(Oil Price) – Equinor does not consider returning to Venezuela, which it quit years ago, Anders Opedal, the chief executive of the Norwegian energy major, told Reuters on Wednesday.

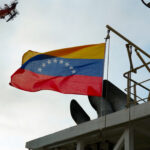

Following the capture of Nicolas Maduro by U.S. forces, the industry is buzzing with talk about the opportunities for Western, especially U.S. oil firms, in Venezuela, the holder of the world’s biggest proven oil reserves estimated at about 303 billion barrels.

“At the moment, that’s not on the table,” Equinor’s Opedal told Reuters on the sidelines of a business event in Oslo.

“We pulled out of Venezuela because we wanted to reallocate capital,” the executive added.

Equinor launched operations in Venezuela in the 1990s, buying into both onshore and offshore opportunities and investing billions of U.S. dollars in the country.

However, following re-prioritization and strategic focus shifts, the Norwegian firm quit operated assets in Venezuela at the start of the 2020s. In 2021, Equinor completed the sale of its 9.67% non-operated interest in the Petrocedeño project onshore Venezuela to state-owned Petróleos de Venezuela (PdVSA).

At the time, he Norwegian company said that “The transaction supports Equinor’s corporate strategy to focus its portfolio on international core areas and prioritised geographies where Equinor can leverage its competitive advantages.”

While Equinor says it’s not interested, other major Western firms could be tempted to return to Venezuela, security situation and legal frameworks permitting.

U.S. President Donald Trump wants the big U.S. oil firms to return to Venezuela and invest in rebuilding the oil infrastructure. U.S. oil companies could be “up and running” in Venezuela’s oil sector within 18 months, President Trump told NBC News on Monday.

The total investment over a decade could be upwards of $100 billion, according to various analyst estimates.

On Tuesday, President Trump claimed that Venezuela would be “turning over” between 30 and 50 million barrels of oil.

By Tsvetana Paraskova for Oilprice.com