Divestiture allows Denver-based Caerus to grow its Piceance footprint

Encana announced the sale of its Piceance basin assets today, in a deal with private operator Caerus Oil and Gas.

In total, Caerus will pay Encana $735 million in cash for the properties. In addition, Encana will reduce its midstream commitments by about $430 million and will market Caerus’ production from the sold properties.

Encana is selling about 550,000 net acres in total, with approximately 3,100 operated wells. These properties produced an average of 240 MMcf/d and 2,178 barrels of NGL in Q1 2017. Encana estimates that associated reserves are 814 Bcfe.

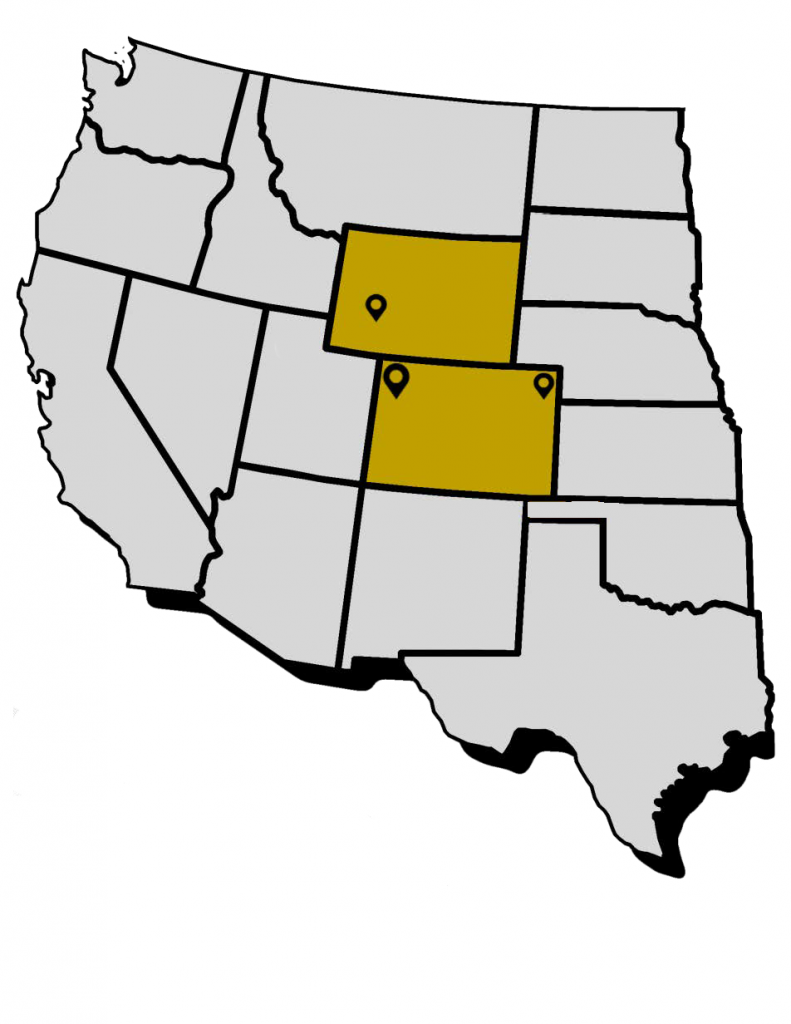

Caerus, a Denver-based operator formed in 2009, primarily invests in conventional properties. The company already focuses on the Piceance basin, so this acquisition will be a good fit for the company. Not counting the acquired properties, Caerus owns over 800 producing wells in the basin, with over 2,000 potential drilling locations.

Caerus has additional properties in the Green River basin in Wyoming, focusing on the Pinedale and Moxa Arch. Caerus also owns 23,000 net acres of undeveloped land in the northeast portion of the Wattenberg. The company reports 500 producing wells in northeast Colorado.

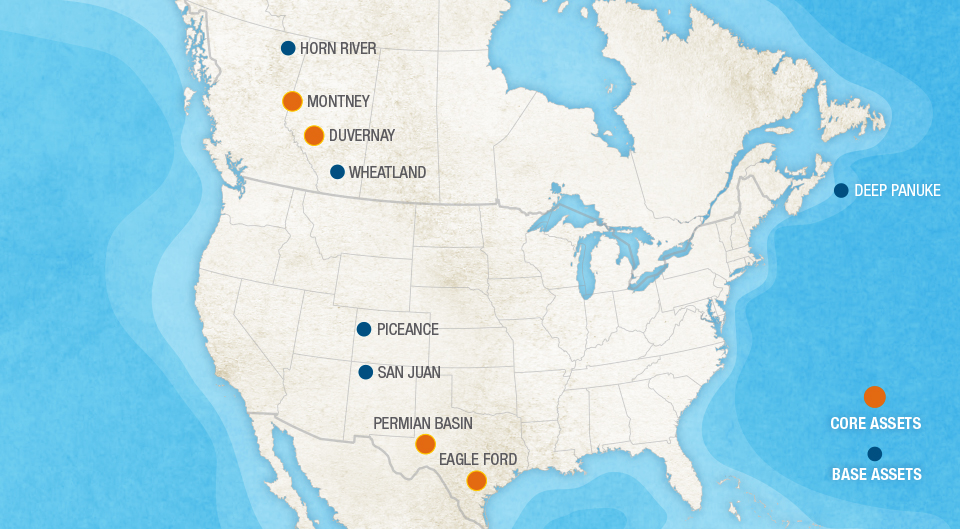

Encana is also focusing on its core assets—the Permian, Eagle Ford, Duvernay and Montney. Encana’s Permian acreage is focused on the Midland portion of the basin, with 127,000 net acres. The company plans to operate an average of five rigs in the basin this year and drill about 140 wells.

Encana President & CEO Doug Suttles commented, “This transaction advances our strategy, makes the company more efficient and delivers significant proceeds that we will use to further strengthen our balance sheet.”

The transaction is expected to close in Q3 2017.