Early today Goodrich Petroleum Corporation (ticker: GDP) announce a preliminary capital expenditure budget for 2018 of $65 to $75 million.

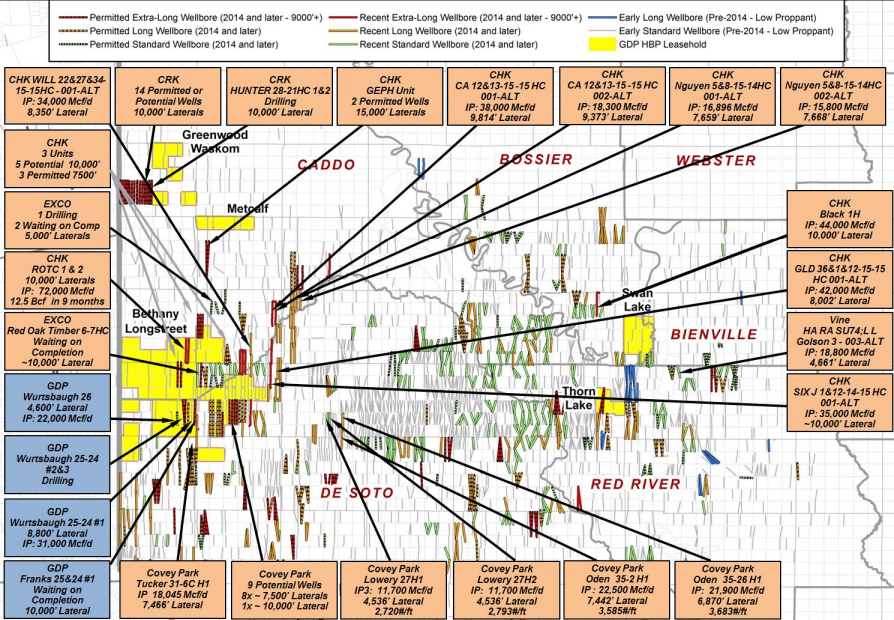

100% of the coming year’s budget will be allocated to the company’s core acreage in the Haynesville Shale in the Bethany-Longstreet and Thorn Lake areas of Caddo, DeSoto, and Red River Parishes, LA. Goodrich Petroleum plans to drill 16 gross horizontal wells in 2018, with an average lateral length reaching 9,000 feet. The budget was designed with GDP operating approximately 85% of its net wells throughout the year.

Looking for 130%-145% production growth in 2018 – 95% natural gas

In 2018 GDP plans to increase production by approximately 130%-145% compared to 2017. The company plans to produce 28.3 – 30.3 Billion cubic feet equivalent of gas in 2018, which equates to 77,000 – 83,000 thousand cubic feet equivalent per day. Natural gas is expected to account for 95% of total producing fluids.

Source: Goodrich Petroleum Corporation

Hedging

For 2018 Goodrich Petroleum hedged roughly 40%-42% of the expected natural gas volumes to an average price of $3.02 per Mcf and roughly 50%-55% of expected crude oil volumes to $51.08 per barrel.

Operations

According to the company’s press release, Franks 25&24 No. 1 well is currently being fracked along its 10,000-foot lateral segment in Bethany-Longstreet field of DeSoto Parish, LA. GDP has plans to zipper frac its Wurtsbaugh 25&24 No. 1 & 2 after the Franks Well is completed. Both of the Wurtbaugh wells have approximately 7,500-foot laterals. All three wells are planned to be brought online in early January, 2018.

The Carson-Dickson 14&23 No. 1 & 2 wells are currently being drilled in Red River Parish, LA. Both of the wells are designed to have 10,000-foot laterals and will be fracked in February, 2018.

Source: Goodrich Petroleum Corporation