For the global oil and gas industry, world events are shaping the future. If the shale revolution started in 2004, the shale evolution will have its genesis in 2015.

The industry’s previous business model, using scarcity as its raison d’être, is dead and buried. We have seen the potential of the horizontally drilled well, and it is good. Technology is the model. If you don’t have it, you don’t get access to capital. Without technology, your capital allocation decision process will lag your competitors, and your return on capital will suffer. Yes, a rotary phone still works, as does a vertically drilled well. But you can’t stream video on the princess phone and you can’t grow net asset value drilling shallow, vertical wells.

If drilling, completion and transportation technologies are a permanent part of the capital equation, what is the answer? Low cost extraction, production and transportation. Better per-well, per-field, and per-basin EURs that only improve with more application of technologies. E&P companies will produce their wells at the highest and best rate of production. Mega projects (with lead times of three years or more) will give way to projects with a clearer line-of-sight on higher full-cost returns on capital.

In summary, companies that experienced break-neck growth at any cost can now use the last 18 months (and counting) to grow at an acceptable pace that manages personnel, returns and capital.

EnerCom’s Annual Finding and Development Study

EnerCom has put together its annual Finding and Development (F&D) study on U.S.-listed E&P companies in its database. EnerCom has 10 years of quarterly financial, operating and ratio data on more than 300 E&P and OilService companies, data the company uses in its analytical and valuation consulting practice.

A low F&D cost can be an indicator of superior asset quality, a company’s ability at executing and realizing efficiencies in its drilling plans, and supply chain management; e.g, purchase power of mission critical services (drilling rigs and frac spreads) and inventory (pipe, power and proppant). After a year of depleted commodity prices, we can numerically see the effects on per unit additions of reserves from a significantly lower SEC price deck. The average WTI price for 2015 was $50.28/barrel, a drop of 44.7% from $94.99/barrel in 2014.

If a portion of a company’s proved reserves become uneconomic to drill at a given year’s SEC price deck, the company may have negative revisions in its reserves reconciliations, shrinking the denominator in the calculation. Negative reserve revisions became a norm in 2015 as many companies saw the overall volume of reserves diminish, driving up F&D costs for the lowest performing companies. For all of the companies in the EnerCom database, 9.4 billion BOE (BBOE) were lost due to revisions, and 2.5 BBOE were lost after adding in extensions and discoveries, improved recovery, and purchases.

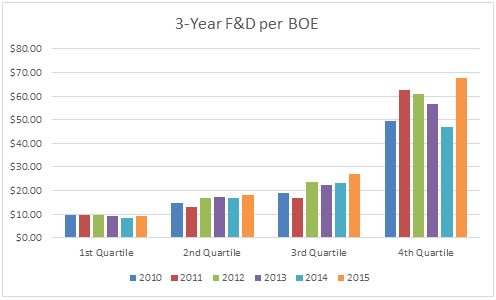

The chart below, as well as charts that will follow later, breaks down the data from EnerCom’s database into the average of each quartile of performance, the 1st Quartile is the average of the top 25% of performers, the 2nd Quartile is the average of the group from 26% to 50%, and so on.

In EnerCom’s database for the last five years, negative one-year finding and development costs, (attributable to negative overall reserve additions) was significantly higher in 2015 than previous years. In 2011, 9.0% of companies had a negative one-year F&D cost, it climbed to 22.7% in 2012, fell back to 6.5% in 2012, 8.5% in 2014. In 2015, 55.3% of companies had a negative F&D cost due to negative overall reserves additions.

In 2012, the numbers was so high due to depletion of natural gas prices, with the SEC price for Henry Hub natural gas falling to $2.76/MMBtu from $4.12/MMBtu. We believe the fall in commodity prices did more than just impact a one-year figure. The five-year rule for measuring reserves and the associated forward curve of the commodities impacted the categorization of the entire reserve base, from P1 to P3.

As a partner at Netherland Sewell & Associates said to us when we asked about future reserve adds: “If a well, field or basin works at $30 today, it won’t work at $30 tomorrow. It will only work at $30 if two things happen: costs have to come down or technologies have to just make it work at $30. Netherland Sewell has been in business for more than 50 years. During that time we have analyzed reserves when oil prices were at less than $5.00 and gas sold for a dime. It’s really about the cost side of the equation. Drilling, production and transportation costs in 2015 do not match commodity prices. Technologies make the tight sand and unconventional rock productive. But at a cost. And that cost is too high right now.”