EnerCom’s Effective Rig Count is a measure of drilling efficiency that accounts for the unique attributes of shale and the way shale plays are being developed in 2017

The industry has traditionally relied on the BHI weekly rig count as an indicator of the level of oil and gas activity taking place across the country and of what direction it is going. But in 2017 this number can be misleading, according to analysts at EnerCom Inc., a Denver-based oil and gas consultancy and energy communications firm.

The commodity price crash that began in mid-2014 forced North American exploration and production companies to cancel rig contracts and focus their capital and manpower only on the ‘core of the core’ within their most productive areas. As the crash continued through 2015, a reduction in capital available for oil and gas development forced companies to cherry pick the properties they drill, and to be super-efficient in how they go about drilling them.

Add to that an onslaught of new drilling and completion technologies brought to market since the start of the shale revolution along with the fact that operators are using these new technologies on their best acreage. This combination of factors has resulted in drilling efficiency shooting through the roof.

Upshot: the greatly reduced number of rigs still drilling have realized much higher levels of production on a per-rig basis.

Because of the highly efficient development methods that operators are using in the shale basins—drilling on multi-well pads, zipper fracs, migrating toward extended laterals, drilling stacked zones, tweaking the completion formula for each area, using better equipment—a simple one-for-one rig count is no longer an accurate measure of where oilfield activity stands—especially when it comes to accounting for productivity in shale plays, according to EnerCom’s analytics team.

EnerCom’s ERC: a more accurate measure of oilfield productivity

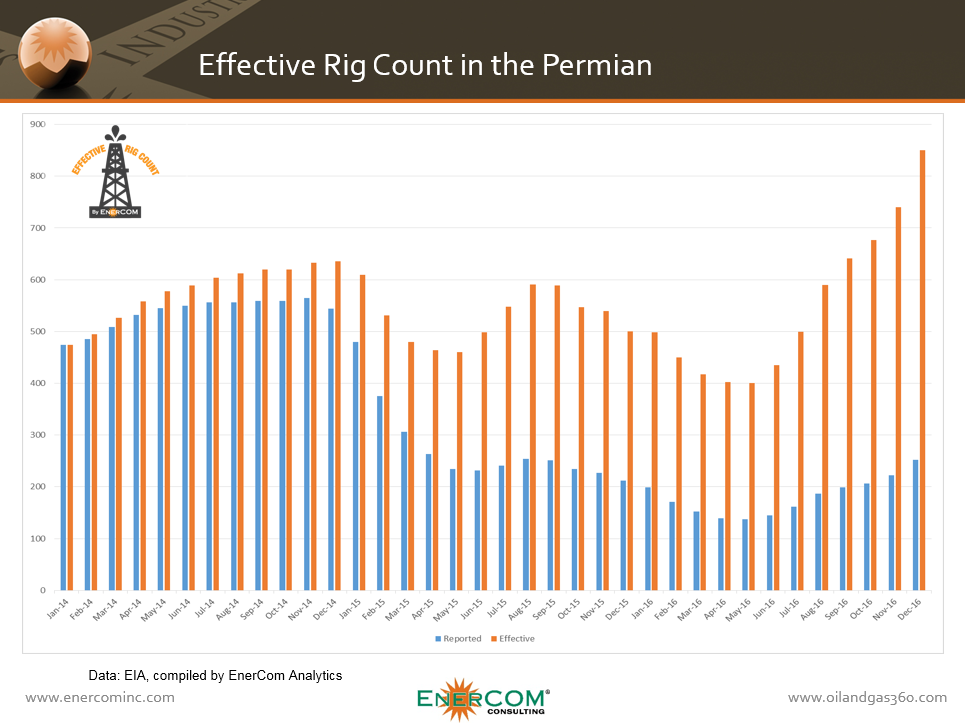

Taking the Permian basin as an example, when you compare today’s working rigs on a production-per-rig basis, the rig count in the Permian was higher in December 2016 (the last month that both rig and production data was available from the EIA) than it was in January 2014. EnerCom’s Effective Rig Count (EERC) in the Permian was 3.4 times the actual rig count at the end of last year.

How EnerCom’s Effective Rig Count works

In 2017, oil prices have stayed above $50 per barrel and drilling activity has started to pick up again. The weekly rig count (provided by Baker Hughes for the past 70 years) reflects an increase in active rigs over the past few weeks.

“When you think of what is getting done in the shale basins, looking at the rig count in the same way as we did in 2014 is misleading,” said Aaron Vandeford, managing director at EnerCom.

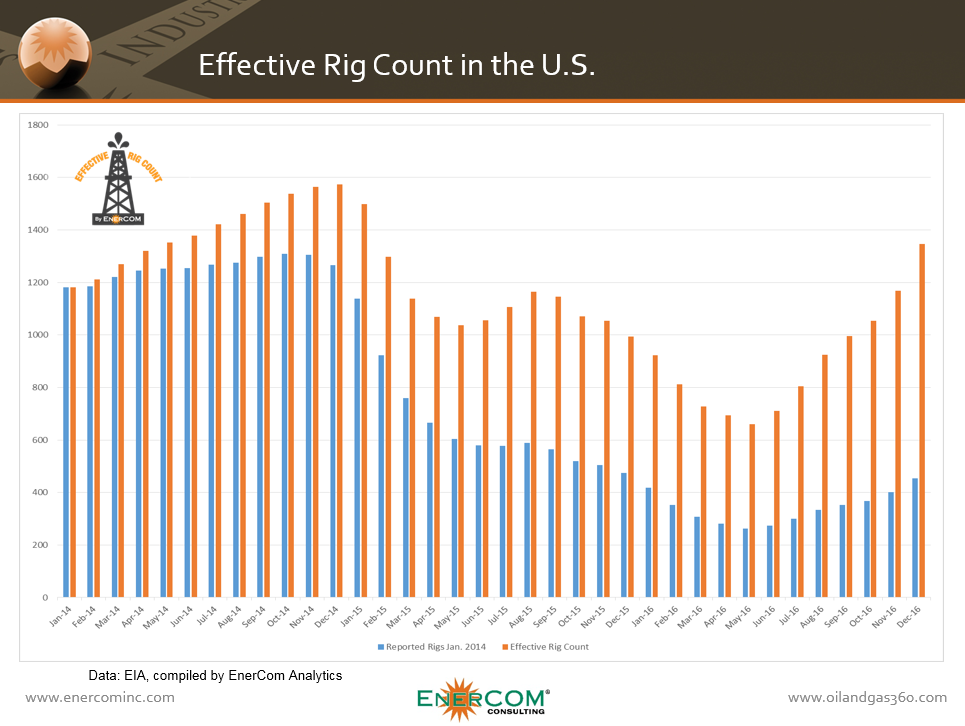

To generate a more accurate measurement tool, EnerCom looks at the rig count reported by the Energy Information Administration along with production in the basins, converting each basin’s rig count to a production-per-rig measure. EnerCom believes that its Effective Rig Count is a better measure of activity levels in the shale basins.

“Looking across the U.S. shale basins, the effective number of rigs in some basins is as much as 3.6x higher than the reported number actually being drilled due to the increase in efficiencies,” Vandeford said.

The Permian basin: EnerCom’s Effective Rig Count is 3.4 times the actual rig count

The difference is most striking in the Permian Basin, where E&P companies have been rushing to drill what is quickly becoming the most coveted oil asset base in the U.S.

The reported rig count for the Permian in December 2016 stood at 252 rigs, 47% lower than the reported rig count for January 2014, and 55% below the peak of 565 rigs in November of 2014.

Taking into account how much more oil each individual rig produced in December 2016, EnerCom says the Effective Rig Count for the Permian was 3.4x higher than the reported rig count, with 252 Permian rigs producing as many BOE as 851 rigs were producing in January 2014.

By taking into account the much higher per-rig production in the Permian at the end of 2016, EnerCom’s Effective Rig Count in the basin is actually 80% higher than than the reported rig count was in January 2014.

Not just the Permian: improved drilling efficiencies have changed the picture across the whole U.S.

Taking all of the basins in aggregate, EnerCom’s Effective Rig Count for the entire country for December 2016 was 1,346 rigs, almost three times more than the reported actual working rig count of 454.

Even though the reported rig rate has fallen approximately 65% from a peak of 1,309 in October 2014, the EERC was roughly 3% higher at the end of 2016 than the reported peak 14 months earlier.

Interpreting the data

Investors and members of the oil and gas industry look at a wide range of different factors when trying to determine the direction of the market. EnerCom Inc. strives to help its clients understand the realities of the market through a number of products including EnerCom Analytics’ Energy Data and Trends Report, a comprehensive monthly report of the oil and gas industry as it operates within the global economy.

January Energy Data and Trends Report lays it out

EnerCom’s Effective Rig Count was developed as part of the EnerCom January Energy Data and Trends Report. January’s report discusses which production and financial metrics lead companies to achieve a premium valuation from investors. The January report also looks at which basins offer the greatest potential upside for investors. To learn more about receiving EnerCom’s monthly Energy and Trends Report, click here.