Mountain Valley Pipeline project expected to receive remaining permits and approvals in Q4 2017, with construction to commence soon after

EQT Corporation (ticker: EQT) released its Q3 earnings report today.

EQT Q3 Highlights and financial results

- Production sales volume was 5% higher than Q3 2016

- Average realized price was 26% higher than Q3 2016

- Received FERC Certificate for Mountain Valley Pipeline

| Three Months Ended September 30, 2017

($ millions, except EPS) |

||||||||||

| 2017 | 2016 | Difference | ||||||||

| Net Income/(Loss) Attributable to EQT | $ | 23.3 | $ | (8.0 | ) | $ | 31.3 | |||

| Adjusted Net Income/(Loss) Attributable to EQT (a non-GAAP measure) | $ | 20.8 | $ | (47.9 | ) | $ | 68.7 | |||

| Diluted Earnings Per Share (EPS) | $ | 0.13 | $ | (0.05 | ) | $ | 0.18 | |||

| Adjusted Earnings Per Diluted Share (EPS) (a non-GAAP measure) | $ | 0.12 | $ | (0.28 | ) | $ | 0.40 | |||

| Net Cash Provided by Operating Activities | $ | 402.4 | $ | 274.3 | $ | 128.1 | ||||

| Adjusted Operating Cash Flow Attributable to EQT(a non-GAAP measure) | $ | 205.9 | $ | 166.5 | $ | 39.4 | ||||

Operating expenses and well drilling

- $62.0 million higher than the same period last year

- Transmission expense increased $38.3 million

- Gathering expense increased $13.7 million

- Processing expense increased $10.8 million

EQT drilled (spud) 35 gross wells in Q3 2017, including 29 Marcellus wells, with an average expected length-of-pay of 7,500 feet; and 6 Upper Devonian wells, with an average expected length-of-pay of 7,000 feet. EQT turned-in-line 49 wells during Q3 2017, including 32 Marcellus wells, and 16 Upper Devonian wells.

EQT Corporation Q3 conference call

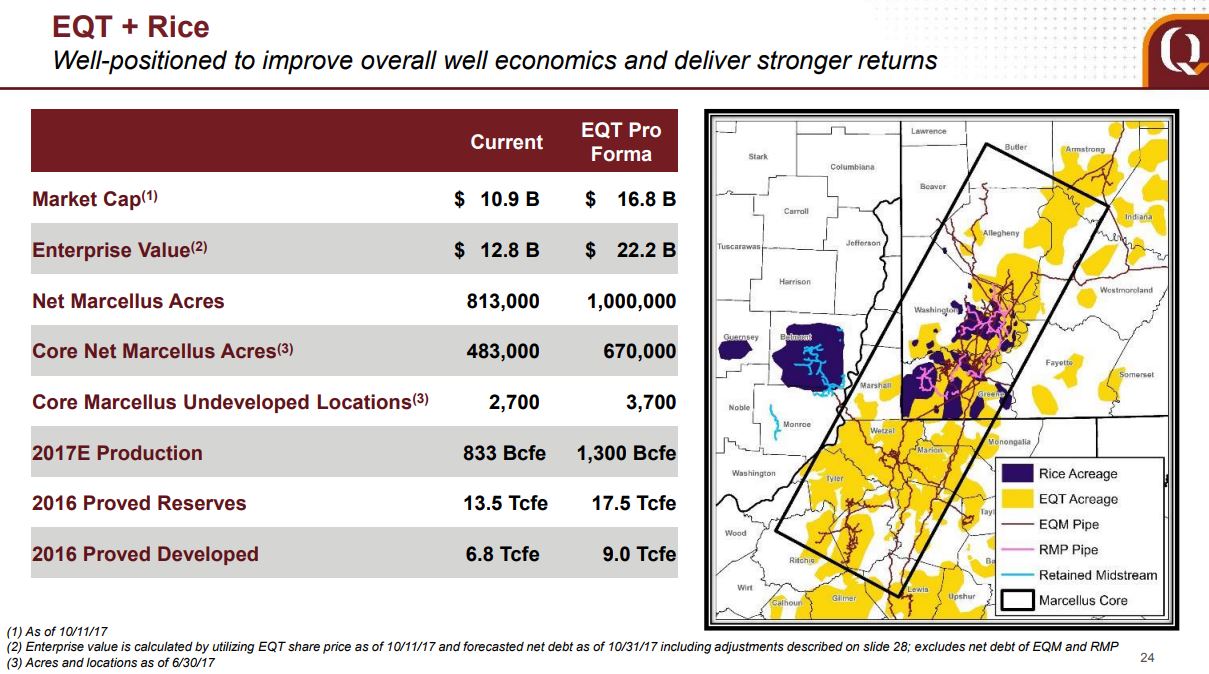

President and CEO Steven Schlotterbeck addressed feedback from shareholders regarding the Rice acquisition. Over the last few months a decision was made to establish a board committee to evaluate options for addressing the “sum of the parts discount.” The decision of that committee review will be announced by the end of Q1 2018. Two new independent directors will be added to the board to focus on the midstream business. The director nomination deadline has been moved to be after the announcement.

Volume growth as a metric has been removed from future compensation plans and will be replaced with return on capital, operating and development cost metrics.

CEO Schlotterbeck concluded his prepared statements with, “Our competitors may be able to replicate things like new drilling technology or new drilling techniques, but they can’t replicate an acreage position that supports 12,000 foot laterals in the core of the Marcellus. While this is a main attribute of the transaction, there are many benefits of the transaction that create real value for our shareholders. The deal is 20% cash flow accretive in 2018 and 30% in 2019. It is accretive to NAV per share.”

Conference call Q&A

Q: There is much discussion about the ongoing capital needed to fill in holes to make acreage truly contiguous in Appalachia. Can you talk to your efforts on this in Q3 and the risks that you see of increasing – to increasing lateral length whether or not the Rice acquisition is successful.

EQT Corporation President and CEO Steven Schlotterbeck: We expect between $100 million and $200 million per year for additional fill-in acreage to put these laterals together. That’s actually consistent with what it already takes for us to achieve our roughly 8,000 foot lateral average today. So without Rice, we spent about $140 million per year, getting to 8,000 feet. We expect to continue to spend roughly that much to put together the 12,000-foot laterals with Rice.

We’ve got a large land apartment, it’s the second biggest apartment in the upstream company, second only to the field personnel, the operators. And they work every day putting the jigsaw puzzle together, that’s what they do.

The overlay with Rice is such a good overlay that we frequently run into Rice when we’re trying to fill in those holes. If we have Rice consolidated with us, then picking up those missing pieces will likely be easier and perhaps even cheaper.

Q: Can you give us a timeline update on the Mountain Valley Pipeline?

EQT Midstream Partners Senior VP and COO Jeremiah Ashcroft: We’re still looking for a notice to proceed in 2017. We’ve got 80% of the pipe already here. We’ll soon have a 100% and be ready to have a shovel ready project at the beginning of 2018. That should put us in line for service at the end of 2018.

We still have some state and federal permits that we have to get through, we still have to finish up some things with West Virginia and Virginia, which we will be doing in November and December. Once that’s done, the FERC should give us the notice to proceed.

Q: Could you talk about the market dynamics as you see them in the Southeast markets as you bring on MVP?

Senior VP and COO Ashcroft: It gives us the opportunity to move both into the Southeast and to go into the Gulf Coast. As you know, the petchem facilities in Louisiana and Texas are really expanding. We see that as an opportunity and we also see the population growth in the Southeast being a big pool, so the Appalachian supply hub can feed both.

Q: I wanted to see if you could dig down a little bit, obviously a lot of focus recently has been on the kind of acreage maps and interpretations of how many long lateral locations you have on a pro forma basis.

President and CEO Schlotterbeck: I’ll give you a couple of stats that will relay some confidence, especially in contrast to some of the noise that’s been out there. In Greene County, which is where the bulk of this acreage is, it’s a lot in Washington too, but if you just focus on Greene County for a second, Greene County has a total acreage of 370,000 acres. To date, over the last 11 years, 75,000 of those acres have been developed. So the gas is being drained from 75,000 acres.

At least 295,000 acres in Greene County alone are not-yet, or as of now, undrilled, undeveloped and undrained. That’s about 80% of the acreage in Greene County that is still available to produce gas. And one other stat for Greene County, again the 370,000 acres. After the Rice transaction, EQT will control 212,000 of those acres. So 57% of the county will be under the control of EQT where 80% of that is remaining to be drilled. So there is lots of remaining inventory acreage, tremendous amount of resource in place.