High Rates Continue from the Dry Gas Window

On June 30, 2015, Gastar Exploration (ticker: GST) reported its Blake U-7H well located in the dry gas Utica Shale region of Marshall County, West Virginia, produced at a peak 48-hour gross rate of 36.8 MMcf/d. On a restricted flow basis, its post peak rate 30-day production averaged 20.2 MMcf/d. Gastar holds a 50% working interest and 41.1% revenue interest in the well.

The Blake U-7H is the second Utica well to be drilled in Point Pleasant by GST. The Simms U-5H was the first and was completed in September 2014. It had collectively produced 2.5 Bcf as of April 19, 2015.

Gastar holds a 50% working interest in both wells with an average revenue interest of 42.2%. Individual results on the two wells are listed below.

|

Well |

Peak 48-hr gross rate | Choke | PSI | Lateral Length | Fracturing Stages | Proppant (MM of lbs) | Cost (MM) |

|

Simms U-5H |

29.4 MMcf/d | 30/64 | 6,700 | 4,447 | 25 | 10.6 |

$12.0 |

| Blake U-7H | 36.8 MMcf/d | 32/64 | 6,235 | 6,617 | 34 | 14.8 |

$14.6 |

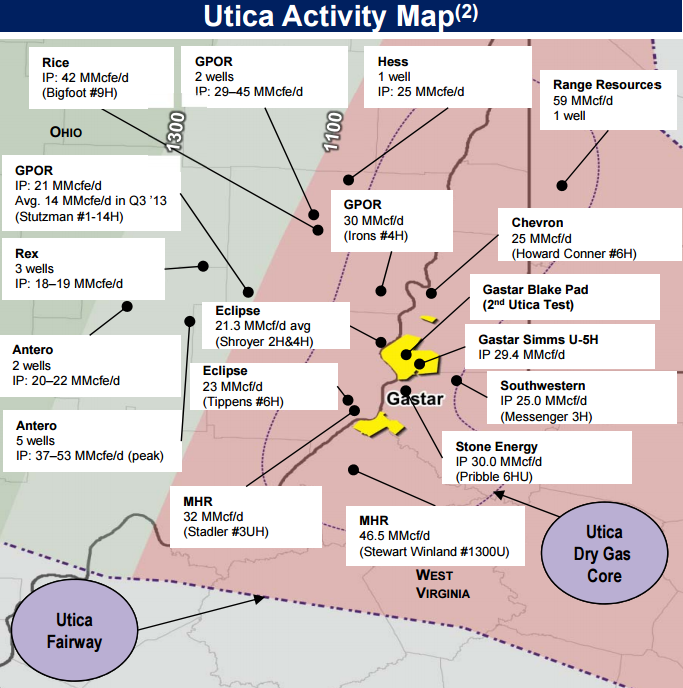

Utica/Point Pleasant Continues to Impress

Gastar’s operations in Utica/Point Pleasant are in the early stages, but the E&P is surrounded by a handful of wells that are on pace or even exceed their two completions. Among those include a well in Tyler County, West Virginia, operated by Magnum Hunter Resources (ticker: MHR), which returned an initial production rate of 46.5 MMcf/d. Range Resources (ticker: RRC), the most active driller in the Marcellus/Utica, set the record with a 59.0 MMcf/d well in Washington County, Pennsylvania, late in 2014.

Global Hunter Securities describes GST’s stronghold as “prime acreage,” and the Blake well further validates its position. The firm added, “On a lateral-adjusted basis, the Blake well result is slightly lower than GST’s initial well, but a slight drop in productivity is to be expected as lateral lengths increase.” OAG360 notes the Blake well lateral is approximately 50% longer than the Simms. Capital One Securities estimates area value at about $5,000/acre considering Gastar’s average rate of 6 MMcf/d per 1,000 lateral feet.

77 More Marshall County Drilling Locations Await Improved NatGas Prices

Gastar management said it will not drill another Utica/Point Pleasant well until gas prices improve, but the groundwork is in place. According to Gastar’s latest presentation, its 11,100 net acres are prospective for both the Marcellus and Utica, and only five of its 109 gross identified locations have been drilled to date. An estimated 77 of those locations are in Marshall County, where it’s the Simms and Blake wells are located.

Michael A. Gerlich, Senior Vice President and Chief Financial Officer of Gastar Exploration, admitted the regional spot price decline was “significant,” considering it was in the range of about 40% in comparison to NYMEX prices. However, he explained oncoming infrastructure projects at a conference last week in Chicago. “We do believe infrastructure will come and alleviate this problem,” he said, adding that a recent reversal from the Rockies Express Pipeline will add 1.8 Bcf/d of takeaway capacity.

“If you look out at 2018, 2019 and look at the basis differential, what today is 40-ish% discount is more in the 18% to 20% discount range. Since we don’t have any near-term lease expiration issues on our Utica acreage, so you could see us putting our capital back in the Utica once you see prices improve,” Gerlich said.