Enerplus Resources Corporation (ticker: ERF) has three main operation centers in the Williston basin, the Marcellus shale, and Canadian waterflood operations.

Enerplus’ Williston basin is responsible for the lion’s share of the company’s production, with 25,100 BOEPD leaving the basin. Following behind the Williston are the Canadian waterflood operations, which account for an average of 13,600 BOEPD, and behind that is the company’s Marcellus production at 206 Mmcf per day. These production values were reported as of May, 2017.

The company’s focus on its North Dakota assets is reflected in its 2017 budget, wherein $330 million (Canadian) is allocated to the Williston basin, out of a total of CAD $450 million. The remaining CAD $120 million will be split evenly between the Marcellus assets and the Canadian waterflood projects.

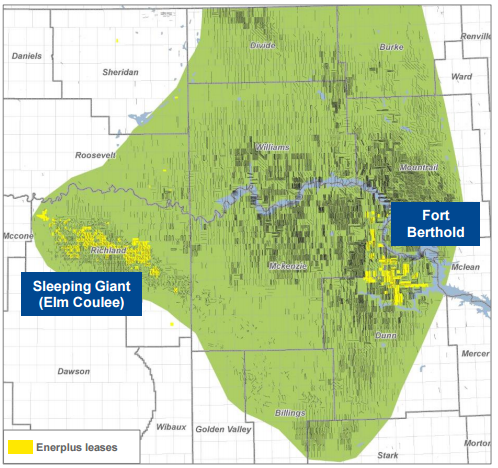

Williston

In the Williston basin, where Enerplus holds acreage split between Montana and North Dakota, it exhibited Q1, 2017 production of approximately 4,220 BOEPD and 20,840 BOEPD, respectively. The Fort Berthold, North Dakota assets are the subject of more attention, with two operated rigs present in the area in Q1. The Sleeping Giant, Montana, assets are utilized as a strong free cash flow generator with relatively shallow declines.

In the Fort Berhold area, Enerplus operates approximately 65,500 net acres—where the company suspects 524 gross (457 net) future drilling locations exist. The company notes that the acreage is lightly drilled, at approximately two wells per drilling spacing unit (DSU), but that full development may amount to approximately 10 wells per DSU.

As of May, 2017, Enerplus reported that it had recently completed 11 wells in the Fort Berthold area.

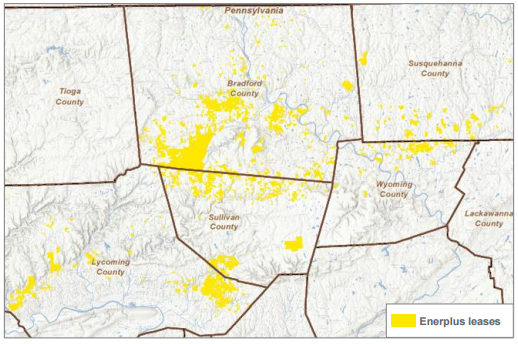

Marcellus

Enerplus holds approximately 39,000 net acres in the Marcellus shale, and believes that 129 net future drilling locations exist. Enerplus is encouraged by the improvements to natural gas price differentials, as prices begin to more closely reflect Henry Hub prices in 2017. The company anticipates that planned pipeline projects, such as the Atlantic Bridge, Connecticut expansion, and Susquehanna West expansion, to name a few, will further improve differential prices and allow produced gas to reach market.

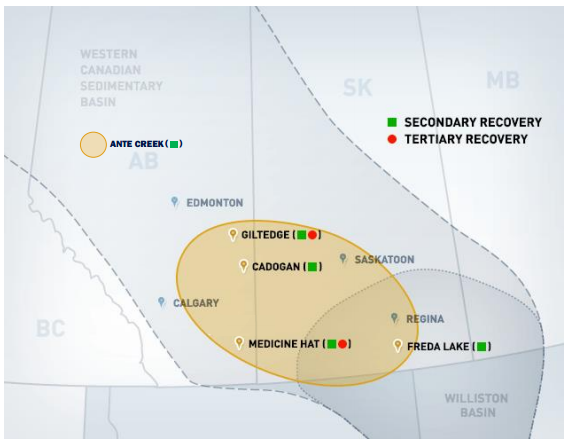

Canadian waterflood

The Canadian waterflood projects, which stretch between Alberta and Saskatchewan, offer low declines—with an average of 14% decline rates—for the establishment of stable cash flows. The activities currently are dominated by waterflood enhancement and optimization with polymer flooding.

Enerplus Corp. is presenting at EnerCom’s The Oil & Gas Conference® 22

Enerplus will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.