Next Up: IPO

Hess Corporation (ticker: HES) has announced plans for a 50/50 joint venture (JV) consisting of its midstream assets in the Bakken Shale. The company will receive cash consideration of $2.675 billion from its partner, Global Infrastructure Partners (GIP), as part of the agreement. The full value of the deal is $5.35 billion.

GIP is a private equity company with offices in three different continents and interests in projects around the world. The equity investor holds a business relationship with Williams Partners LP (ticker: WPZ) and owns a 25% stake in the Freeport LNG project, which is scheduled to be commissioned in 2018 and export a maximum of 1.8 Bcf/d.

Hess and its Midstream Dream

The joint venture will operate under the name Hess Infrastructure Partners, and the company will pursue an initial public offering (IPO) for Hess Midstream Partners LP once the transaction closes in early Q3’15.

Tallgrass Energy GP (ticker: TEGP) and PennTex Midstream Partners LP (ticker: PTXP) are the only oil and gas MLPs to commence IPOs to date in 2015.

In preparation of the new venture, Hess will begin reporting its Bakken midstream division as a separate segment. Pertaining to Q1’15 financials, the division earned net income of $27 million with EBITDA of $64 million. Capital expenditures for 2015 are expected to range from $325 to $350 million and will be funded purely by the JV. Fiscal 2015 net income is expected to reach $150 million at its midpoint, with EBITDA reaching $290 to $300 million.

Bakken Value Holds Up

Raymond James Equity Research noted the richness of the deal in a note titled “The Bakken Hasn’t Lost Its Luster.” Based on guidance, the transaction multiple equates to 18x EBITDA – a valuation that is “lofty even for publicly traded MLPs, to say nothing of private transactions,” says Raymond James. “GIP is clearly a motivated buyer!”

Capital One Securities agreed. The transaction value of $18.70 per share is nearly triple the initial estimated value of $6.80 per share.

Hess management spoke publicly about establishing a master limited partnership as long as one year ago. John Hess, Chief Executive Officer, outlined tentative plans in his company’s Q1’15 conference call. “Even though the contracts will work for Hess and Hess will maintain all the commodity exposure, the MLP will not have that commodity exposure,” he said. The possibility of selling its midstream services outright was also explored, but the MLP route enabled Hess to “Retain operational control, while maximizing the value of (its) infrastructure investment.”

Hess Midstream’s Assets

Hess Midstream’s Assets

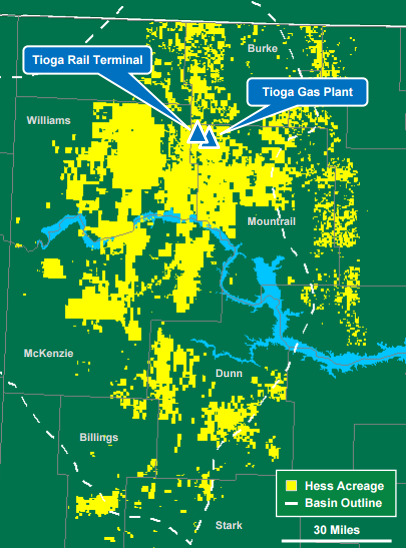

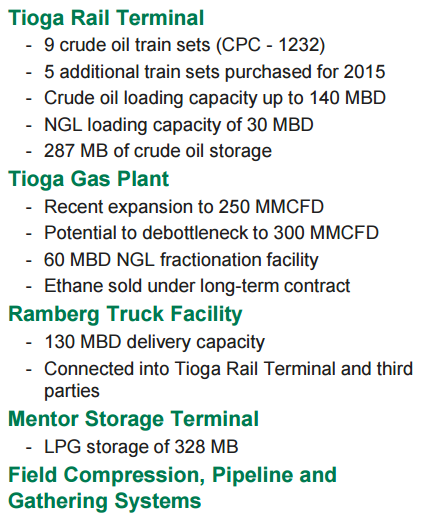

The midstream provider will be one of the largest operators in the Bakken Shale, according to Hess management, consisting of more than 3,000 miles of pipeline, various processing plants, gathering systems, storage caverns and loading terminals. The Tioga gas plant is the largest of its kind in North Dakota and holds gas processing capacity of 250 MMcf/d. It is also the only ethane extraction system in the region, with NGL capacity of 60 MBOPD.

The venture will incur $600 million of debt through a 5-year Term Loan A facility which will equally divide proceeds between the partners. The JV has access to capital by means of a $400 million five year senior revolving credit facility, which is fully committed.

Combined with the war chest of GIP, “The joint venture will be in a strong position to fund future energy infrastructure investments and continue to grow its midstream business,” said Hess. Stock repurchases will be executed on a “disciplined” basis, said management. The six-person board will consist of three members from each company.

Hess will remain the operator of the assets, giving it control of the day-to-day operations. Strategic matters, such as capital structure, will require nearly unanimous approval from the board, however, meaning GIP will have more influence on the JV’s macro decisions.

Hess, the Parent Company

The nearly $3 billion in proceeds from the transaction equates to roughly 16% of Hess’ market cap as of June 10, 2015, and its liquidity nearly doubled. “We now have more than $8 billion of liquidity, a pro forma net debt-to-capital of approximately 10% and no significant near term debt maturities,” said John Rielly, Chief Financial Officer of Hess.

Raymond James called the transaction “extremely bullish” for Hess, and that the scale of the monetization was “dramatically larger than we could have envisioned.” Its operations in the Bakken are on the rise; Q1’15 volumes of 108 MBOEPD were 71% higher on a year-over-year basis. Production from the region accounts for about 30% of Hess’ flow. 2015 capital guidance was revised modestly to $4.1 billion the previous estimate of $4.7 billion.

3,300 Bakken Drilling Locations in Inventory: 8 Rigs Going

The large cap E&P still has plenty of work to do in the Bakken. An estimated 3,300 drilling locations remain in its acreage, and the company believes it can generate returns of up to 22% within five years if the midpoint price of West Texas Intermediate is $45. Eight rigs are scheduled to be in service throughout 2015.