Encana plans to invest virtually all its anticipated 2018 capital in its core assets, with around 70% directed to the Permian and Montney

Encana Corp. (ticker: ECA) anticipates between 25% to 35% production growth from its core assets from the fourth quarter of 2017 to the fourth quarter of 2018, with significant oil and condensate growth in the second half of the year, the company said in a statement.

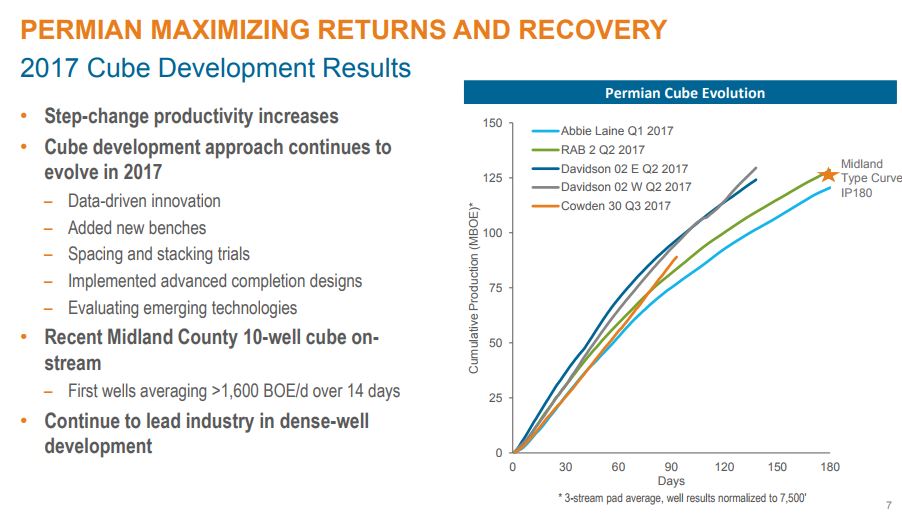

Cube development and enhanced completion designs delivered strong performance in the Permian where fourth quarter production exceeded 80,000 BOEPD, eclipsing its target of 75,000 BOEPD.

Encana entered the Permian back in Sept. 2014, when it bought Athlon Energy for $7.1 billion. For reference, Exxon Mobil Corporation (ticker: XOM) had chart-topping $5.6 billion Permian basin purchase in 2017.

In the Montney, liquids production more than doubled from the fourth quarter of 2016 to the fourth quarter of 2017 driven by a focus on condensate rich wells and the early start-up of the Tower, Saturn and Sunrise processing plants.

In 2018, Encana expects to grow its liquids production as it fills capacity at the new plants and completes two additional liquids hubs in the second half of the year.

Encana President and CEO Doug Suttles said the company planned to fund its capital program from corporate cash flows.

In the fourth quarter, Encana further focused its portfolio with the sale of most of its Wheatland assets in south central Alberta. These assets consisted of approximately 520,000 net acres and approximately 4,750 gas wells. In 2017, Encana’s production from the assets was approximately 60 MMcf/d of natural gas.

Encana said its core assets had production growth of approximately 31% from the fourth quarter of 2016 to the fourth quarter of 2017, exceeding its original target of 20% and its revised 25% to 30% guidance range. Encana said it created this growth with a capital investment of approximately $1.8 billion.

Encana said it will issue 2018 guidance along with its 2017 fourth quarter and year-end results on February 15, 2018.