(Oil and Gas 360) – Energy Advisors recently released its latest edition of its MarketMonitor series, Letter From Dallas, highlighting key themes driving A&D. Market conditions remain favorable to sellers with strong buyer demand from private equity firms, family offices, institutional investors, hedge funds, and well-capitalized public companies. Valuation for producing (PDP) assets is strong, while competition across the minerals and NonOp markets is described by some as “fierce”

How were the 3Q25 A&D Markets?

Deal activity rebounded sharply in the third quarter, with 22 notable transactions recorded—up from 12 in 2Q and closely aligning with the 23-deal quarterly average since 2022. However, total deal value fell short, registering just $9.6 billion compared to $13.5 billion in 2Q. This figure also remains well below the $26.5 billion quarterly average since 2022, though that number is skewed by the mega-mergers that dominated headlines in 2023 and 2024.

More Public Mergers? Basin Consolidation?

Public-to-public mergers are expected to persist, reducing the number of public E&P companies—now estimated at less than 40. California Resources’ acquisition of Berry Petroleum underscores the trajectory, while Civitas is reportedly exploring strategic alternatives. One driver: a persistent valuation gap between large-cap and small-cap operators with EV/EBITDA multiple spread of ~4.5x vs. ~3.0x.

Beyond public mergers, Basin consolidation will likely continue in the Delaware, Eagle Ford, Anadarko, Utica, and Bakken. Other areas —such as the DJ, Midland, and Appalachia—are already highly consolidated, limiting large-scale M&A.

Assets In Play: Natural Gas in Spotlight.

Many expected a wave of non-core divestitures from the $100B+ in mega-mergers in late 2023 and early 2024—Exxon/Pioneer, Chevron/Hess, ConocoPhillips/Marathon, and Diamondback/Endeavor. Some activity has occurred, though modest due to the high quality of the companies acquired: Diamondback sold $4B of Endeavor’s minerals to Viper, Conoco divested $2.5B and plans to offload another $2.5B by 2026, and Exxon has trimmed parts of its non-core Permian portfolio. Chevron has yet to make significant moves.

Still, material assets are in play, particularly natural gas. In Ohio’s Utica shale, Antero is marketing assets and Ascent Resources has signaled IPO or other liquidity plans. The play gained attention after Infinity’s IPO in January and EOG’s $5.6B cash buy of Encino—the company’s largest deal since Yates in 2016.

In the Haynesville, Aethon reportedly received offers of $8–$10B, first from ADNOC and more recently from Mitsubishi. Meanwhile, GEP Haynesville II (a GeoSouthern/Williams JV) is reportedly in talks with Japanese utility JERA for up to a ~$2B deal. Hedge fund Citadel is also reported be in advanced talks to buy 150 MMcfpd and 38,000 net acres from Comstock’s legacy Haynesville as a logical bolt-on to its $1.2B buy of Paloma Natural Gas VI in February.

Private Equity, PDP and More.

After divesting more than $30 billion since mid-2024, Private equity is back in acquisition mode. Having raised $10B+, the sector has launched 15+ new acquisition teams—further intensifying competition for assets.

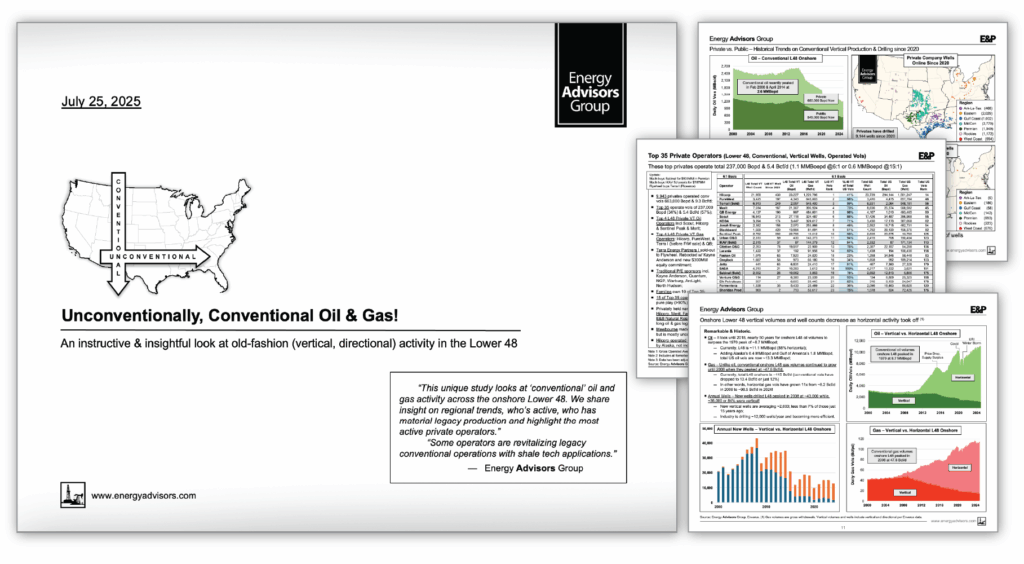

PDP appetite is strong. Buyers like Hilcorp, Diversified, Mach, Presidio, TXO, Scout and Merit to continue targeting conventional production. In some cases, these companies are tapping into a growing ABS market for oil and gas assets fueled by strong demand from pension funds and insurance companies. Energy Advisors’ 90-page research report Unconventionally, Conventional! provides a detailed look into the U.S. onshore conventional sector— by region, volumes, activity, formations, and ownership. We highlight a fragmented but vital part of the market, with over 10,000 private conventional operators, 1,500 of which produce more than 100 BOEPD.

About Energy Advisors oilandgas360.com contributor

Energy Advisors is a leading firm in oil and gas transaction advisory services and thought leadership having served the industry for over 35 years. We trace our roots back to PLS Inc which sold its listing service, research, and databases to DrillingInfo in 2018 and rebranded its advisory and marketing arm as Energy Advisors in 2019.

Contacts:

Brian Lidsky

Director of Research

713-600-0138

Blake Dornak

VP, Marketing

713-600-0123

bdornak@energyadvisors.com

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Advisors for the full report. Please conduct your own research before making any investment decisions.