New Iranian Oil Volumes Could Hit the Market as Early as Oct. 2015

Chairman of global oil and gas consultancy FGE, Dr. Fereidun Fesharaki, in a conference call organized by Credit Suisse, said he believes that the basics of an agreement are already in place and that a deal could be announced in the first week of July.

Dr. Fesharaki was born in Iran and has served as Energy Adviser to the Prime Minister of Iran, a member of the Council on Foreign Relations, president of the International Association for Energy Economics (IAEE), and he is presently a member of the National Petroleum Council.

500,000 BOPD

The Credit Suisse conference call focused on Iran and the effects it could have on the global oil and gas market. Research by Thomas Adolff and other analysts at Credit Suisse, in combination with Dr. Fesharaki’s comments during the conference call, point to as much as 500 MBOPD of Iranian oil production and condensates returning to global markets by the end of 2015.

The sale of additional crude will come after a verification process, which Iran expects will take two to three months. The U.S. anticipates the process lasting from four to six months.

Fesharaki said that the five permanent members of the U.N. Security Council and Germany (P5+1) and Iran have most likely crafted the fundamental agreement, and that both sides are now “socializing” the deal with each side’s respective constituents.

Iran is ready for the new realities of the oil market

Fesharaki said that Iran understands the new realities of today’s oil market, and is “unlikely to engage in a bitter price war it cannot win.” Iran anticipates receiving no more than $60/bbl for its oil, and is prepared for even lower prices, according to the Credit Suisse research.

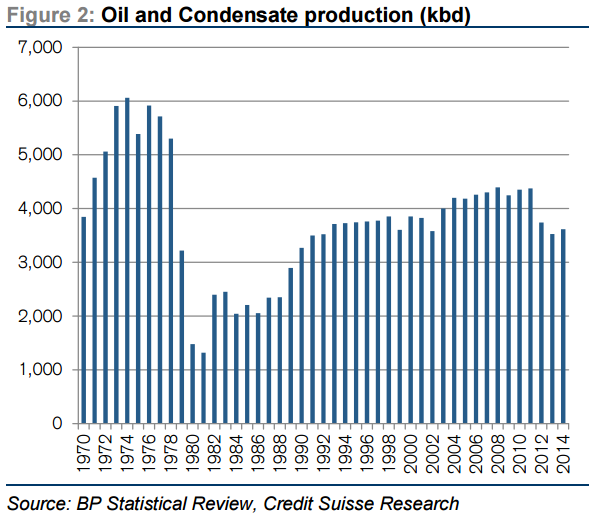

Adolff’s research suggest that Iran could reach pre-sanction levels of production by mid-2016, but the impact to oil markets will be manageable as long as Libyan production does not come back online. Dr. Fesharaki believes that the impact on markets will be around $3 to $6 per barrel. Iran hopes to reach 5 MMBOPD of production by 2020, but Adolff believes that goal is ambitious.

Iran may have some difficulty marketing its additional crude production unless Saudi Arabia makes room for the added barrels, says Fesharaki. Prime customer prospects include Turkey, Korea, India and China, as well as several buyers in Europe, according to Credit Suisse.

The Floating Storage: not oil

Estimates on the exact number of barrels being stored in floating storage have varied, usually running between 30 and 40 million barrels. Many experts have worried that this floating storage could return to the market immediately following a deal with Iran, but Adolff believes the effect floating storage will have on markets is minimal. Adolff pegs floating storage at approximately 37 million barrels, but none of it is likely to be oil, he says. The makeup of the storage is “5 million barrels in oil products, and the rest [is] condensates.”

Iran will have a “no condensate export policy,” according to Adolff. The country plans to build new splitters in order to utilize its condensate production and make itself self-sufficient with respect to gasoline, with a longer-term goal of becoming a net gasoline exporter.

The Iranian Gold Rush: Not for U.S. E&Ps

Once a deal has been implemented, President Obama is likely to cancel Treasury sanctions against Iran through the use of executive order, says Adolff.

President Obama has agreed to suspend regulations against non-U.S. companies operating in Iran if a deal is reached, meaning that E.U. and Asian companies will be able to begin investing in Iran as soon as sanctions are lifted.

Dr. Fesharaki believes once sanctions are lifted, an Iranian “gold rush” will begin, but U.S. companies will be unable to participate due to additional laws in place against Iran, related to nuclear matters and human rights concerns. These additional laws will prohibit U.S. companies from investing in Iran’s upstream sector even after a deal is reached.

While President Obama can use executive action to remove the Treasury sanctions, the additional laws can only be reversed by Congress. Adloff estimates that it could take an additional three to five years for Congress to remove resend those laws, allowing U.S. companies to take part in upstream investment in Iran.

With respects to natural gas, Credit Suisse said Iran wants to become a regional gas player (not a major LNG player), which would reduce the call over time on LNG imports into the Middle East. But the bank expressed that it sees challenges to Iran’s “pipe-dreams.”

Iran holds some of the world’s largest deposits of proved oil and natural gas reserves, ranking as the world’s fourth-largest and second-largest reserve holder of oil and natural gas, respectively, reports the Energy Information Administration (EIA), with 40% of Iran’s massive gas reserves being held in the South Pars field. Iran also ranks among the world’s top 10 oil producers and top 5 natural gas producers. The country produced almost 3.4 MMBOPD of petroleum and other liquids in 2014 and an estimated 5.7 Tcf of dry natural gas in 2013.