Hi-Crush opened 2 new facilities, announced $100 million buyback

Q3 highlights

- Revenues of $167.6 million

- Quarterly record of 2,456,195 tons of frac sand sold

- Net income of $29.8 million, resulting in $0.33 basic and $0.32 diluted earnings per limited partner unit

- Q3 2017 distributable cash flow of $37.5 million vs. $22.9 million in Q2 2017

- Resumed quarterly cash distribution of $0.15 per unit; announced unit buyback program of up to $100 million

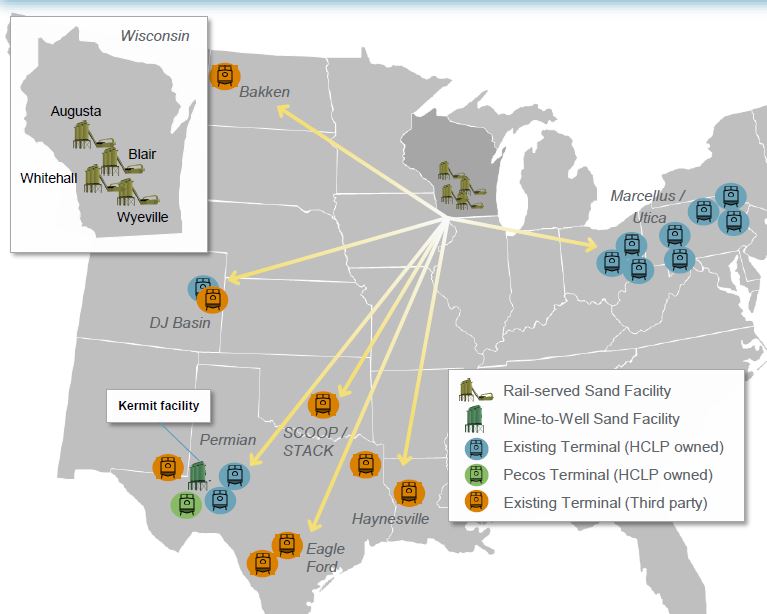

Hi-Crush CEO Robert E. Rasmus said, “Over the last several months, we completed several critical projects, including the construction and commencement of operations at our Kermit facility and Pecos terminal in the Permian Basin.”

Hi-Crush said the average sale price was $68 per ton in Q3 2017. Prices generally improved due to continued increases in frac sand demand, in excess of available supply, particularly for fine mesh sand. There has been a 16% growth in volume sold, according to CFO Laura C. Fulton.

Kermit facility

Operations began in July 2017 and the Kermit facility is the first to produce and sell in-basin frac sand in the Permian. The annual production capacity is an estimated 3 million tons, 90% is currently contracted with customers under long-term, fixed-price arrangements. The Kermit facility reduces delivery costs and improves production and logistic capabilities within the area.

Fulton said that volumes sold from Kermit contributed to 10% of total sales volumes for Q3. Construction and operations began two months ahead of schedule. Production reached full utilization mid-October and should produce better financial results in Q4.

Pecos terminal

The new Pecos, Texas terminal began operations in October. The terminal is the first unit train capable terminal with silo storage in Southern Delaware Basin. Hi-Crush is actively delivering sand via rail to the Pecos terminal, which includes 20,000 tons of vertical silo storage on-site, from its two Union Pacific-connected Northern White facilities in Wisconsin. This is the third Permian Basin terminal, the other two terminals, Odessa and Big Spring, are located in the Midland Basin.

Rasmus said construction and operations began on time. He also said that the terminals will provide flexibility, diverse sand products, and enhance surety of supply by mitigating logistical bottlenecks.

PropStreamTM

PropStream, Hi-Crush’s last-mile containerized delivery solution, allows direct sand supply into the blender hopper at the well site. Seven PropStream crews are currently operating in the Permian Basin and Marcellus and Utica plays. The total number of crews is expected to grow to nine or more by the end of 2017.

Liquidity and capital expenditures

- $193.2 million of long-term debt outstanding

- $82.1 million in cash and available capacity, revolving credit

- Capital expenditures ending Sept. 30 totaled $108.1 million; costs are related to the construction of the Kermit facility, the Pecos terminal, and equipment for PropStream

- Planned Q4 capital expenditures: $7 to $17 million

- Total capital expenditures for 2018: $35 to $45 million

Hi-Crush expects Q4 sales volumes of 2.7 to 2.9 million tons. All five production facilities project a 85% utilization rate in Q4.

Conference call Q&A

Q: How did the basin mix change quarter-over-quarter, in terms of where you were selling sand? Could you talk about the use of third-party terminals? What about a normalized rate, was this quarter normalized or were the prior two quarters more normal?

HCLP CFO Fulton: I think you bring up an interesting point. We are in a state of transition as the Kermit mine is ramping up its operations to full capacity. When I look at the basin mix, for the third quarter, it was still probably similar to where it’s been in the past. We sell about half of our volumes in the Permian, about a third of our volumes in the Marcellus and Utica, and the rest are kind of scattered around through the Bakken, the DJ, Mid-Con, and other places.

When I think about our use of third-party terminals, obviously we are biased to using our owned and operated terminals. Those are the most efficient and give us the greatest throughput in the Permian, Marcellus, and Utica.

But as we have seen increases and activity in the Bakken, the Mid-Con, and the DJ, we have been using some third-party terminals in those locations. And so I think that’s where you’re seeing a slight change.

It’s all going to kind of depend quarter-over-quarter. But I think over time, we would expect our use of our owned and operated terminals to increase more particularly now that Pecos has come online and we started shipping unit trains to that location and are delivering into the truck there.

Q: Are you guys seeing any cost inflation on the logistics side? If I look at logistics’ cost per ton in the quarter, it looks like it was up about 9% sequentially?

HCLP CEO Rasmus: I think it’s a function of two things. One, it just depends where you ship into which basins, the further you ship obviously you’re going to have greater logistics costs. And the other was, we had some issues that we experienced and we had to work around with the CN.

The CN has acknowledged publicly that they had operational issues in their most recent quarterly earnings call. And those issues really are related to crew availability as well as power availability, how they manifested themselves at a Hi-Crush was in terms of the cancellation of over 20 unit trains, so that over 200,000 tons of volume that we had to forego. Also, we incurred some direct dollar costs that affected our contribution margin to a negative about $0.50 per ton in that respect.

It could have been even worse. Due to our logistics expertise, we worked proactively with the CN and to try to mitigate those effects to the greatest extent possible. In terms of a resolution, the CN has estimated an end of year resolution. We’ve seen some incremental progress in solving some of those issues. We’ve been conservative assuming that those CN issues are resolved at the end of the quarter, rather than throughout the quarter. So as a result, I think we’re positioned for good volume growth and strong EBITDA growth in the fourth quarter, as well as continued improvements in the first quarter of 2018 and beyond.

Q: In the third quarter, could you elaborate a bit on Kermit, approximately what percentage of the contribution margin did it comprise?

CFO Fulton: I think it’s tough to look at the actual contribution margin itself. It may have been a relatively small percentage, maybe 5%, 10%. But when you look at the contribution from Kermit on a dollar basis, it’s more significant. When you spread that over the full volume sold on the contribution margin per ton, it becomes obviously less significant. We only operated at about 50% of the rates on average for the two months that we were operating about a third of its capacity – when you consider the full quarter.

Q: It sounds like volumes from Kermit were about 250,000 tons in Q3 and you’re expecting full utilization in Q4, so that’s up about 500,000 tons. The volume guidance suggests a sequential increase of 350,000 tons at the midpoint. So, should we expect volumes to fall at certain Northern White facilities in Q4, or is there some conservatism embedded in the guidance?

CFO Fulton: Well, I think there is some conservatism embedded in the guidance, and of course, Kermit didn’t reach full utilization until mid-October. Of course, there’s always a seasonality that you have in the November, December timeframe with the holidays and hunting season. I think we’re expecting a little bit of a drop off in sales volumes just from the regular seasonality that we’ve seen over the past several years. But we do expect to come and to be running at really strong rates in the fourth quarter and so the majority of that volume uplift is coming from that location.

CEO Rasmus: I mentioned earlier some of the issues we’ve experienced on the CN and that we’ve been conservative and assume that those issues will not be fully resolved until the end of this quarter.