Crude storage is becoming less attractive as futures prices decline

Swiss mining giant and commodity trader Glencore (ticker: GLEN) is looking to divest its global storage assets, following similar moves by rivals Vitol and Gunvor. As the futures curve begins to flatten and the market enters backwardation storage is becoming a less attractive asset for commodity traders who stockpiled crude while prices remained low.

Demand for storage skyrocketed when oil prices cratered throughout 2015 as traders bought crude oil with the intention of holding on to the commodity and selling at a higher price at a future date. As oil prices recover, however, future prices are no longer trading at a steep premium to immediate prices, making storage less attractive.

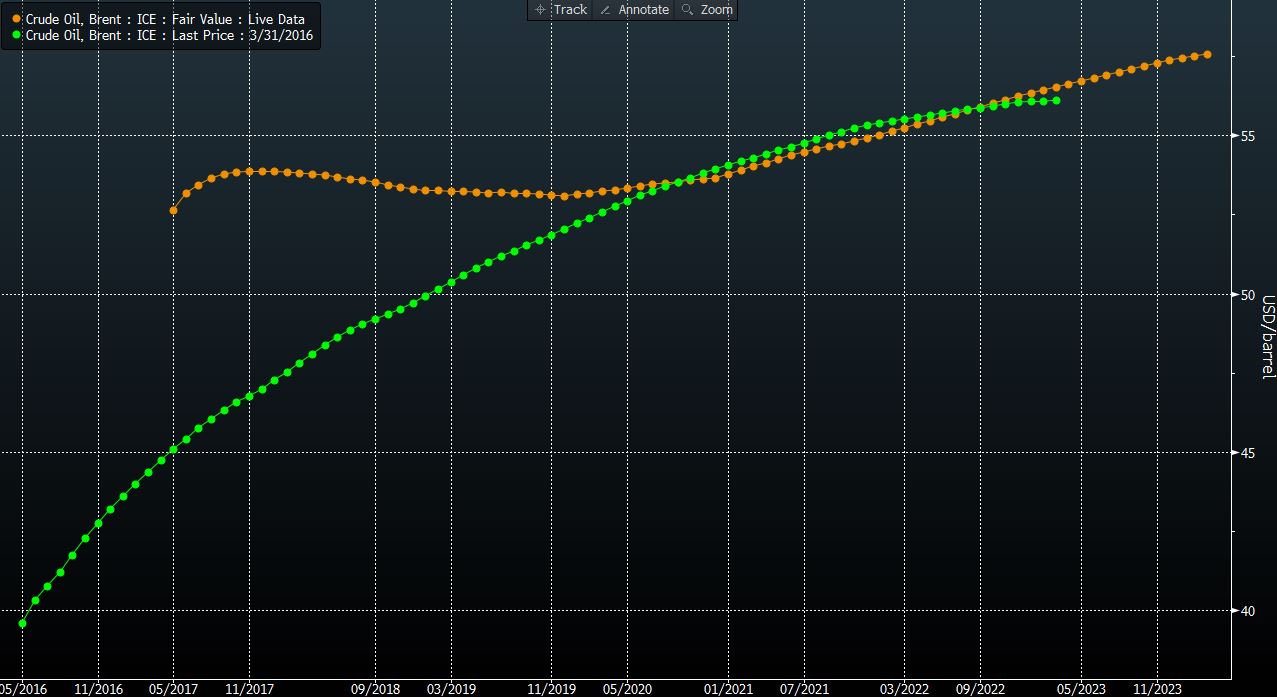

The futures curve for Brent a year ago (green in the graph above) was considerably steeper, allowing traders to buy low and sell high. The curve today (gold above) shows some backwardation before returning to contango, meaning traders are both buying at a higher price, and seeing a thinner margin for the crude they store, and in some cases even a loss.

Glencore will likely end up with minority stakes in the assets it sells, sources told Reuters. The company owns much of its storage terminal interest via joint ventures and is selling half of these stakes, sources familiar with the sale said.

The assets were generating EBITDA of approximately $75 million a year, according to a source familiar with the assets. Given a wide range of price to earnings ratios inside the storage sector, the assets could have a fairly wide valuation as well, ranging from $0.5-$1.1 billion, according to Reuters’ calculations.

Vitol sells 50% stake in terminal business for $1.15 billion

Vitol, one of Glencore’s competitors, closed a deal to sell a 50% stake in its terminal business, VTTI B.V., to Bukcey Partners (ticker: BPL) in January that netted Vitol approximately $1.15 billion. VTTI is one of the largest independent global marine terminal businesses that, through its subsidiaries and partnership interests, owns and operates approximately 54 million barrels of crude storage across 13 terminals located on five continents, according to the company’s press release.

“This investment in VTTI provides immediate access to a stable portfolio of international terminalling and storage assets, as well as an established platform to participate in further attractive growth opportunities across the globe,” said Buckeye Chairman, President and CEO Clark C. Smith.

Glencore’s assets may attract a similarly-minded buyer, according to Reuters’ sources.

“It’s an exotic combination of assets with a variety of functions, mainly storage. It’s most, if not all, of Glencore’s global liquid storage,” one source said.

The portfolio includes assets in Argentina, Belgium and Madagascar, the source said.

“As a bundle it would appeal to someone looking for an entry point to certain countries,” the source added.