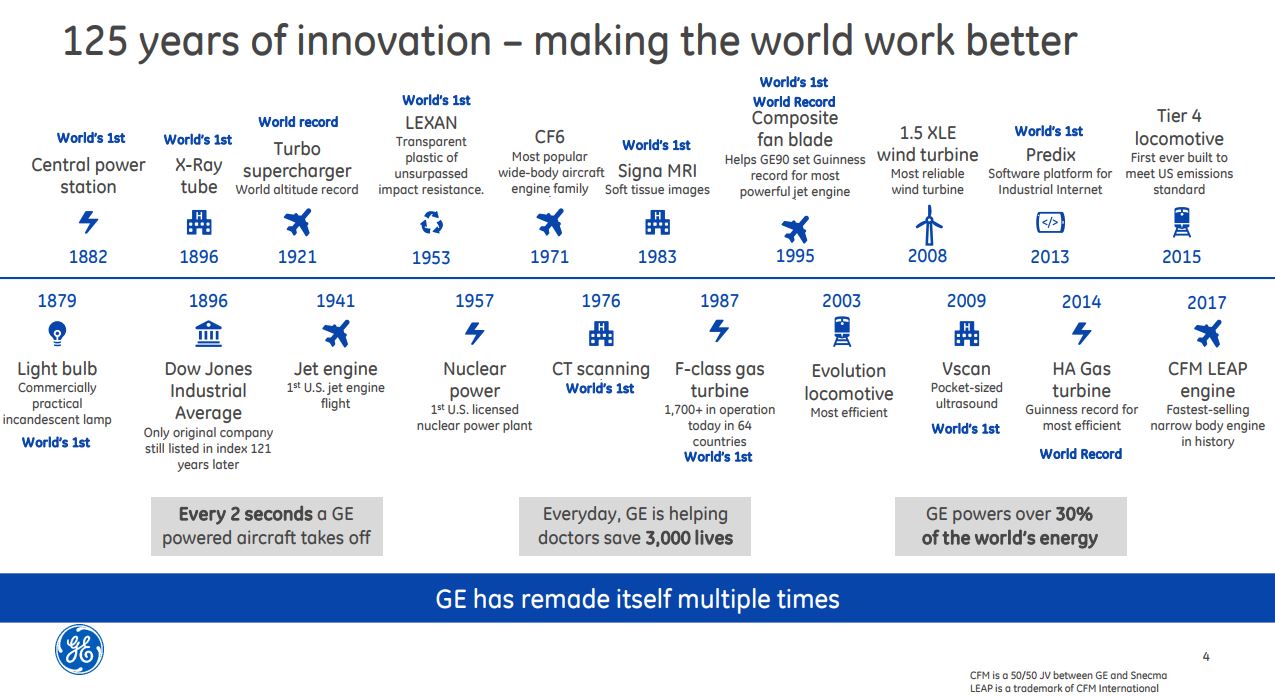

The history of GE dates back to Thomas A. Edison. In 1876 Edison opened his Menlo Park, NJ, laboratory, from which came perhaps the greatest invention of the age – a successful incandescent electric lamp. In 1890, Edison established the Edison General Electric Company by bringing his various businesses together. Two years later Edison’s company combined with a competitor. They called the new organization the General Electric Company.

Several of Edison’s early business offerings are still part of GE today, including lighting, transportation, industrial products, power transmission, and medical equipment. The first GE Appliances electric fans were produced at the Ft. Wayne electric works as early as the 1890s, while a full line of heating and cooking devices were developed in 1907. GE Aircraft Engines, the division’s name only since 1987, actually began its story in 1917 when the U.S. government began its search for a company to develop the first airplane engine “booster” for the fledgling U.S. aviation industry. Thomas Edison’s experiments with plastic filaments for light bulbs in 1893 led to the first GE Plastics department, created in 1930.

Last week, GE’s (ticker: GE) new CEO John Flannery—who replaced the outspoken Jeffrey Immelt as chief executive of the 125-year-old iconic American industrial powerhouse on August 1, 2017—hosted an investor update in which he outlined what GE’s direction for the future will be under his leadership. In a nutshell: healthcare, aviation and power will chiefly drive the company.

Rigorous, in-depth review of all aspects of the company

Essentially, Flannery said everything at the company either was previously or is presently under strategic review, and he outlined some of the findings and conclusions he had regarding the company and its numerous business segments.

GE recently reported that its third quarter earnings fell by 50 percent from a year earlier and it announced it would cut its dividend by half – only the second time that company has cut the investor payout since the Great Depression, the Houston Chronicle reported.

$20 billion in GE assets, businesses could hit the block – BHGE is one

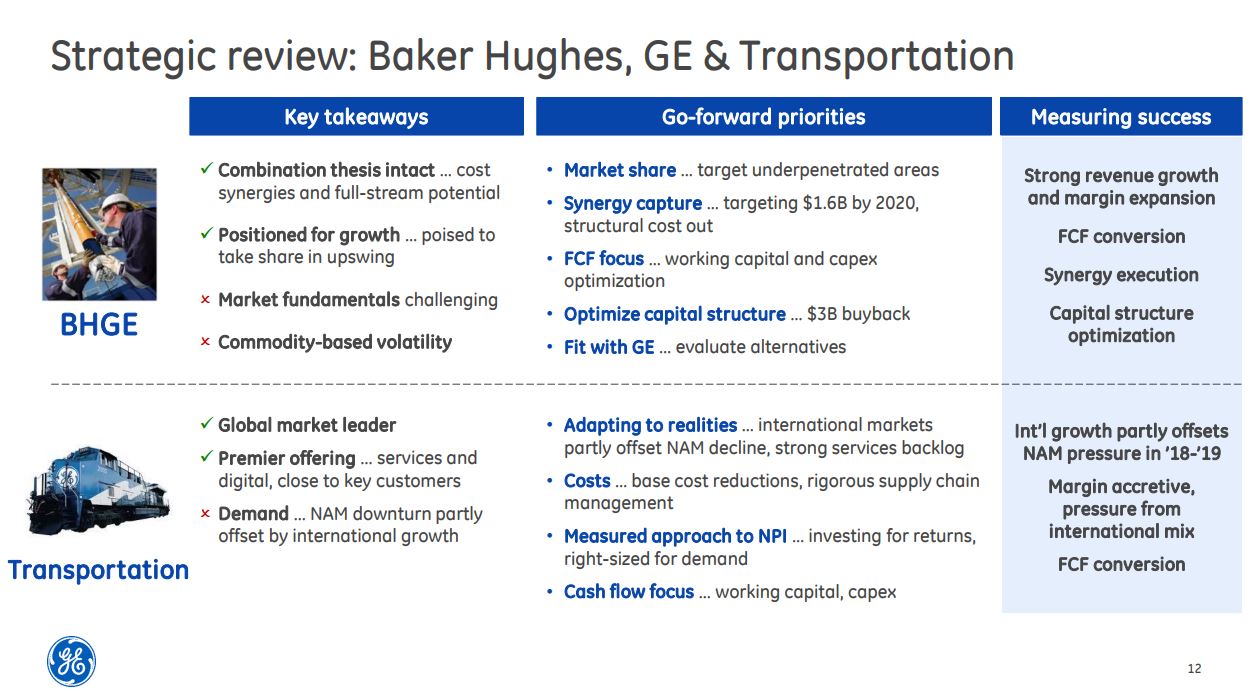

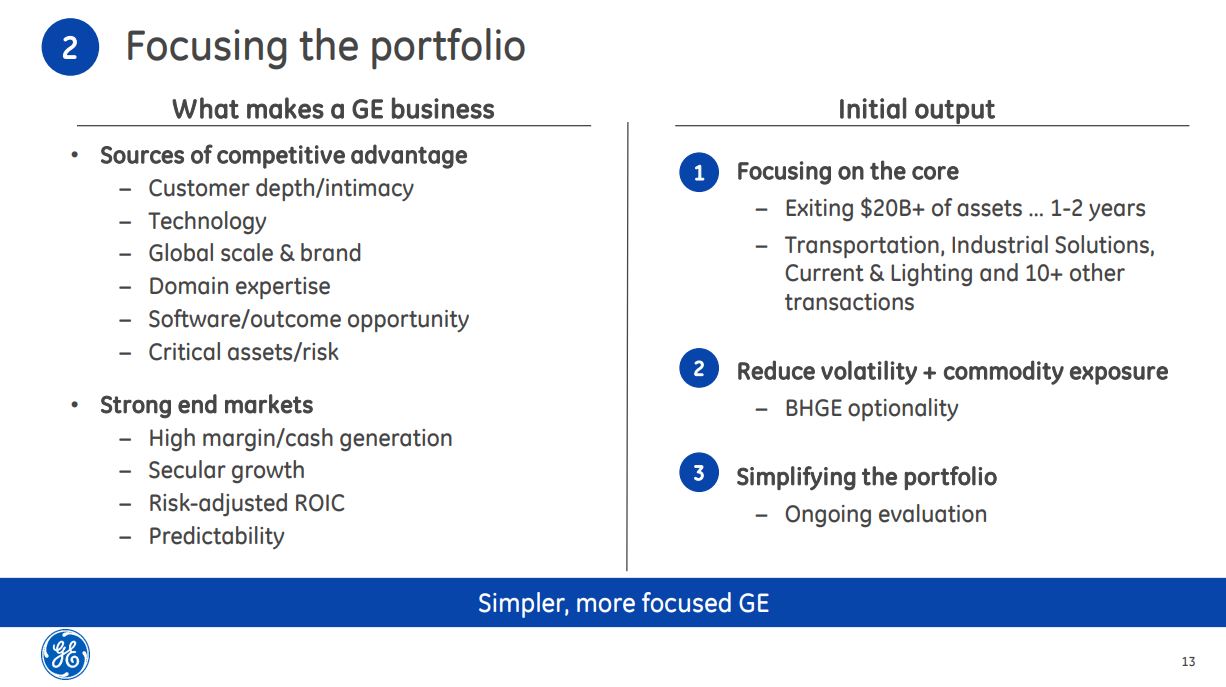

Flannery described how GE is “focusing on the core.” Flannery said the company would be exiting $20 billion worth of assets over one-two years, including transportation, industrial solutions, current and lighting, and ten or more other transactions. GE said its goals included reducing volatility and commodity exposure, which it described as ‘BHGE optionality’.

Acquiring Baker Hughes was Immelt’s deal

As to the status of Baker Hughes – a GE Company (ticker: BHGE), the publicly traded entity that former GE CEO Jeffrey Immelt championed to handle the merger of Baker Hughes and GE Oil & Gas, vaulting Baker Hughes to second ranking behind Schlumberger (ticker: SLB) at the top of the list of the world’s leading oilfield service companies, Flannery spoke plainly:

“We … have a standalone entity in Baker Hughes – GE; this is a good company. We’ve just appointed a committee of our board, a new committee of our board, the Finance and Capital Allocation Committee, and the first thing I’ve tasked them to work on is evaluating our exit options on Baker Hughes,” Flannery said.

One of the analysts on the call asked, “You earlier mentioned your investment in Baker Hughes, and it sounds like more flexibility with subcommittee of the board able to look at that potentially in earlier basis than this sort of notional lock up period that’s out there of a couple of years. Can you maybe talk about what might drive that, or is it just market dynamics that you think would allow that subcommittee to say an earlier exit or monetization for GE would be in the interest of Baker Hughes shareholders as well, something that would allow you, and what would you do with it?”

John L. Flannery: Sure. So just maybe to deconstruct that in a few ways. Going back to the origin of the deal. So there is a two-year basically window that ends in July of 2019, where the independent directors basically from Baker Hughes have certain consent rights, essentially, to things that GE does. There is a Conflict Committee to go through day-to-day life, and then there’s a Board Committee for something like this, first thing.

Second thing, I’d say, when the whole transaction was put together, it really was a great combination of businesses. We had an upstream equipment business, they had a service business, but it was specifically designed to create the optionality that we’re talking about right now. So obviously it’s a listed entity. And so this was – this is not a new thought, I guess, in terms of the context of that. How that goes forward is what the Committee is going to work on, how that works with the Baker Hughes’ team, we’re going to work on, we’re still – we want to maximize, at the end of the day, this is capital allocation decision. We own 62.5% of this company. We want to maximize the value of that for the shareholders of our company, part of that’s going to be how we deliver synergies, part of that’s going to be how we share technology, and part of it might be, is there a different form or structure for the ownership of that asset?

So it goes back, I would say, to the origins of the deal. It’ll be determined going forward, there’s no decision made formally by us. And obviously, we would have to interact with Baker Hughes prior to 2019.

Not thrilled with commodity-dependent businesses

And then lastly, I’d tell you what’s most important, ultimately, for everybody is where do we go with the company in the future. This is all really in the context of making us simpler and easier to operate. Complexity hurts us, complexity has hurt us. So the context of talking portfolio is around simpler and more focused GE. We’re focused on strong end markets, in areas where we have competitive advantages, areas where there’s opportunity for digital disruption, areas where we can earn premium returns, that’s where we want to concentrate our resources going forward.

Baker Hughes GE … is right now a public reporting entity. So, there’s a lot of information out there for you on that. Merger going well. Lorenzo and the team doing quite well. Good meshing of the GE and Baker Hughes teams. Fully committed to getting the synergies that we outlined there those are on track and fully committed to getting the value creation of mixing things like GE’s digital capabilities with Baker Hughes service capabilities. So, we like the team. We like the business. We expect good growth in this business over the next two or three years in terms of top line and the earnings.

The problem and challenge that we have in this business is the cyclicality and the commodity nature of the business. So, it tends to overwhelm a lot of the management actions, and you’ve seen that in this business going forward. So, a strong business, a lot of commodity and risk exposure.

Second, when you look at reducing our volatility, reducing our commodity exposure, that leads you obviously to a discussion of our Baker Hughes GE business. As I said earlier, we formed a committee – a new committee on our board, the finance and capital allocation committee. The first thing I have tasked them with reviewing is our optionality in Baker Hughes. So, that’s what’s going on inside the company. Again, the team is strong in Baker Hughes, the merger going well. We expect that to grow significantly. And we’ll evaluate what options we have, and we’re committed to supporting that business going forward. But when you look, in many ways, at the transaction we did when we merged GE Oil & Gas with Baker Hughes, part of the deliberate thinking of that transaction was to create optionality with that asset, and that’s what we’re evaluating right now.

Oil & Gas, the market conditions really continue, Baker Hughes is on really nice trajectory around their synergy realization, we’re very committed to them and helping them achieve that and we see the deal fundamentals as continuing to be quite strong.

One last thing I’d just say on that just, this again, where we talk capital allocation, maximizing value, the ability – first of all, Baker Hughes was a under-leveraged company, basically no net debt. You’re in a rate environment where the after-tax cost of the interest is roughly the dividend on the company, so they can essentially self-fund this on its own. And the company is going to go through an expansion of EBITDA and revenue and cash in the next two years. It made a lot of sense, in that asset, to do that kind of recapitalization. So we’re going to continue to look at all sorts of things through that lens.

Another analyst questioned the CEO. “Why are you putting Transportation on the block? It seems like you’ve been in the business 100 years, through the Great Depression, you make big machines, lots of sensors, lots of digital content, customer services agreements.”

John L. Flannery: So one of the things we talked about is focus, and the other thing we talked about was really cycles, and which businesses are exposed to cycles. So on the cycle side of things, we foresee a] protracted slowdown in the North America market, including some things that are secular, around coal shipments and other things. So it is an excellent asset. We have a very strong franchise, we have incredible customer relations, but we think it’s going to be an extended slow period in North America, and the international business can pick up some of that, point one. Point two, again, we’re exploring the options that we have with these assets. So that may be a sale, it may be a spin, it may be – so I think you have to watch again the form in which this happens.

And then the last thing, I would say is, focus means focus. So when we look at areas that I want to invest in, and where I want to put the shoulder of the company behind, Transportation is a great asset, it’s 3%, 4%, 5% of the company. And so, we’re concentrating deliberately on the areas where we think we can make the most impact for the owners, and then we maximize the value of the other assets.