Energy XXI (ticker: EXXI) is an independent oil and natural gas exploration and production company whose growth strategy emphasizes acquisitions, enhanced by its value-added organic drilling program. The board of directors of Energy XXI announced on March 12, 2014, the acquisition of EPL Oil & Gas (ticker: EPL) for a total consideration of $2.3 billion, consisting of about $1 billion in cash (65% of total consideration) and about 23.4 million common shares of Energy XXI (35%).

In a conference call following its Q3’14 release (for the three months ended March 31, 2014), Energy XXI management said the cash to shares ratio will likely be within 15 percentage points of the initial deal but will not be finalized until its closing. Since the merger is not complete, company representatives did not reveal updated operations plans for its potential new acreage but mentioned similarities.

“I can’t say enough good things about the asset review,” John Schiller, Chairman and Chief Executive Officer of Energy XXI said during the call with investors and analysts. “Organizationally we know where we are going to be in terms of a management team. So we had all the right people in the room for those reviews and their change of titles I think went very well and I think you’ll see a very good program going forward as result to the combination of the two companies.”

Q3’14 Results

EXXI’s Q3’14 results, announced on April 30, 2014, include net income of $4.4 million ($0.06 per diluted share) on revenues of $285.2 million. The company received approximately $100 million in cash from the divesture of approximately 2,000 BOEPD of non-operated properties in Eugene Island 330 and South Marsh Island 128.

EPL Deal Details

Source: EXXI May 2014 Presentation

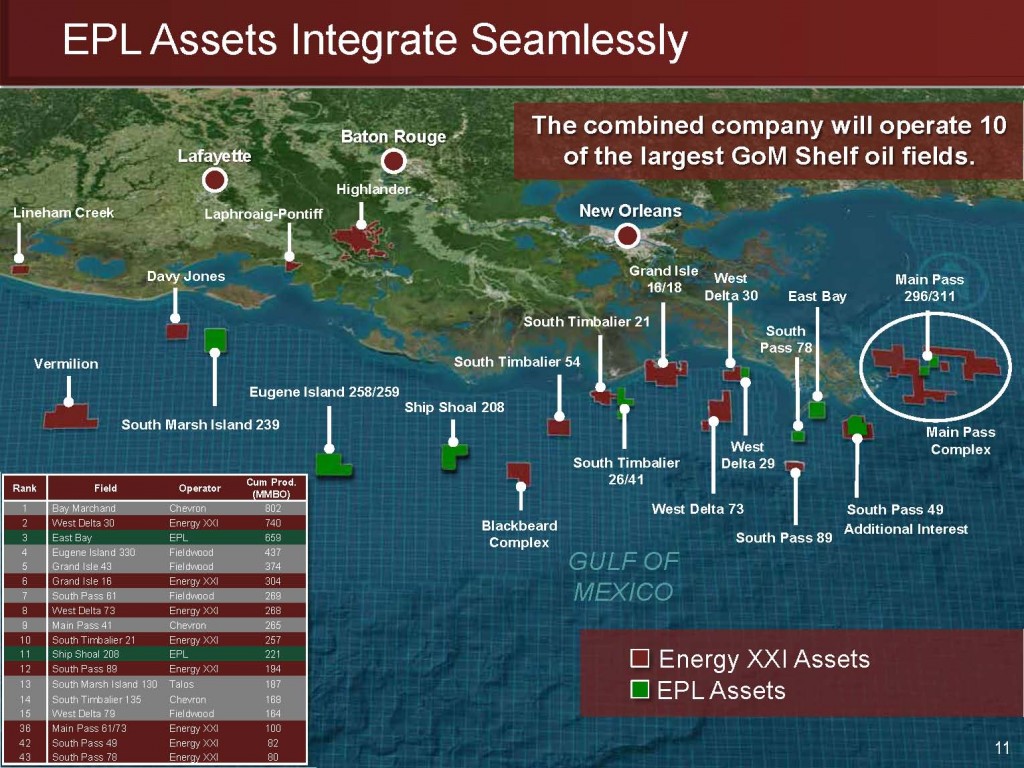

The per-share consideration for EPL is $39, a 34% premium to the close of business on March 11, 2014. EPL’s 2013 estimated proved reserves, prepared by Netherland Sewell & Associates, were 84 MMBOE including the unbooked assets associated with the Eugene Island 258/259 (EI 258/259) Field acquisition that was announced on January 2, 2014. EPL’s probable reserves were estimated to be 29.8 MMBOE. The company’s average full-year 2013 daily production rate was 16,938. EPL estimated having a March 2014 production exit rate of 22,700 BOEPD.

OAG360 went in-depth on the metrics of the sale in a featured article.

An acquisition meeting between EXXI and EPL shareholders is scheduled for May 30, 2014 and the merger is expected to be completed around June 3, 2014. The record date has been established at April 21, 2014. Pro forma for the transaction, EXXI is the largest independent operating in the Gulf of Mexico and is involved in 10 separate fields.

“Obviously both companies have been driven the same way which we have a highly operated positions,” said Schiller. “There are not that many assets in the non-operated sort of environment.”

Production Overview

Production for the quarter averaged 42.3 MBOEPD (67% oil) and is currently at 41 MBOEPD following the previously mentioned divesture. A development well in the Main Pass 61 field (100% working interest) was spud in April and is targeting the same sands as the nearby Don Carlos well, which produced 1,250 BOPD from dual completions drilled at measured depths of 10,450 feet.

Source: EXXI May 2014 Presentation

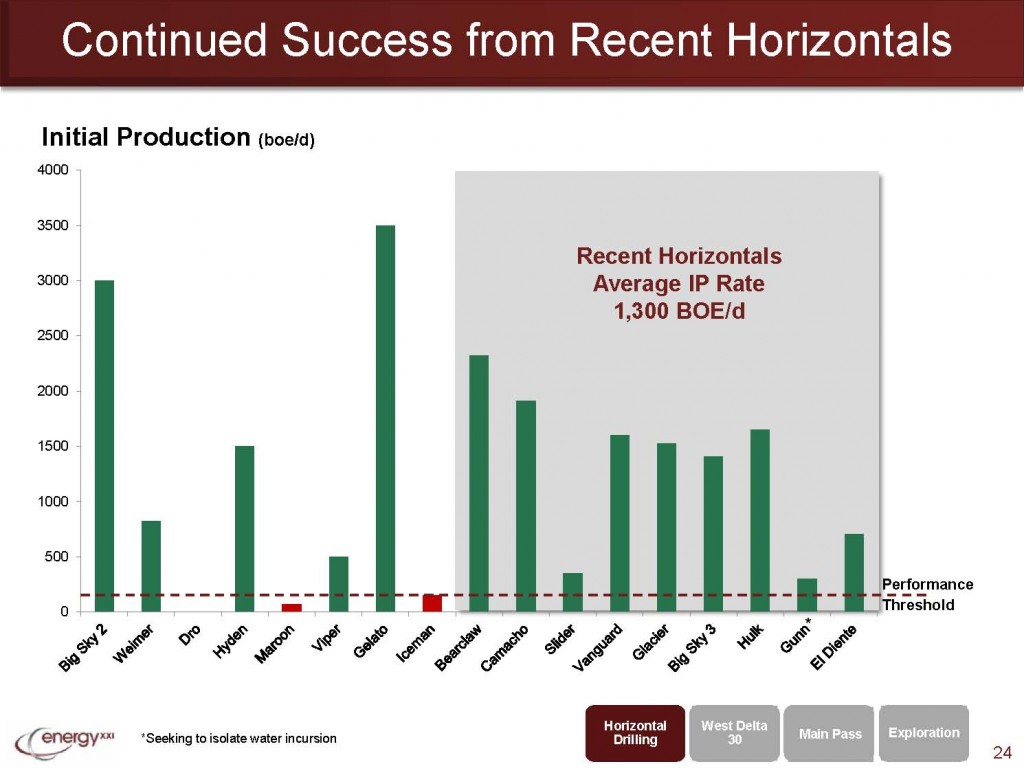

The El Diente well at West Delta 73 (100% working interest) returned IP rates of 532 BOEPD (94% oil) at measured depth of 10,462 feet when brought online in February. The platform was temporarily shut in but production is expected to surpass 1,000 BOEPD once operations resume. Two similar wells (Scully and Columbo) are currently preparing to drill off of nearby platforms and will reach depths similar to the El Diente. The Columbo will be drilled from a second rig recently added to the area. In its April 2014 presentation, EXXI listed ultimate recovery in the region at 1,340 MBO per well.

The Black Widow well at West Delta 30, the first of a multi-well development program in shallower waters, has been completed and is producing 400 BOEPD. The well encountered 100 feet of pay after being drilled to 3,440 feet of measured depth. Two additional horizontal wells have been identified and are scheduled to drill off of one rig in the region. A total of 60 wells (45 horizontal) have been identified.

Schiller explained the Delta field differences in the call. “The biggest difference between the nice shallow wells and what we are doing now is you need bigger pay sands. So it’s a little bit trickier drilling, whereas at West Delta 73 we are actually targeting sands at 15 foot thickness and been successful getting in them, because there’s not a lot of structural change. So when you drill against salt on our three way closure one of the things you want is a thicker oil column and that’s what we had in West Delta 30.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. As of the report date, an EnerCom employee had a long-only position Energy XXI.