Schlumberger receives go-ahead from Chinese Ministry of Commerce

The world’s largest oilfield service company, Schlumberger Limited (ticker: SLB) jointly announced with Cameron International Corporation (ticker: CAM) today that the Chinese Ministry of Commerce (MOFCOM) cleared their proposed merger, which is valued at $14.8 billion. MOFCOM’s approval came without any conditions, and represented the last major closing condition of the proposed merger. As a result, the two companies plan to close the transaction on April 1, 2016.

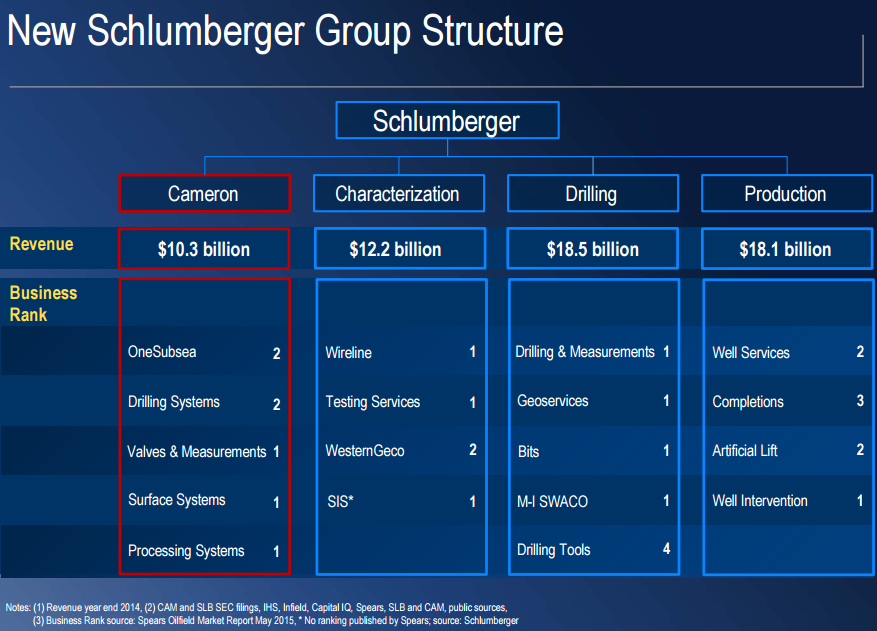

The combined companies reported 2015 revenue of $44.3 billion, with Cameron adding about 20% to Schlumberger’s revenue base.

When the merger was first announced, the companies said the combination would create a “pore-to-pipeline” services company by combining SLB’s reservoir and well technologies with CAM’s expertise in surface, drilling, processing and flow control technologies.

“As we seek new ways to drive total system performance in the areas of both drilling and production, it has become very clear to us that there is huge potential in a much closer integration between the surface and subsurface parts of both drilling and production systems,” said Schlumberger Chairman and CEO Paal Kibsgaard.

Opposition remains to Halliburton/Baker Hughes merger

As the world’s largest OFS company closes on its merger, the second and third largest, Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI), continue to grapple with antitrust concerns over their merger.

Announced in November 2014, the deal is valued around $35 billion. The deal was scheduled to close last year, but has been delayed as the U.S. and E.U. hold up the transaction over competition concerns.

Earlier this month, the European Commission said the companies have yet to provide a formal divestiture offer addressing the E.U.’s antitrust concerns, reports Reuters.

“Once the missing information is supplied by the parties, the clock is restarted and the deadline for the Commission’s decision is then adjusted accordingly,” said Commission spokesman Ricardo Cardoso. “Failure to do so will lead the Commission to stop the clock.”

Total (ticker: TOT) CEO Patrick Pouyanne also came out against the deal while attending an energy conference in New Orleans last week, reports Bloomberg.

“Obviously when you have less competition in service providers, I’m not in favor,” said Pouyanne, who heads the world’s fifth-largest producer.

Brian Uhlmer of GMP Securities told Oil & Gas 360® that he didn’t think the Halliburton-Baker Hughes merger would ever go forward, with the EU pushing back, Norway strongly against it, the U.S. demanding divestitures, and other forces pressuring the deal.