Rice Energy (ticker: RICE) announced the intent to form a master limited partnership (MLP) prior to its Q2’14 earnings release on August 11, 2014. The announcement comes less than seven months after Rice closed its initial public offering in January 2014. The MLP offering is expected to consist of the company’s Pennsylvania gas gathering assets and will likely close in the first half of 2015.

MLP Payoff

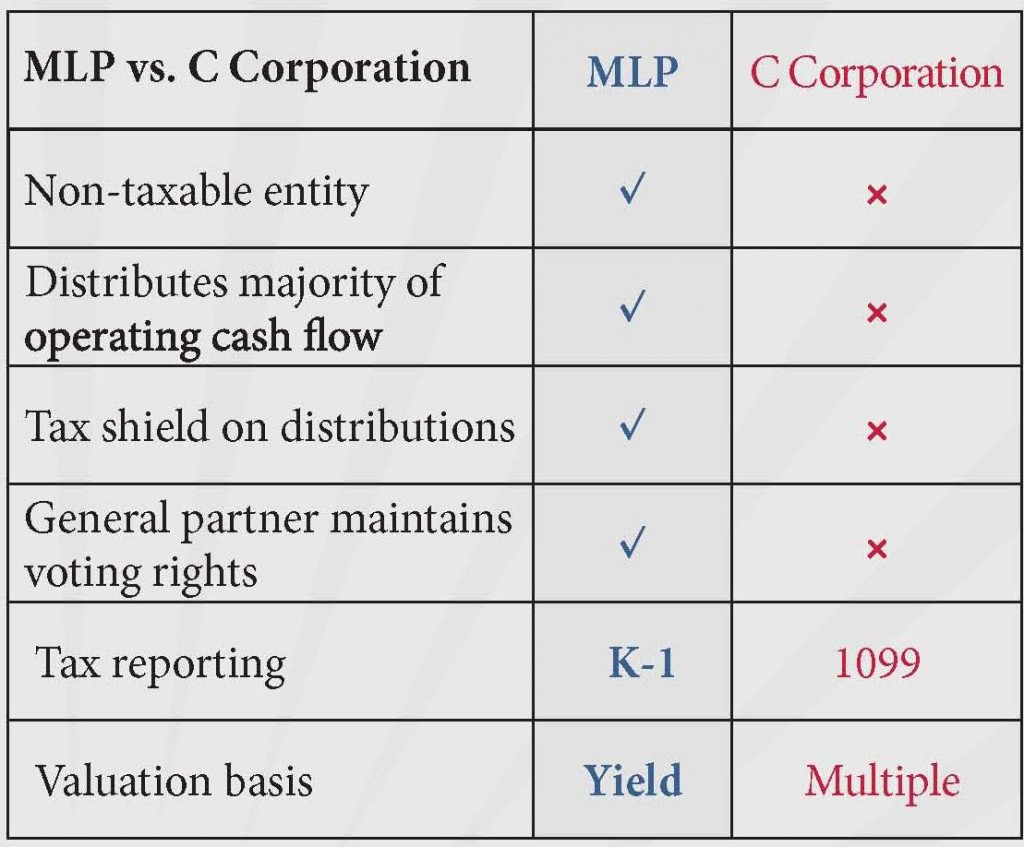

Fidelity Investments breaks down the benefits and drawbacks of MLPs on its site. Put simply, “Master limited partnerships are publicly listed securities that trade much like a stock, but they are taxed as partnerships, not as corporations,” according to the page. Listed benefits are high yields and potential tax advantages, and most MLPs are created from a company’s midstream assets. In fact, Forbes reports at least 17 E&Ps have issued plans to create MLPs in 2014 alone. Noble Energy (ticker: NBL), CONSOL Energy (ticker: CNX), Devon Energy (ticker: DVN), Hess Corporation (ticker: HES) and Breitburn Energy Partners (ticker: BBEP) are just a handful of large companies who have announced MLP plans within the year.

“Even though the contracts will work for Hess and Hess will maintain all the commodity exposure, the MLP will not have that commodity exposure” said John Hess, Chief Executive Officer of Hess Corporation, in his company’s Q1’14 conference call. The company was also exploring the possibility of selling its midstream services outright, but the MLP route enabled Hess to “Retain operational control, while maximizing the value of (its) infrastructure investment.”

Due to SEC regulations, Noble, Rice and CONSOL did not comment on their respective MLPs.

Disadvantages?

Fidelity also listed several possible disadvantages of an MLP, including concentration risk, illiquidity, exposure to potential volatility, tax reporting complexity, fiscal policy and market risk. Joanna Bewick, a portfolio manager for Fidelity, explains that MLPs can face cash flow problems since most of its proceeds are distributed to investors. “Capital markets all but shut down in 2008 and 2009, and MLPs displayed commensurate volatility because they rely so heavily upon debt and equity markets to raise capital,” she says on the company page.

The site also says, “MLPs has been desirable for some investors in this low bond yield environment, an eventual rise in interest rates might diminish their appeal.” The Federal Reserve has hinted towards raising interest rates within the year but has yet to execute on such a decision. Charles Goodson, a member of the Energy Advisory Council of the New Orleans Branch of the Federal Reserve Bank of Atlanta, told OAG360 in April that he believes the Federal Reserve will likely be out of the bond buying market by October or November 2014, potentially followed by a quarter-point rise in interest rates in the second half of 2015.

MLP Pioneer Reevaluates its Position

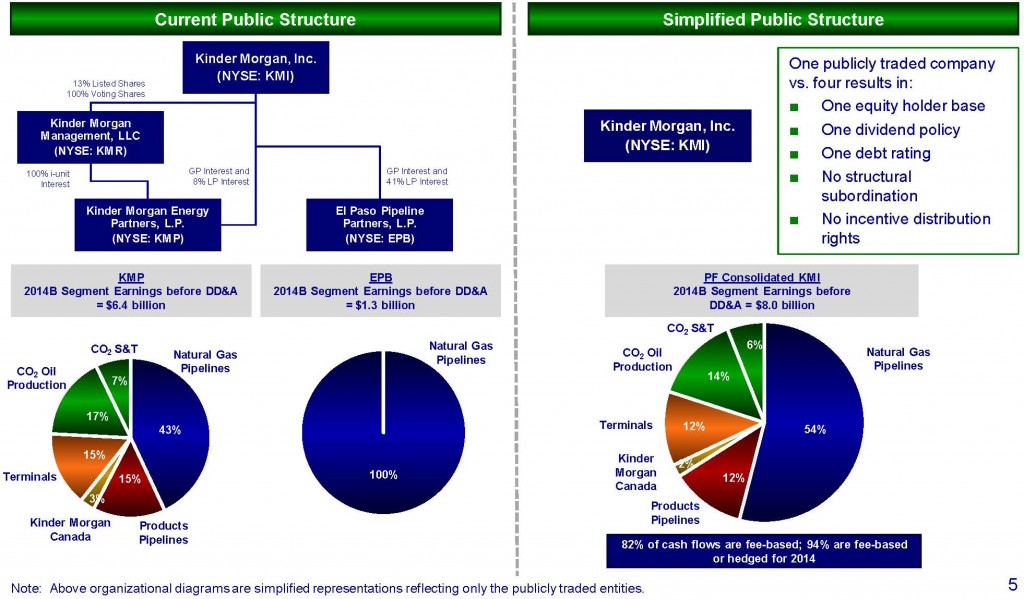

Kinder Morgan Inc. (ticker: KMI) announced plans to reacquire its three MLPs on August 10, 2014, ultimately creating North America’s largest infrastructure company. The Wall Street Journal reports that KMI had simply outgrown the MLP structure and the merger prevents future limitations due to cash constraints, since Kinder Morgan Energy Partners (ticker: KMP), for example, was distributing as much as 46% of its cash to KMI.

“This transaction dramatically simplifies the Kinder Morgan story, by transitioning from four separately traded equity securities today to one security going forward, and by eliminating the incentive distribution rights and structural subordination of debt,” said Richard Kinder, Chairman and Chief Executive Officer of Kinder Morgan, in a press release. Kinder added the merger will lower the investments necessary for new infrastructure and set the stage for anticipated growth of 10% from 2015 to 2020. Other benefits, according to KMI, are significant tax benefits for shareholders from depreciation deductions associated with the upfront purchase and future capital expenditures.

Benefits for Smaller Companies

The MLP structure fits well for companies smaller than KMI, which stands to hold an enterprise value of $140 billion following the merger. The two most recent MLP creations of Rice Energy and Breitburn Energy Partners hold advantages for each respective company. Breitburn is spending $3 billion to acquire QR Energy, an upstream-based MLP, and will benefit BBEP’s horizontal drilling program. “The decline rates on those horizontal wells are real high,” said Mark Pease, President and Chief Operating Officer of Breitburn, in the company’s Q2’14 conference call. “As we move forward with the program, we will be able to structure something that ameliorates that high initial decline and will very likely alleviate some of the capital upfront.”

Although volatility can cause worry on the MLP front, major publications believe the surging oil and gas industry still provides plenty of upside. “With demand for pipelines growing, the appeal of MLPs is likely to remain strong, even if the Federal Reserve raises interest rates,” said Loren Steffy, a contributor to Forbes. “In other words, the MLP structure still works for most partnerships.”

Michael Aneiro agrees in his Barron’s Magazine column, and said: “The long-term prospects for MLPs still look good: The U.S. is evolving into a major producer of oil and natural gas, and all of that production needs infrastructure…. These “pipeline” or “midstream” MLPs collect their fees regardless of the prices of the oil or natural gas they’re transporting, making them among the best MLP investments.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.