Gazprom Neft completes nine-stage frac job in the Bazhenov formation, but is the formation economic?

The oil production arm of Russia’s state-run gas giant Gazprom (ticker: OGZPY) announced this week that the company completed a nine-stage horizontal well in the Bazhenov formation in Western Siberia. Gazprom Neft (ticker: GZPFY), as the oil arm is known, said it is the first Russian company to apply the full cycle of technology involved to complete a hydraulically fractured well.

Though small compared to unconventional wells in the U.S., Gazprom’s well indicates it is technically possible for Russian companies to explore unconventional resources even without the help of Western companies.

The company’s press release said the well was drilled to a depth of 2,300 meters (7,546 feet) and 1,000 meters (3,280 feet) horizontally. Gazprom reported a flow rate of 45 tons (330 barrels) per day with zero water cut.

“The drilling of 1,000 meter horizontal wells and the performance of multi-stage hydraulic fracing under current foreign economic restrictions is a unique breakthrough not only for the company, but for the whole of Russia’s oil and gas industry,” said the Gazprom Neft’s First Deputy Director General Vadim Yakovlev.

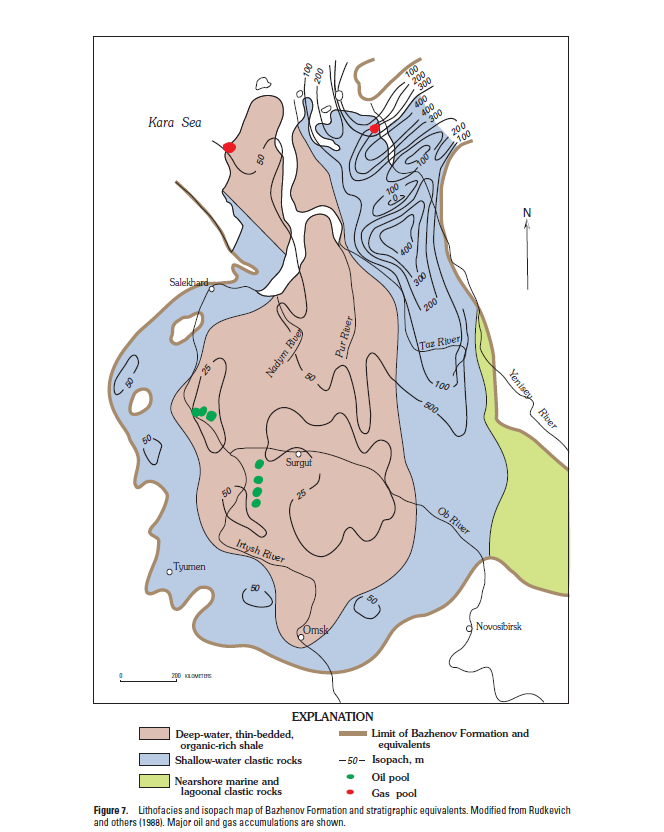

The Bazhenov formation will be a challenge to develop

While Gazprom touts its technical achievement, the actual viability of future projects is questionable. The oil in place is immature and slow to move, making it difficult to produce. The best spots to drill would likely be deep in the play, but the further down Gazprom drills, the less economic the wells will become.

The geology will make further development very difficult. It’s a Permian-like basin full of oil, but the oil that’s there is immature. It looks great on the logs, and you can calculate a lot of oil in place, but the oil does not move well.

The other danger Gazprom faces is a lack of innovation, since a handful of companies hold a near-monopoly on the industry. With one company operating all the wells, there’s a much smaller chance of finding new ways to extract the oil more economically. Parts of the basin are likely economical, but with such a lumbering structure, Gazprom may have a difficult time making future wells worth the investment.