Oil traders warn of impending supply crunch

Investors’ preference for projects with fast returns could spell trouble for future supply, warn oil traders and service executives. Many of these short-cycle projects involve U.S. shale operations, but with demand continuing to grow, shale projects will be unable to sustain the entirety of future demand, and underinvestment in long lead time, larger projects today will mean fewer barrels in the future.

“We are sowing the seeds for potential instability in the future and more volatility,” Mercuria Energy Group President Daniel Jaeggi told Bloomberg. In three to four years, “you won’t be able to satisfy demand with short-cycle barrels.”

Investment in long-lead oil projects will increase this year after back-to-back declines of about 25% in 2015 and 2016, which brought global investments down to about $433 billion last year, according to the IEA. U.S. producers are leading the spending revival, and will contribute most of the growth in supplies outside OPEC through 2022, the agency said.

Resilient production paints a misleading picture – Schlumberger

The concerns voiced by oil traders were echoed earlier this week by Paal Kibsgaard, CEO of Schlumberger (ticker: SLB), who pointed to underinvestment as the source of smaller reserves replacement numbers from E&P companies. While production numbers have surprised many to the upside, smaller reserves replacements mean wells are taxing existing resources harder.

“In a scenario where the additions of proven developed reserves are curtailed through lower investments while production is upheld by producing wells harder, the decline rate will be low and the production base will falsely appear to be very resilient,” said Schlumberger’s CEO.

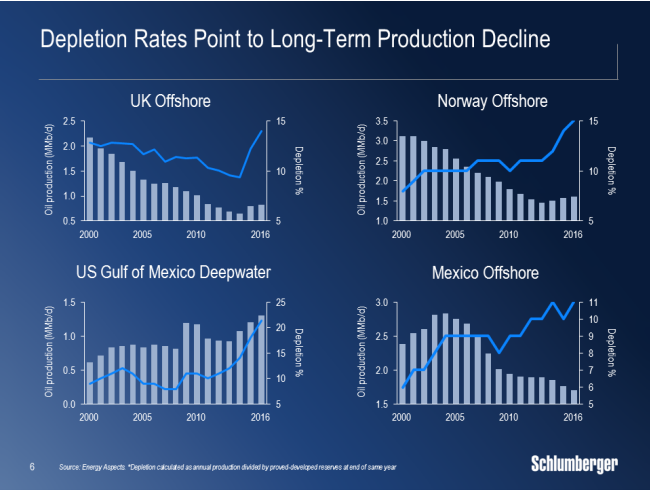

“However, the real picture is such a scenario is told by the depletion rate, which will show an increasing trend since production is kept at high levels with little to no additions to proven developed reserves.”

Depletion rates have already increased 15% to 20% in the world’s major offshore basins, according to Schlumberger. Production has remained relatively stable in each, giving the impression that production is resilient, but as reserves are depleted and no replacements found because of lower investment over the last three years, the resource still in place will be quickly produced and there will not be enough supply to meet demand.

Shale is the low-hanging fruit, but investment may return to larger projects

While U.S. onshore continues to show signs of growth amid relatively stronger oil prices, many E&Ps are producing Tier 1 assets, and may not be able to continue growing economically once they move to acreage outside of “the core of the core.”

“The low-hanging fruit on the short-cycle projects are being used now so I am more in this camp that says we are starting to see potential issues three or four years down the track,” Co-Head of Group Market Risk and former Head of Crude Trading at Trafigura Group Ben Luckock said.

High levels of production from shale projects are keeping oil prices below the level many would like to see before they start investing in long-term projects, but the market for long-lead oil development is warming up as prices stabilize.

Operational efficiencies are working their way into larger projects as well, helping to bring down cost, and with oil prices significantly more stable thus far in 2017 compared to the last two years, “people might be more willing to invest,” Head of Global Commodities at BP Oil International James Foster said.

OPEC supply continue to create price instability

While prices have not been fluctuating to the same extent seen in the last two years, continued concerns around oversupply saw crude prices drop earlier this month only to partially recover over Wednesday and Thursday as news from Libya showed a 20% reduction in crude output.

The OPEC member reported crude output of 560 MBOEPD Wednesday, down from 700 MBOEPD from the week before. The pipeline carrying crude from Sharara, Libya’s biggest oil field, to the Zawiya crude terminal ceased operation today.

The news is just the latest in a string of incidents in which Libya has been forced to halt crude production or export as internal strife disrupts the production and transportation of crude inside the country. Libya continues to target 800 MBOEPD by the end of April, but its success or failure could lead to more volatility in the market.