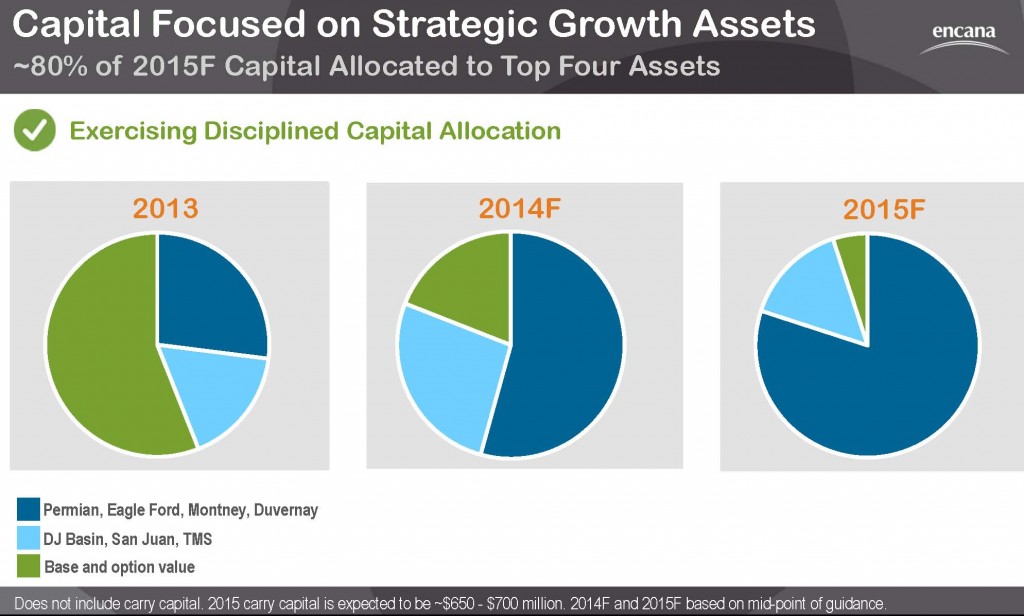

Encana Corporation (ticker: ECA) has announced a 2015 capital budget of $2.7 to $2.9 billion, with approximately 80% directed to four of its highest margin growth plays; the Montney and Duvernay in Canada, as well as the company’s Permian and Eagle Ford assets in Texas. Encana is one of the few E&Ps to increase its budget compared to 2014, when the company allotted $2.4 to $2.5 billion for expenditures.

The company expects its four focus areas to contribute about 60% of total production and 70% of total upstream operating cash flow in 2015. The low supply costs of $35 to $55 per BOE “are capable of delivering quality returns in a lower commodity price environment,” says the release. ECA expects these four core assets to produce 243 to 264 MBOEPD , or roughly 60%, of its expected total production of 405 to 440 MBOEPD.

Encana expects the Montney play to provide more than 25 years of drilling inventory with the potential of more than 2 Bcf/d and 50 MBOEPD of natural gas and liquids production. The company plans to invest $250 to $350 million in the play and drill 20 to 30 net wells with two to three rigs. An additional $350 million is expected to be invested through Encana’s Cutbank Ridge Partnership with Mitsubishi Corporation, representing a total gross investment of $600 to $700 million.

In the Duvernay, the company plans to invest $250 to $350 million and continue to accelerate development in the Simonette area where it expects to run about three to five rigs and drill 15 to 25 net wells. An additional $800 million is expected to be invested in the play through Encana’s joint venture with Brion Duvernay Gas (formerly named Phoenix Duvernay Gas), representing a gross investment of $1.0 to $1.2 billion.

The company plans to invest $650 to $750 million in 2015 in the Eagle Ford, running three to five rigs and drilling 75 to 85 net wells. In the Permian, Encana plans to invest $850 to $950 million in the play and run anywhere from nine to 13 rigs, with plans to drill 180 to 200 net wells.

Encana continues shift toward liquids

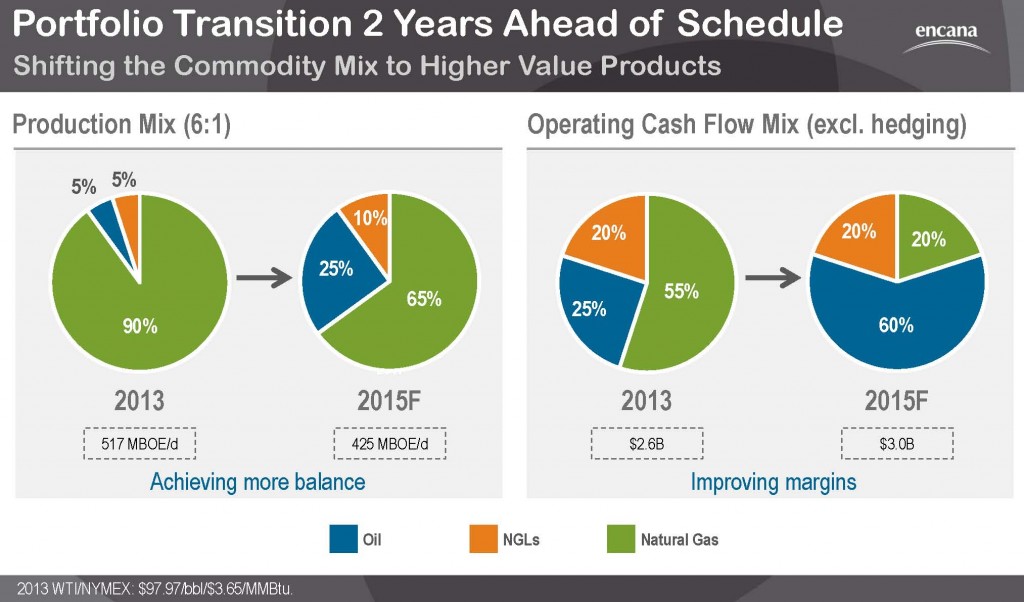

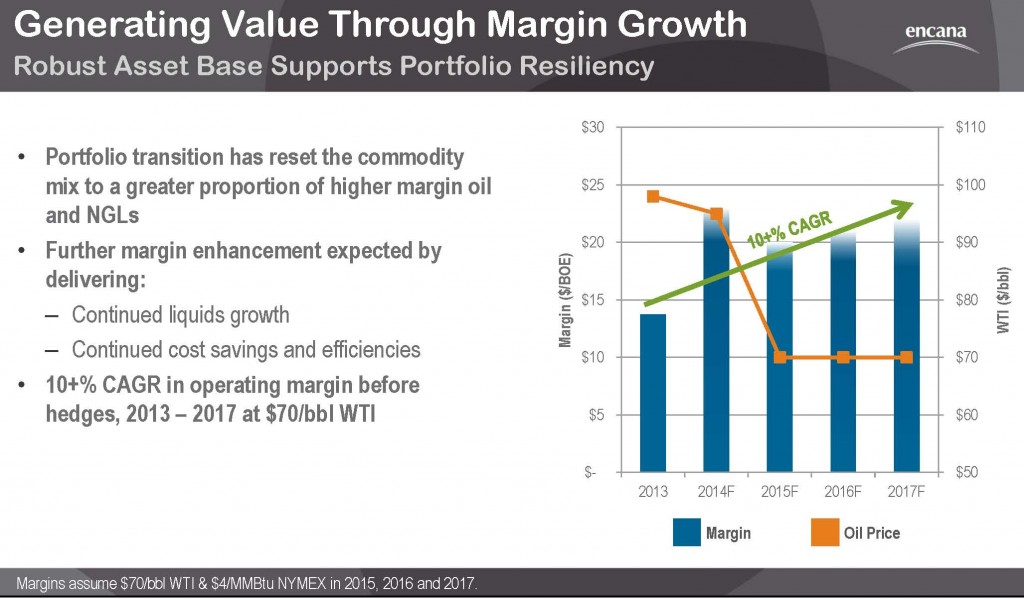

Encana will use the four assets to continue its push towards becoming a more liquid weighted producer. According to the release, Encana expects approximately 75% of its 2015 cash flow to come from oil and liquids production. The company estimates total liquids production will grow approximately 70% compared to 2014 to reach 150 MBOEPD at its midpoint, representing approximately 35% of its anticipated total production for 2015. On EnerCom’s E&P Weekly comparison of 88 companies, dated December 12, 2014, Encana’s production was 86% gas weighted; meaning this shift towards oil and liquids is a significant transition.

The company expects to see liquids production to grow 5% to reach 19 to 20.5 MBOPD in the Montney and 200% to reach 6 to 7 MBOPD in the Duvernay. Liquid production in the Eagle Ford, is expected to reach 44 to 49 MBOPD and Permian volumes are projected at approximately 50 MBOPD.

In Encana’s 2015 guidance announcement, Doug Suttles, President and CEO, said, “We enter 2015 focused on our long-term strategy, increasing liquids production, capturing new efficiencies throughout the business and protecting our balance sheet.”

Protecting the balance sheet

Encana expects to generate net proceeds of around $800 million in the first quarter of 2015 through the completion of the previously announced divestiture of the majority of its Clearwater assets and other anticipated transactions.

The deal, which was announced October 8, 2014, is for 1.2 million net acres of land and over 6,800 producing wells with second quarter average production of approximately 180 MMcfe/day of natural gas, according to a press release from ECA.The sale to Ember Resources Inc. (ticker: EBR) was priced at C$605 million (USD$544.60 million at the conversion rate listed for October 8, 2014). At the time of the press release, Suttles said, “This divestiture continues to advance our strategy. We are unlocking additional value from non-core dry gas assets as we focus on liquids rich growth areas.”

The Ember deal follows a $1.8 billion sale of gas assets to Jupiter Resources in June. Encana’s desire to jump into liquids plays is apparent: the company spent more than $10 billion in two separate 2014 deals, including $3.1 billion for 45,000 acres in the Eagle Ford and another $7.1 billion to purchase Athlon Energy and its ten year drilling inventory in the Permian Basin.In its investor presentation for the company’s 2015 guidance, Encana announced it had no plans to add new debt to its balance sheet. The company plans to use the profit from its divestitures and its portfolio shift to liquids to continue strengthening its balance sheet, even as commodity prices continue to fall.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.