EOG achieves its fourth-highest adjusted earnings ever

EOG Resources (ticker: EOG) announced first quarter results today, showing net earnings of $638.6 million, or $1.10 per share. After adjusting for non-recurring charges, the company earned $689.5 million, or $1.19 per share. This is the largest adjusted earnings reported by EOG since before the downturn, and the fourth-highest adjusted earnings ever reported by the company, exceeded only by Q1 and Q2 2014 and Q3 2008.

EOG produced an average of 659.9 MBOEPD this quarter, up 15.6% year-over-year. This growth is expected to accelerate through the year, with crude oil production growing 16% to 20% in 2018.

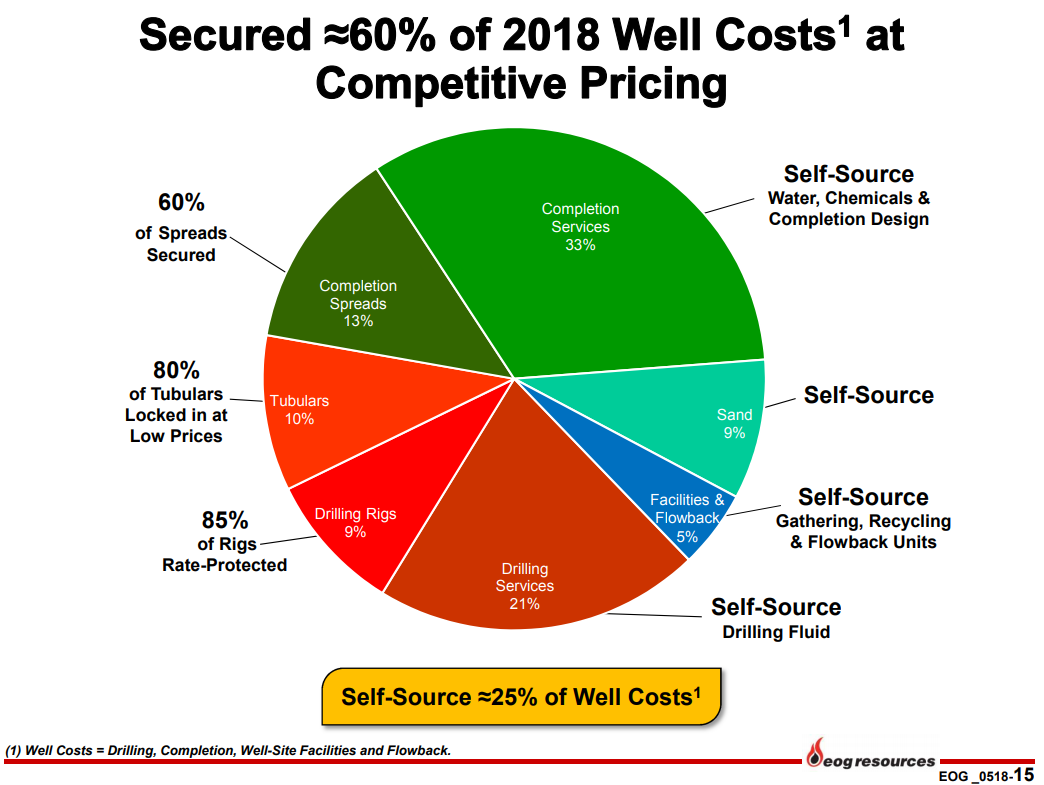

Well costs expected to fall 5%

EOG expects to spend about $5.6 billion this year, while reducing average well costs by 5%. The reduction in well costs is partially due to EOG’s self-sourcing activities, as the company self-sources 25% of well costs. Much of the raw materials involved in drilling and completions, like water, sand, chemicals and drilling fluid are self-sourced. Most of the company’s rigs, tubulars and frac spreads are locked in at fixed prices, so cost inflation from these sources is reduced.

EOG’s Delaware Basin activity was back-weighted this quarter, as the company brought 70 wells on production in Q1 but only 14 of these began production in January. EOG continues to focus on delineation work in the Delaware, investigating additional targets and testing development patterns in different areas.

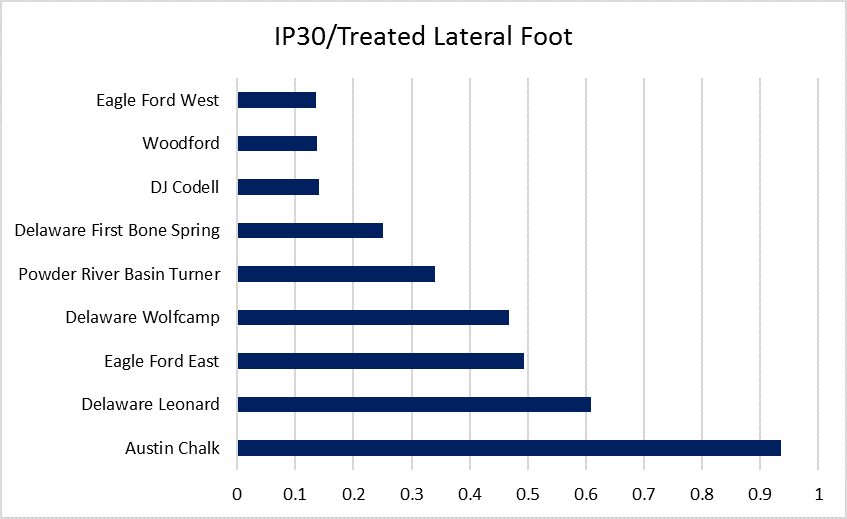

Shorter laterals, higher IP30s: EOG’s Austin Chalk wells show tremendous efficiency

EOG’s Eagle Ford/Austin Chalk are generating headlines as well, with the Austin Chalk producing highly efficient wells. EOG’s Austin Chalk wells are shorter than most modern unconventional wells, with an average treated lateral length of only 4,600 feet. However, these wells are some of EOG’s most productive, with an IP30 of 4,305 BOEPD. At 936 BOE/1000 ft, these wells have the highest IP30s per lateral foot of any activities EOG outlined this quarter.

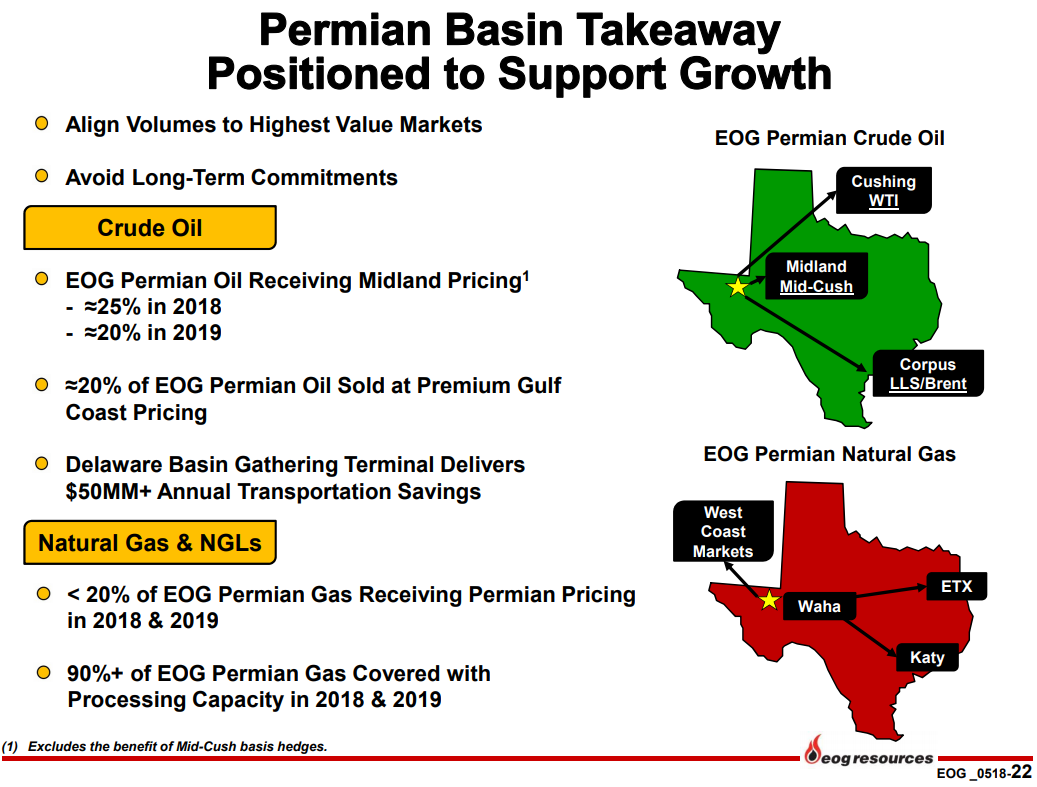

EOG reports its Permian production is mostly safe from the heavy oil and gas differentials seen in the basin, as about 25% of Permian oil and less than 20% of Permian gas receive local pricing. EOG is currently selling 20% of its Permian oil at Gulf Coast pricing, which runs a premium to Cushing WTI.

Corporate M&A off the table

EOG Chairman and CEO Bill Thomas discussed the company’s strategy and goals in the coming year, including how EOG plans to invest the cash flow it is generating. “Along with reinvestment in high return wells,” Thomas said, “we’ve outlined the following priorities for utilization of free cash flow. First, an impeccable balance sheet is fundamental to a commodity-exposed business, having low debt strengthens the sustainability of our dividend and maintains our investment flexibility through the volatility of the commodity price cycle.”

“Concerning flexibility, let me be clear on one point, we have no interest in expensive corporate M&A in any commodity price environment. EOG is an organic exploration company with the ability to continually add premium drilling through low cost organic leasing and low cost tactical property additions. And it’s important to emphasize here that our premium hurdle rate applies across the board to everything we do. We have set a target to reduce total debt outstanding by $3 billion over the next several years. Tim Driggers will provide more detail on our debt reduction plans in a moment.”

“Second, we will target dividend growth above our historical 19% compounded annual rate. We have a long history of delivering a dividend that we can maintain throughout the volatility of the commodity price lifecycle. The result has been 17 increases in 19 years without a single dividend cut. We believe our prospects for cash flow growth will support strong dividend growth that is sustainable through price cycles.”

Q&A from EOG conference call

Q: I have a question for the Eagle Ford trend which you guys definitely was the first mover, and it’s been going on nine years, I was wondering what is the organic growth rate for this trend in 2018. And also regarding the Austin Chalk, I want to understand what are the key gating factors that would lead you to fully develop this concept, and when would the Chalk be a meaningful contributor to your Eagle Ford trend growth.

EOG: I don’t think we’re going to spend any time today guiding to the direct growth on that asset right now. But what I will say about the Eagle Ford is the upside we see there just involves our continued progression of integrating the data that we’ve collected over the development cycle that we’ve had there. We continue to integrate both high-graded geologic mapping completions data back into of our geologic model, and it helps kind of drive our precision targeting as we develop even finer scale and high graded targets.

And then also with respect to the Austin Chalk, we’ve gone a little bit slow making announcements on that because, geologically, it is a bit more complex than the Eagle Ford. I would say that it already is contributing in a pretty good way to not only our returns but also in 2017, both the Eagle Ford and Austin Chalk actually showed just a little bit of growth year-over-year. And so we’re happy with our pace of development there in the Austin Chalk and when we have more information on that, we’re a little more comfortable with it, we’ll provide greater detail.

Q: I’m not challenging the discipline of the $40 hurdle for premium locations, but obviously some of the market may have different view as to what the sustainable oil price is. And the question is really about inventory relative to your growth pace. If we had to run a $45 or a $50 number as the threshold for premium inventory, how would it change over the disclosure you’ve given so far? Does it go up 10% or does it double? And I’ll leave it there. Thanks.

EOG: So I think, first of all, we don’t have any plans on changing our criteria. We’re going to stick with $40 oil and $2.50 flat. That needs to be really clear going forward. That is a fundamental thing with EOG.

If you looked at our entire inventory, which is quite substantial, I would say pretty much all of it would be 30% or better rate of return at $50. So it’s a very high quality total inventory. It would be – the inventory that we have in the company that’s non-premium at $40 would be I would say equal to or better than the average inventory of the whole industry. So it’s a very high quality inventory set.

And we have a lot of confidence that we’ll continue to make improvements on the non-premium inventory and bring it to a level to where it will classify as premium at $40 oil. So we’ve got, again, a very sustainable cost reduction. It’s not just a one-year thing. It’s a very consistent cultural attribute of the company. And then we have a tremendous ability to continue to improve well productivity at the same time. Our goal is to convert a lot of that non-premium inventory into premium inventory as we go forward.

Q: I was hoping you could address the Austin Chalk a little bit more. I know that you said that you’re not trying to make extensive comments. I’m just trying to get a sense of the inventory there. I mean, it sounds like this is one of the best returning plays you guys have. Just curious, I mean, is this kind of a couple years inventory or is there a similar 10 years like the Eagle Ford?

EOG: It’s just really still pretty early in in the Austin Chalk. We are still doing a lot of testing on our well spacing, trying to determine kind of the optimal spacing, how many precision targets we have in there. We’ve talked about in the past that it is different than the historical Austin Chalk play. It is a matrix – contributing kind of a matrix drive play. And so it’s not quite as straightforward to use a lot of those historical learnings.

The way we’re developing it is different and it’s unique. I’d say the initial productions look good. I know it seems like we put a lot of wells on but we’d like to be confident before we really come out with any detailed numbers on that. And like I said, when we have a little more detail on that, we’ll certainly talk about it.

Q: And I guess I just wanted to follow up on the Eagle Ford. You guys talked about some of the differing production rates you saw in the first quarter on the eastern wells versus the western wells, but then cited that returns are pretty similar. Just curious, does that kind of imply that maybe your well cost in West are lower than the East, what can you say sort of say about that?

EOG: I think you hit the nail on the head there. The cost per foot – I tried to highlight in those opening remarks the contiguous nature of the western Eagle Ford acreage and a little bit less faulting out there, allows us the opportunity to drill longer wells and larger packages. It’s a little bit less pressured and less shallow too. So in general, the costs are a little bit cheaper there.

In the eastern Eagle Ford side of our acreage position though, we usually have wells with a little bit more robust rates, a little bit bigger wells, but it is a little bit more challenging drilling over there. It’s a little bit deeper, a little bit extra pressure. And then in general, the well lengths tend to be just a little bit shorter due to both the layout of specific leases over there, but then also there’s an increase in the faulting off to that eastern side.