Four-well pad producing combined 20,000 BOEPD 30-day IP

EOG Resources: (ticker: EOG) reported first quarter earnings today and also said that it set a company record for crude oil production in Q1, producing 315.7 MBOPD, 18% above last year’s Q1 production levels. The company expects to sustain an 18% year-over-year growth rate throughout the year assuming $47 flat oil.

For Q1 of 2017, EOG announced net income of $28.5 million, or $0.05 per share. After adjusting for impairments and other one-time charges, the company’s adjusted net income is $89.4 million. These both exceed EOG’s Q1 2016 GAAP and adjusted losses of $471.8 million and $455.4 million, respectively.

Whirling Wind wells break 30-day IP records

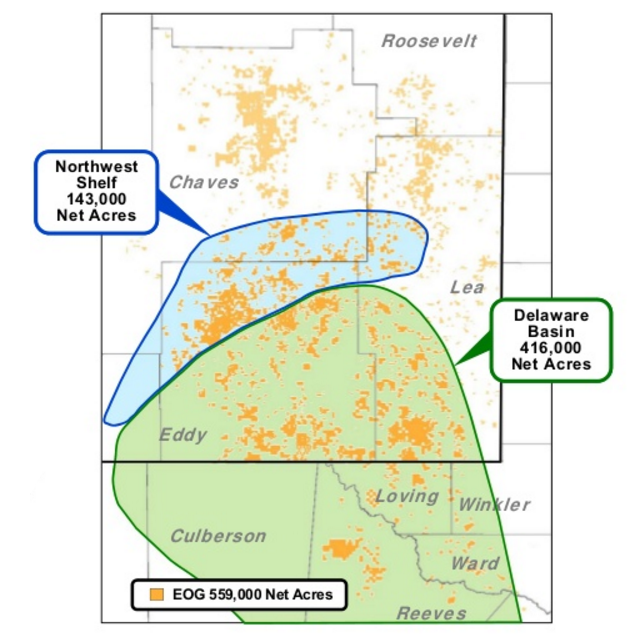

In the Delaware basin EOG has set a claimed new record for 30-day IP.

Each of the four wells in the company’s Whirling Wind 4-well pattern in Lea County, New Mexico has produced an average of 5,060 BOEPD, consisting of 3,510 BOPD, 700 BPD of NGLs, and 5.1 MMcf/d of natural gas. According to EOG, each of the 7,100’ lateral wells exceeded the prior all-time industry record for 30-day IP from Permian basin horizontal oil wells.

In total, EOG completed 33 wells in the Delaware in Q1 2017, with an average 30-day IP of 2,855 BOEPD and average lateral lengths of 5,600’. The company will operate an average of 13 rigs in the basin this year, completing a total of about 110 wells.

Premium inventory growing quickly

One of EOG’s current goals is to focus on its premium inventory, concentrating on adding and developing its best wells. For EOG, “premium” refers to wells with a minimum 30% direct after-tax ROR at $40 oil. The company seeks to add to this inventory at least twice as fast as it is drilling, through converting existing locations to premium, exploring new opportunities or acquisitions.

During Q1, EOG added 1,200 net well locations and 1.4 BBOE of premium inventory, significantly more than the 480 wells that the company will complete this year. In total, EOG reports 7,200 net premium locations, representing 6.5 BBOE of potential reserves. Despite service cost inflation, EOG reports its average well cost in the Eagle Ford, Delaware and Bakken was 6% lower than 2016 averages.

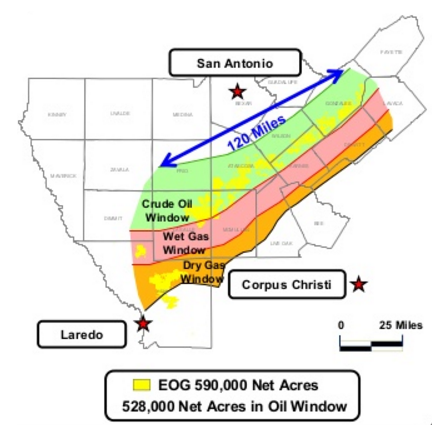

100 Eagle Ford wells to begin EOR

The Eagle Ford remains EOG’s most active area, as the company completed 65 wells in Q1 and expects to complete an additional 130 through the rest of the year. The company is moving forward with its enhanced oil recovery plan in the Eagle Ford following its successful test in 2016. This process typically requires a capital investment of $1 million per well, and adds 30% to 70% incremental reserves. EOG plans to use enhanced oil recovery on about 100 wells in the Eastern Eagle Ford this year.

Q&A from EOG Q1 2017 conference call

Q: Congratulations on the Whirling Wind well. They’re truly impressive. Just wondering if they are from the upper Wolfcamp? And then what is driving the performance? Is it the completion techniques? Geosteering of better rocks? And can this be replicated over a large area?

Lloyd W. Helms: So those Whirling Wind wells are drilled in the upper Wolfcamp, and what really led to the high production rates that we’ve seen is a combination of several things that we’ve talked about. And I see it leads off with understanding the geology and understanding where the best rock is and then being able to keep the target in that best rock throughout the length of the lateral, and these are over 7,000 foot laterals.

And then combining that with the high density completion technology that we continue to advance, those – the combination of things is what led to that production increase and we don’t think we’ve reached the peak of that knowledge yet. We think we still have advancements that will continue to drive productivity increases throughout the play. Every play the geology changes across the basin, so every location won’t be exactly like these wells, but there’s still a lot of potential for improvement across the play.

Q: So should we expect sort of a more spectacular flow rate as such in the future, maybe from slightly different geographic area? Can this be replicated?

Lloyd W. Helms: Yes, I wouldn’t say that we’ll continue to set record after record every well we drill, but they’re all – I’d say the uplift on the overall program will continue to increase and one thing that I think I would add some color to is that as we have stepped with the inclusion of the Yates acreage, as we’ve stepped out across the play, we’ve seen uplift in the productivity more so than we expected when we acquired that position. And so we’ve been pleasantly surprised by the application of the EOG technology to the acreage that we acquired in the Yates position to improve productivity across the basin.

Q: So this quarter a lot of Delaware operators are talking about what pads might look like in development. Could you discuss where you are in that transition, if the wells we’re seeing right now are pretty representative or what they might look like in future years? Or will there be a dramatic change in how you go about developing the stack in Delaware?

Lloyd W. Helms: So in the Delaware Basin I’d say we’re still in the early innings of trying to develop our multi-well pads. We’re testing largely as we know the Wolfcamp interval to start with and we’ve still got a lot of horizons sand test both most of which are above the Wolfcamp and so we’re looking at what is the optimal way to increase our well count in this area and ultimately end up with a greater number of wells in each section or spacing unit that we drilled. But right now I think we’re probably drilling on average three or four wells per pad initially, and we’re coming back in behind that with additional development.

Q: And I think in your intro comments you talked about EOG’s experience in understanding density and well interference in prior plays, so is your gut feel that in development you’ll need to pull back on completion intensity, avoid pressure sinks and that sort of thing when you look at your prior experience elsewhere?

Lloyd W. Helms: I’d say we haven’t seen that occur yet. We’re continuing to optimize the spacing and completion design for every interval. Each interval is uniquely designed with the data that we collect that we talked about and all of our tools that we use to analyze what is the best and most optimal way to develop each zone.

So we haven’t yet seen a limitation on how we space the wells or how we design our frac treatments. I’d say they’re more customize. There’s not a one-size-fits-all is the way I’d think about that. They’re all optimized.

I’d say we’re still testing downspacing in several areas. Our resource assessment is based on our most recent analysis, but we’re testing those and pushing the limits as we speak.

Q: The point on longer lateral lengths – obviously, you’re extending them in the Eagle Ford as well as the Permian. Can you discuss, specifically with the Permian where there seems to be a pretty big opportunity as you look forward, how much blocking and tackling is there yet to do on bolting on acreage? And where do you ultimately think that could end up?

Lloyd W. Helms: The Permian – we have been historically in the years past 4,500 foot to 5,000 foot. I think the average lateral length this year is about 7,000 foot, and we continue to put acreage positions or bolt on acreage positions. We’re trading acreage with other operators and consolidating positions to help us to continue to extend those laterals even further.

So I think it will grow incrementally over time. It may not be the 10,000 plus lateral lengths like we’ve done in some of the other plays, but it will continue to improve and get better over time. The uplift on the economics is pretty dramatic on the longer laterals because they don’t cost near as much, and so you get a big uplift on the economics and the returns on the longer laterals.

And we’ve been able to – I think the most important thing – with our precision targeting technology and identifying the best rock and our ability to keep that bit in the best rock, the entire lateral length has allowed us to continue to have the same productivity per foot on the longer laterals as you do on a shorter one. So if a long lateral is twice as long, we actually get twice as much oil. So that’s a big technology gain that we’ve made just recently.