Devon Energy (NYSE: DVN) and reported Q2 earnings and talked about operations, acquisitions, and returning value to the shareholders.

Q: On Showboat. You did obviously mention there were some I guess a bit stronger declines. Was that related to the parent well being obviously three years old in the area, or was it more the Lower Meramec? And if you could, also comment on what you saw with the Woodford well.

SVP, Exploration and Production of Devon Energy, Wade Hutchings: I think there are three big preliminary insights we’ve taken from Showboat. The first is the difference in performance between Upper and Lower Meramec, which we just discussed.

The second really relates to your question, and that is a very clear trend that any of the wells in either the upper or the lower that were drilled in the parent well’s shadow, those underperformed relative to any of the wells that were in more of what we’d call the greenfield parts of those sections. And underperformance would be reflected at both an IP and even at a decline level.

The third key thing we observed is we’re seeing some initial indications that there’s more vertical connectivity between these reservoir landing zones than we may have saw in other parts of the play. And so those are really our key preliminary observations so far from Showboat.

Q: I had a question on your comments trying to unpack this notion of strategic high-grading. If we look two to three years into the future, what assets are you highly certain stay in the portfolio, and what assets do you think could find a home for someone else? And then I have a follow-up.

President & CEO of Devon Energy, David Hager: First off, we believe very much in the multi-basin approach, and I think you’re really seeing the benefits of that approach right now as we speak. We’re having outstanding results in the Delaware Basin. Tony just described some very promising results that we’re seeing in the Powder.

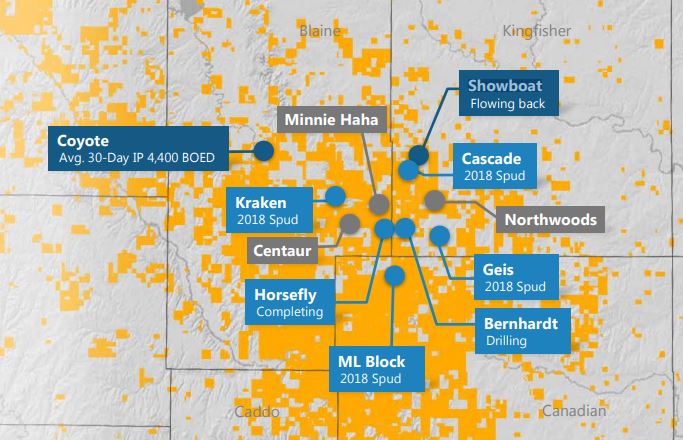

Overall, we have a strong inventory in the STACK. We have admittedly had a little bit of disappointment here, not tremendous, but there’s a little bit of short-term with Showboat with one development in the STACK, but with 90% of our development still in front of us we’re adjusting quickly, and we still have some strong, really strong return opportunities in the Eagle Ford as well. So we believe that this multi-basin approach that allows us to shift capital between several high-return basins is the absolute right approach, and it really optimizes returns versus being overly dependent on one specific play.

But we look at a lot of different things when we look at what may or may not remain in the inventory. We look at what is our overall depth of our development inventory, what’s the intrinsic value of the asset that we may be looking to monetize, and what is its production and cash flow contributions. We look at what are the prevailing market conditions out there. And obviously, we have teams that are very engaged and understand the market from both a buy and a sell standpoint extremely well.

And when we identify an opportunity to pull the trigger, we’re not afraid to do so. If you look at our history here, we’ve had about $30 billion worth of transactions over the past decade. I’m not going to telegraph today specifically what may or may not, but those are the key issues that we look at here. We think we have a very strong inventory where we are, and we’ll continue to evaluate conditions as we move forward.

Q: So getting a little more granular, when you talk about the spacing tests in the Turner, are you aligning those wellbores parallel or perpendicular to that old Cretaceous Seaway?

SVP, Exploration and Production of Devon Energy, Richard A. Gideon: Most of those are running in a north-south direction throughout the play. And we’re spacing those – in the areas that we have two horizons in Upper and Lower Turner, there’s a staggered pattern. And so it’s not just about one horizon. It’s understanding the different horizons and what the interaction is between the two.

Q: Dave, looking through your various spacing pilots in the STACK, Delaware, Powder, it looks like the approach you’re taking is that the initial projects, the spacing is something on the aggressive side, and then you’re working backwards. And I don’t know if that’s a fair assessment. But if it is, is the idea that you can get to the final answer in fewer iterations, are you getting more information in the pilot that actually has some interaction between wells?

President & CEO of Devon Energy, David Hager: Absolutely, I think you’ve nailed it. We want to learn early because we recognize in all of these plays that the vast majority of the development is in front of us. And so we have, just as we did, if you go back even a few years ago on completions, and when you may have said historically we’re pumping 600 pounds of sand per lateral foot, we could have easily taken the approach to go to 800 or 1,000 and test out what it is there. But we took the approach there that says let’s go on to a much higher concentration, up to 3,000 pounds or so, and learn early where the upper limits are, and then we can dial back a little bit.

I think you can take to a large degree that analogy and apply it to what we’re doing with our spacing tests. We chose to learn early. Frankly, we also collected a huge amount of data on the Showboat project, which we think is going to help inform us as well. And we recognize that it was aggressive, the spacing, but we’d rather if we were going to have an issue, we’d rather learn that early versus just slowly, incrementally up the spacing and get large – long distance into the development of the overall play before we really learn what’s optimum.

So there’s some pain with this process, we admit that. We’re feeling it a little bit today. There’s no question about that. But we think that overall, that is the right long-term decision, and leads to a higher returns and higher value in the long run.

Q: One thing I was curious about is the importance of sequencing your drilling, then completions, then putting pads on production across the section and then across multiple sections, and any differences that require sequencing between what you’ve seen in the Delaware, STACK, and now the Powder.

SVP, Exploration and Production of Devon Energy, Richard A. Gideon: Absolutely there’s some difference in sequencing, and the teams do a great job on the planning side of this, whether it be with our frac crews, rigs, or other services. It’s very dependent on how many horizons you’re going after. In the Delaware, we’ve done some tests where you’re hitting six different horizons.

What I’ll tell you is through our learnings and understanding the flow units, you’ll see some areas, especially in the Delaware, where you’ll see some smaller projects where we develop one flow unit, move away and then come back and develop the next flow unit to better utilize our surface facilities and infrastructure within the field, as well as water, et cetera. So I think as we move through this, you’re going to continue to see how we change based on spacing, but based on flow units also.

Q: Just to follow up on that, how do you think about the scale of required capital and working capital that is invested and what’s required for – a company the size of Devon can fund it, but maybe smaller companies, that becomes pretty important and pretty meaningful as you think about that fixed horizon development and the number of wells potentially. Have you done any math on how much capital you actually put into the ground before you turn it on production?

President & CEO of Devon Energy, David Hager: We do. We’ve done a lot of math on I’d say what is the optimum size development to optimize the rates of return. I think we probably have the capital to fund whatever is the right answer, but we do think that there is an optimum size in many cases to what optimizes the rates of return.

SVP, Exploration and Production of Devon Energy, Wade Hutchings: I would just jump in real quick and say we’re absolutely focused on the fact that time is money, and so we’re very much focused on eliminating as much float in the schedule or white space in the schedule as we can. But to Rick’s point, this often is a very technical set of judgments. For instance, on the two Showboat sections, there were six pads, and the team had a very specific order of which pads to stimulate and which pads to flow back in what order because of the impact that they would have on surface operations and even subsurface operations. And so it’s an area of intense work for us.

Q: What are your current well costs? You gave us the Delaware – or you gave us the STACK. What are the Delaware and Eagle Ford current costs?

EVP & CFO of Devon Energy, Jeff Ritenour: Dependent on the horizon in the Delaware again and dependent upon some of these new, we’re in the $7 million range on a lot of these down to about $5 million – $5.5 million on some of the shallower zones. We’re very early as we move into the Wolfcamp, but we are seeing progression of that lowering.

COO of Devon Energy, Tony D. Vaughn: The Eagle Ford wells lately, we’re putting a little bit larger sand loading in these wells, and they’re running about $6.5 million.