Last week a new report was released that detailed a “stunning” production forecast for the Permian. The Permian is forecasted to more than double its 2017 oil production level of 2.5 MMb/d to 5.4 MMb/d by 2023, according to IHS Markit.

However, there is a sticky problem in the Permian that producers are facing and it’s getting more acute by the day—it’s the inability of takeaway capacity to keep up with skyrocketing oil and natural gas production in the basin.

However, one Permian producer WPX Energy (NYSE: WPX) has managed to distance itself from the problem by successfully positioning itself ahead of the curve. How? By using strategic partnerships and forward-planning to establish its own takeaway capacity very early on.

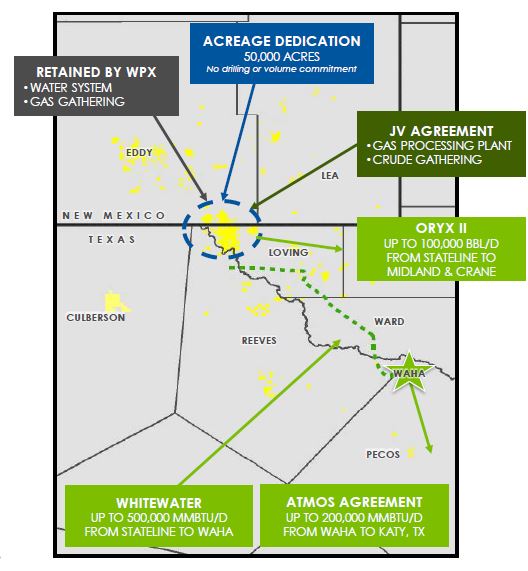

One major milestone for WPX was last summer’s joint venture with Howard Energy Partners.

This JV was setup to complete the buildout of a new crude oil gathering system, already started by WPX in the basin, and to begin constructing a new cryogenic natural gas processing complex with a planned initial capacity of 400 MMcf/day.

JV – Highlights

Assets included in JV

- Crude Gathering System: ~125,000 Bbl/d

- Gas Processing Facility: 400 MMcf/d

Takeaway Agreements

- Atmos Waha, Whitewater Midstream, Oryx II Crude

How did WPX get so far ahead of the takeaway curve in the Permian?

Oil and Gas 360® wanted to learn how WPX has been able to separate itself from the major hurdle that has emerged as a widespread problem for many, if not most operators throughout the Permian Basin. In this exclusive interview with WPX President & COO Clay Gaspar, OAG360 discovered which keys WPX turned to put the company ahead of the takeaway curve.

An exclusive conversation with WPX President and COO Clay Gaspar

OAG 360: Right now, how does WPX move its oil out of the Permian Basin?

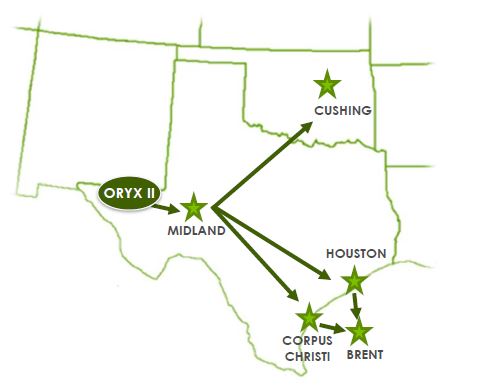

WPX Energy President and COO Clay Gaspar: We think about getting the product to customers downstream. This has taken us beyond the tanks that are on location. We think about getting the oil from the wellsite, the wellhead, all the way to the Midland-Crane local hub. And then very importantly, we’re a couple of years ahead by thinking not just getting it to Midland, but getting it out beyond Midland to more of the end markets like Corpus, Houston, and Cushing.

It’s kind of a two-step process. The first step is getting it to Midland. We do that via the Oryx II, Plains and Rangeland lines. Oryx is our primary outlet, but we’ll continue to use the others, as well. And then secondly, we get it out of Midland through a series of contracts and different pipelines that take the oil we produce to a diversified purchaser base.

OAG 360: What is your current takeaway capacity? In the Oryx II crude takeaway agreement, there’s 100,000 barrels a day, but is that your max capacity currently?

WPX Energy President and COO Clay Gaspar: Our current capacity on Oryx II is 100,000 barrels a day, which is well over our current production and will take some time to grow into. We are not limited to the 100,000 barrels of Oryx capacity though. As I mentioned earlier, we also have connections to Plains and Rangeland and have firm agreements to ship some volume on both of those systems.

OAG 360: A few days ago, Apache CEO John Christmann was on television talking about having to shut wells in in the Permian because of lack of takeaway. Has WPX had to do any of this?

WPX Energy President and COO Clay Gaspar: I’m happy to report we haven’t. I think it’s very important – this is the reasons that we took the steps that we did a year and a half, two years ago, to get these agreements in place. There’s always going to be normal disruptions in a very significant growing area. So, there’s always a constraint if it’s water, oil, needing some kind of infrastructure.

But we have enough existing capacity where it hasn’t been detrimental to our growth.

We see the current takeaway issues as a big challenge to the industry, specifically to the Permian Basin. But it’s not terribly unique. There’s always going to be a current challenge. We pride ourselves in thinking very much strategically about what are those challenges going to be not this year, but next year and the following year?

Rewind to middle of 2015.

We entered the Delaware Basin through our $2.75 billion RKI acquisition. And I can tell you, we got mixed reviews on that entry. It was a very forward-thinking move. We were way out ahead of a lot of the peers in identifying the geologic upside of this area.

And once we really got our hands on and got deep into operating that area, we had no questions anymore about the geology, the reservoir engineering, the producibility of this amazing resource.

The next question was: ‘Well, if we see it and there’s several high-quality operators all around us, if we all get to work in this basin, then what happens? What are the potential disruptors of converting the amazing inventory to amazing value?’

And we came up with three things.

Commodity price risk: use hedging to protect against the downside

The first was just strictly commodity price. We’ve been through an incredible rollercoaster. You’ve seen us be very aggressive hedgers with a mindset of: treat it as insurance. You’re protecting the downside. You have a differential risk to the downside than you do to the upside, meaning if oil price were to go down $20, it would be hugely disruptive – and we were fully exposed – hugely disruptive to our ability to continue to run rigs. If oil goes up that same amount, that’s a far better situation to be in. So that differential risk from the downside to the upside really was important to us to make sure that we protect it. So number one, was strictly commodity price risk.

Get out ahead of the supply chain

The second was supply chain. If things really get to work, we’re all reaching for the same rigs, the same frac crews, the same pieces of equipment and people, how do we get ahead of that?

And so, we got to work early. We aligned very strategically with some partners and initiated longer-term agreements. We also decoupled some of the most important services. For example, hydraulic fracturing historically has been a one-stop shop. They supply all the chemicals, the sand, the water, and the horsepower.

We’ve broken that apart, and so we’ve put agreements in place all the way back to the sand mines to make sure that we had direct access and we controlled that risk. So think of that as kind of that second potential disruptor. We were very proactive around the supply chain.

Lock up pricing assurance and flow assurance

The third is takeaway. And so that manifests in kind of two ways: the first is a differential basis blowout. What you’re seeing is that the gas price in the basin and the oil price in the basin are significantly lower than in other parts of the U.S. market.

That differential is really blown out. But we are well ahead of that. We made sure that we had pricing assurance to make sure that our economics remained intact.

The second component of takeaway is flow assurance: to make sure that you not just have pricing assurance, but you have the ability and the capacity in the lines to ensure that you have dedicated space to send your oil, gas, and NGLs to market. And we’ve done that. We’ve been very proactive locking in agreements a year and a half or two years ago to ensure that we had not just price assurance but also flow assurance—space in those pipelines.

OAG 360: Can you measure the expected financial effect your pipeline JV will have on WPX?

WPX Energy President and COO Clay Gaspar: You’re talking about the JV, and that’s one particular component of the midstream strategy. If I had to summarize it, our midstream strategy is to ensure that midstream is never a negative disruptor to the upstream part of our business. At the end of the day, we are an upstream company, and that’s where literally billions of dollars of value will be created. We just need to make sure that there’s no upsets in the midstream business so that we can deliver that upstream business, ultimately, to the market.

So that’s kind of our overall strategy. One component of that strategy was forming a joint venture with Howard Energy Partners, and that’s been hugely successful. We received some cash upfront; we received a carry, meaning that they’ll continue to pay our portion of the capital investment for some time.

And then most important to me is that we have alignment with a partner that has our best interests at heart and will continue to run with us as we develop the upstream business with the midstream business.

And so instead of essentially cashing a check, turning the keys over and saying, “Good luck, I hope you can keep up,” and then leaving them to essentially solve the equation for their own best interest, that is not what we want to do. We have a partnership, a 50/50 JV. We have three seats on the board; they have three seats on the board. And it is a regular communication between both of us that asks, ‘How do we build this out together?’.

There was some tangible value created at the signing of the deal, but I think the intangible, or yet-to-be-tangible value, will be created over the many years that this partnership continues. So that the partnership will make money, and more importantly, that our upstream business will have all of the needed midstream infrastructure to create that value.

OAG 360: Coming back to the differential you were talking about a little bit earlier, what do you think the WTI Midland price differential will be in the coming years?

WPX Energy President and COO Clay Gaspar: I think, ultimately, differentials solve themselves. Sometimes that happens quicker than other times. You have to know how big of a challenge it is to solve the problem. And specifically, in oil, specifically for the Permian Basin, the way you solve the problem is you build additional lines or additional capacity from Midland to the markets.

The good news is Texas is one of the more open states to the idea of pipeline construction. There are some parts of the country where it’s really not viable [to get a pipeline built]. I think additional lines can be built and will be built in Texas. There are several on the drawing board right now. The challenge is it’s typically a 24-month process from when you say “go” when you have full sanction, to finally get it up and running.

In years to come, to get back to your original question, I think this differential will close back again. Ultimately, we will as an industry, whether it’s arbitrage, capital steps in, and closes that arbitrage, it just takes a little while to do. Our focus is really making sure that we don’t have a negative disruption during this ballpark two years where there is this displacement in the prices.

OAG 360: Has WPX been affected by the differential in a significant way?

WPX Energy President and COO Clay Gaspar: Directly, no. I’ll answer it two parts. I would say when you see our next quarter and the fourth quarter financial releases, we will be very protected against the differentials.

Now, there’s also a kind of an indirect effect. One of my concerns in listing those three disruptors of developing this incredible resource is essentially this: all those are tied together by industry activity.

You’ve got amazing, great rock, you’ve got qualified operators, and when everybody gets to work, essentially the whole crowd is trying to get through the door at the same time, it just doesn’t work very well.

So I think the indirect impact to WPX is actually a benefit, and I see several of my peers talking about pulling capital away from the Permian, funding other parts of their portfolio, and that is really good for the industry overall and it’s really good for us, WPX, to have the industry essentially cool off the unprecedented pace of growth that’s been going on in the area.

OAG 360: Looking at what is happening in the Permian today, could you compare this to the Bakken when it was ramping up?

WPX Energy President and COO Clay Gaspar: I think the Bakken is a great analogy in several ways. I think the Marcellus is another great analogy in different ways. The Bakken is an oil play. You had too much oil for the amount of infrastructure that was in the Bakken. You were doing what I consider sort of unnatural things to solve the problem there. Here’s what I mean by that:

The natural flow, the best-case scenario for oil, is to send it down a pipeline.

But we were forced as an industry into moving a lot of oil via rail or by trucks. It’s temporary, it’s a Band-Aid that can work, but it’s really man-power intensive and it’s just an inefficient way of moving product. So that was a temporary fix. Now that the Dakota Access pipeline is online, that has taken a whole lot more of the Williston crude, and it’s just a much more efficient and safer way to move barrels around.

As I compare it to a place like the Marcellus, where you have an incredible resource – there’s no question in the geology now; similarly, in the Permian, there’s no question in the geology. The challenge for the Marcellus is they’re still infrastructure-constrained, being able to move that gas out of that basin.

And the unique thing about the Marcellus was gas was the issue, and it was a gas play, so that’s where all the economics were met. Contrast that with Midland, where gas will be one of the main constraints, but it is an economic byproduct relative to the oil. Oil is what drives the decisions as to, do we drill or do we not, generally speaking, for this play.

As gas becomes a unique challenge, it’s less the economic driver and it’s more just a means to an end. So how do we get this gas moved? It’s a means to making sure the oil continues to move, and ultimately, the economics of the well are based on the oil and the oil sales for the Permian Basin.

OAG 360: Do you foresee any likelihood that industry will eventually overbuild pipeline capacity in the Permian?

WPX Energy President and COO Clay Gaspar: Yes—not just any possibility, I think there’s an exceptionally high possibility. That’s typically the way this works. Technically speaking, we’re always either overbuilt or underbuilt at any given day. And so what happens is there’s not enough, and so we get projects going; essentially, one too many pipes or plants or refineries or whatever it is ends up getting built, and hopefully it’s only one and not several.

But we end up overcorrecting the other direction, and then we have to work back getting the pricing right and filling those plants or pipes as best we can to recover the returns, cover the investments in that takeaway capacity that was built.