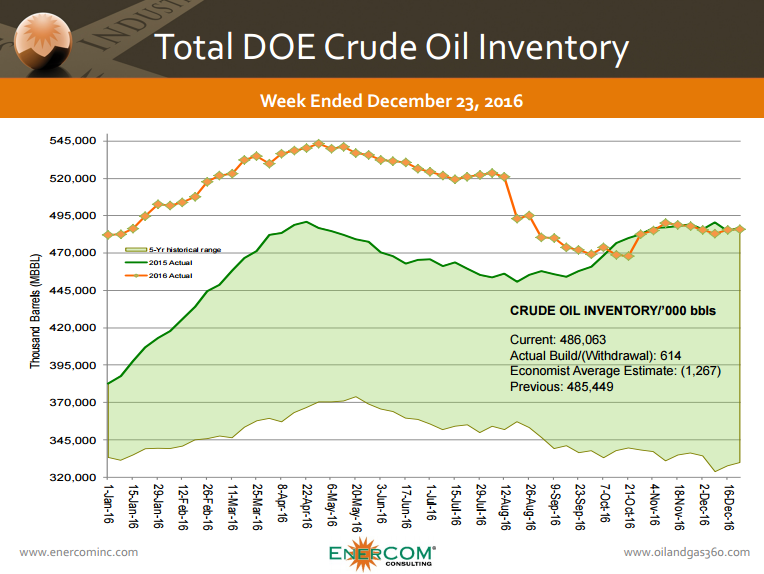

Crude oil stocks increase as products draw down

Crude oil inventories rose for the week ended December 23, 2016, according to the Energy Information Administration. Analysts expected a draw of approximately 1.3 MMBO, but the government agency reported 0.6 MMBO were added to stockpiles last week.

Typically, an increase in crude oil stockpiles puts downward pressure on prices as more oil in storage indicates supply outpacing demand, but crude prices remained relatively unchanged following the news.

“What seems to be giving this report kind of a bullish tilt is the fact that we saw pretty a good drawdown in both gasoline and distillate inventories,” Phil Flynn, trader at Price Futures Group, told Reuters.

Gasoline stocks fell 1.6 MMBO, compared with analysts’ expectations in a Reuters poll for a 1.3 MMBO rise.

Distillate stockpiles, which include diesel and heating oil, fell 1.9 MMBO, versus expectations for a 1.8 MMBO increase, the EIA said.

Kyle Cooper, analyst at ION Energy in Houston, noted that sharp declines in stocks across the energy complex show a tightening between supply and demand, even as crude inventories rose.

“You look at those underlying total inventory numbers and they were very, very solid. Crude’s just a small portion of the overall complex,” he said.

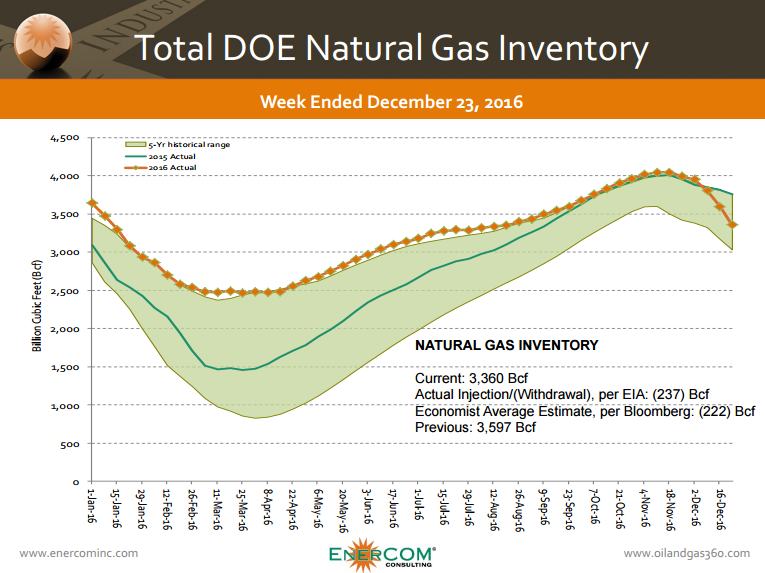

Cold weather pushes natural gas prices higher

The natural gas inventory report was released alongside the crude oil report today due to a scheduling change after the Christmas holiday. According to the EIA, natural gas inventories fell 237 Bcf compared to analyst expectations of a 222 Bcf draw.

Colder weather has seen a spike in demand for natural gas, and more winter weather is in the forecast, likely increasing demand further.

Natural gas for January delivery gained as much as $0.17, or 4.5%, to settle at $3.93 per MMBtu on the NYMEX, the highest settlement value in more than two years, according to The Wall Street Journal.

“It’s not the most liquid of times for the markets,” said Scott Shelton, a broker at ICAP, noting that jockeying ahead of the contract expiration could have an outsize effect on prices amid otherwise light holiday trading.

“Bullish sentiment could push people out of short positions and cause short covering. I think that’s what we saw today in the expiration of the January contract but it’s probably true in some of the other contracts as well,” said Tom Saal, a broker with INTL FCStone, adding that front-month prices will likely test $4 again this winter.