October production already exceeds Q4 target

Encana (ticker: ECA) reported third quarter results today, showing net earnings of $294 million, or $0.30 per share.

Encana produced 284 MBOEPD in Q3, down from the 316 MBOEPD the company produced in Q2. This production drop reflects decreased natural gas output, primarily due to the company’s sale of its Piceance Basin assets, which closed in July. Storm-related curtailments also forced about 13 MBOEPD offline in Q3.

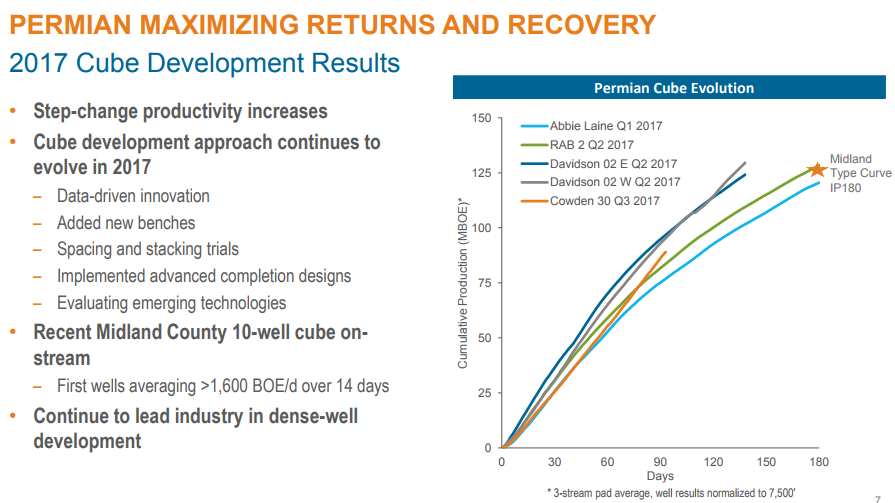

Encana’s Permian production is growing quickly, and averaged 80 MBOEPD in October. This is up 25% from the third quarter, and is well above the company’s Q4 target of 75 MBOEPD. Encana continues to develop its “developing the cube” process, testing new spacing and completion designs. Preliminary results from a recent ten-well test have been encouraging, with the first wells averaging over 1,600 BOEPD over the first 14 days and still cleaning up.

Encana expects its activity levels in the Permian in 2018 will be largely similar to its activity in the basin this year. Mike McAllister, Encana COO, reported the company has contracted its frac services for 2018 at competitive rates, allowing it to keep its crews through the year.

This was a big quarter for Encana’s Montney operations, with several new developments. The company brought three processing plants online, which will support growth of condensate production. This will be a major development for the company’s Montney operations, as condensate will significantly boost economics. McAllister reports that condensate trades at a premium in Canada, and will drive the company’s margins higher.

Eagle Ford: cash flow machine

Encana’s Eagle Ford Production is also outperforming its 2017 targets, with recent wells in both the Eagle Ford and Austin Chalk exceeding the type curve. The company has turned its Eagle Ford properties into a cash flow generator, and is holding production flat. According to McAllister, Encana’s Eagle Ford assets will generate 1.5 times capital expenditures in 2017.

Q&A from today’s Q3 earnings call

Q: Looking out into 2018, what percentage of your drill program in the Permian and the Montney will be accounted for by cube development as opposed to the drilling of single wells? And then, as a follow-up to that, where do you think you stand in terms of optimization of cube design in those plays?

Douglas James Suttles: I don’t actually think we drill single wells anywhere anymore, but Mike can confirm that. As far as the cube development approach, I think the expectation everyone should have is this is going to continue to evolve. We continue to invest heavily in understanding how this combination of how we complete our wells with how we do three dimensional spacing of our wells is maximizing recovery and returns. And you’ve already seen that, that we continue to adjust it as we go forward and keep trying to optimize both as we said earlier, the returns and the recovery.

Michael G. McAllister: We haven’t fully set our 2018 program yet. But as Doug mentioned, I can’t think of a single well that’s going to be drilled that’s not in a cube. We’re never going to stop learning. We’re never going to stop trying to improve, but we’ve seen some pretty significant improvements with our first 28 well cube that we drilled in the Montney up in Tower where we set a 25% reduction in our well costs. So there’s more to come. There’s more learnings to come, but we’re really, really encouraged about what we’re seeing so far.

Q: How does the Eagle Ford fit into your plans on a go-forward basis? It’s one of the smaller of the four, but you’ve also got compelling well results as you were mentioning.

Douglas James Suttles: I think that the Eagle Ford, just to be honest, it sort of reinforces our deep belief in why we want to be in the best parts of the best basins, because you could argue the returns and the performance in the Eagle Ford today is better than it’s ever been, even though prices are lower, much lower than they were three or four years ago.

These well rates are incredible that we’re seeing. We have wells that routinely pay out in months, not years. The impact of enhanced completion designs there has been incredible. And in fact, even at the Investor Day, we indicated in the short term, the Eagle Ford may attract a bit more capital than maybe what we had thought of a year or so ago just because the performance has been so strong.

It does have a more limited land base. We’ve kind of said for quite some time that we see it around the 50,000 barrel a day asset through the end of the decade. That may go a little longer now with some of the performance we’re seeing. But the returns are incredible and I think Mike mentioned on his piece, despite investing reasonably heavily in that asset, it’s a big free cash generator for the company, which just emphasizes the quality of that resource.

Q: In 3Q, I understand obviously there were issues with Harvey, but outside of Harvey, are you seeing any bottlenecks on the services side whether it’s ancillary type stuff or maybe sand delivery to the wellhead? Are there any bottlenecks in particular that you’re seeing?

Douglas James Suttles: I think there’s lots of, depending where you are, but in particular places like the Permian and the Montney, which are very busy. You have to just manage the supply chain. And, so I think what you’re seeing is some companies having their plans and programs being impacted by either access and availability to services or the performance of those services. We’ve been able to manage through that with some great supply chain work. As you know, we generally self-source things like sand ourselves and we manage the logistics. So we’re trying to be in front of that.

Mike already mentioned we’ve already essentially secured our frac services for 2018. Not only is that about availability and price, but we work really hard with those service companies to get it to the very highest performance and then we keep the crews. We don’t want our crews rotating on to other operators’ locations because we get them to a high-performing level and keep them there. So, I think it’s good. A little bit of pressure around steel prices, which is a global commodity, but we’ll manage that. And our goal here is any inflationary pressures, we’ll find an efficiency in the business to offset those.