Sanchez Energy Corporation (ticker: SN) will be presenting at EnerCom’s The Oil & Gas Conference® in Denver on August 15, 2016. Sanchez is an independent exploration and production company located in Houston, Texas, that is involved in unconventional hydrocarbon development in the Eagle Ford Shale and the Tuscaloosa Marine Shale.

Sanchez’s operations are primarily focused on the Eagle Ford, where the company is trying to maximize returns through cost reductions and increased well performance. Sanchez Energy’s 2016 upstream capital spending guidance remained in the range of $200 million to $250 million. This is a significant reduction from 2015, when the annual total upstream capital expenditures totaled $545 million.

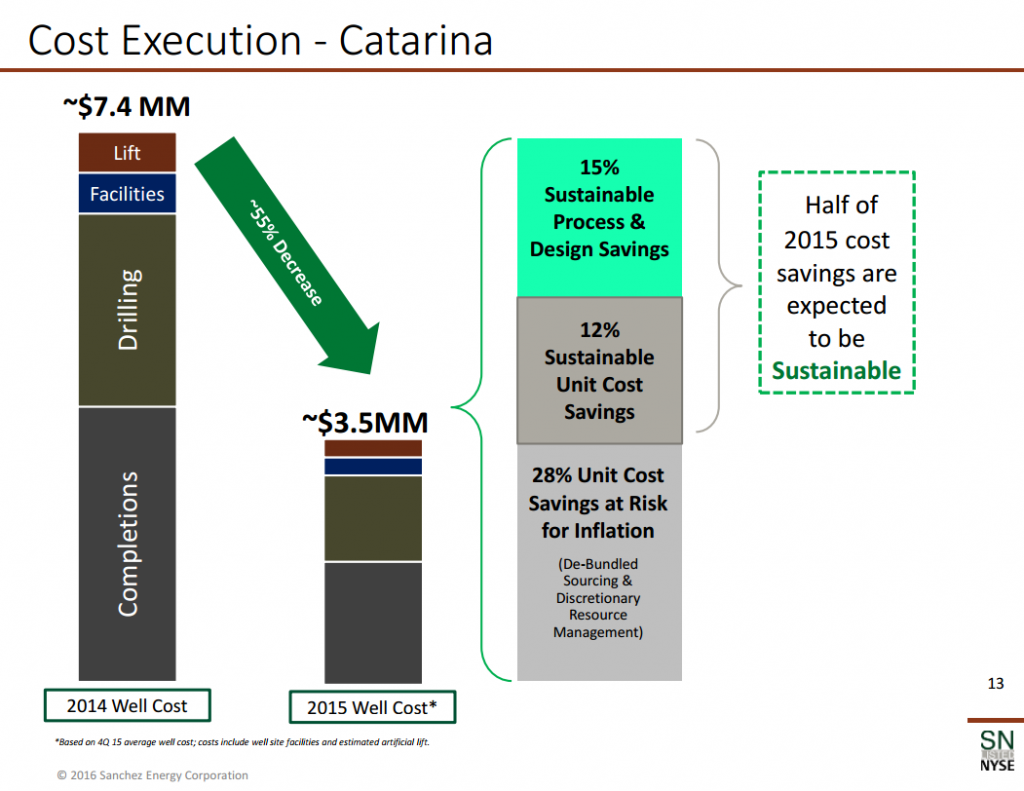

The company increased production approximately 4% over the second quarter of 2015, from 4.9 MBoe to 5.1 MBoepd, despite a significant reduction in capital spending. The company expects 2016 production as a whole to remain flat compared to 2015 levels. Additionally, Sanchez Energy has improved drilling times and has experienced drilling cost reductions of over 65% since 2014 in the Catarina area, which is the focus of the company’s Eagle Ford development.

The company has focused on reducing the costs of wells and improving the well performance. In an operations update for the second quarter 2016 Sanchez announced an average cost per well of $3.3 million, with the results of some wells coming in below $3.0 million during the quarter.

On its first quarter earnings call, Sanchez Energy CEO Tony Sanchez said, “Because the majority of our cost savings is a result of efficiency gains, we continue to believe these savings are sustainable even in a higher commodity price environment.”

The reduction in well costs is accompanied by the improved type curves coming from new wells. Wells in the South Central region of Catarina show average 30-day initial production rates that range from 1,600 to 1,900 Boe/d, the company’s best wells to date. Preliminary type curves are indicate an improvement of 20% to 30% better than expectations.

On a GAAP basis, Sanchez reported a net loss attributable to common stockholders of $69.8 million for the first quarter 2016, which includes a non-cash impairment charge of $22.1 million and a non-cash mark-to-market loss on the value of the company’s hedge portfolio of $30.4 million. Company reported Adjusted EBITDA was $64.6 million for the first quarter of 2016. The company has significant hedge positions, which were valued at over $123 million as of March 31, 2016. This corresponds to hedge contracts covering approximately 82% of expected 2016 production.