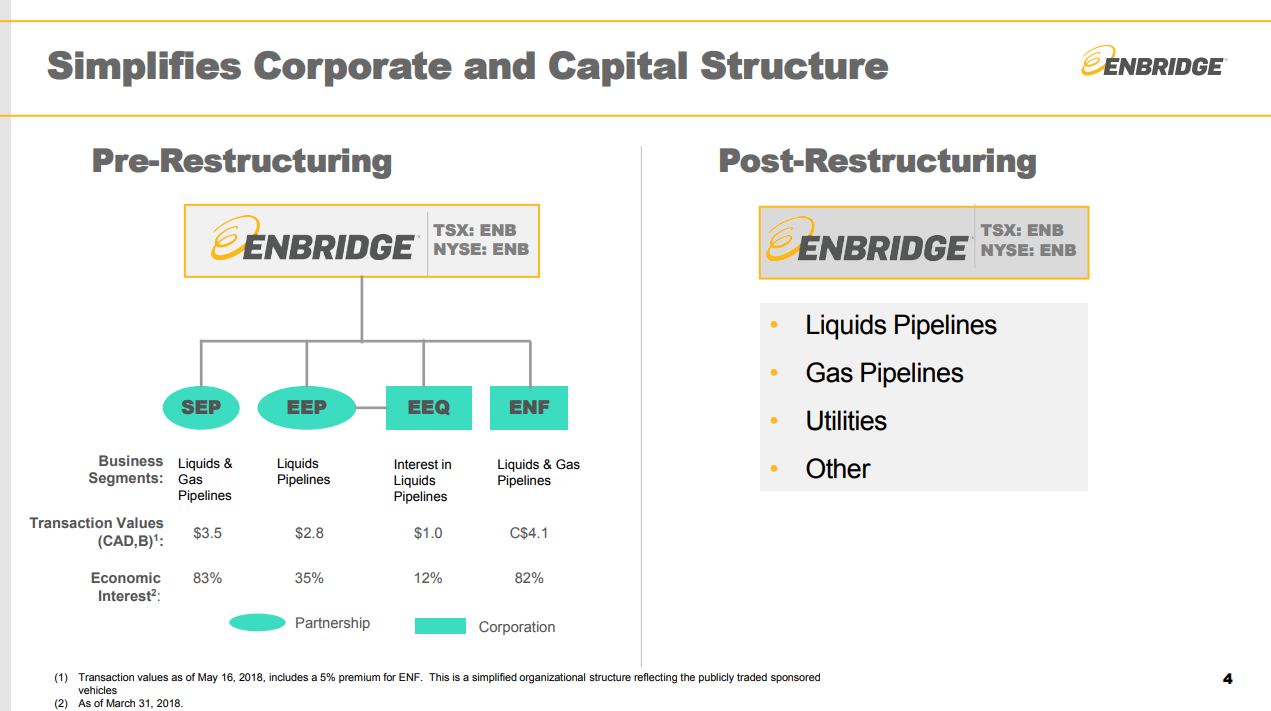

Enbridge is also in the process of a major transformation, as it announced it would consolidate its four separately traded subsidiaries in May. The deals are valued at a combined $9 billion in equity, and will leave Enbridge as the sole holder of all assets owned.