Husky announces approval of 10 MBOPD modular Rush Lake 2 project

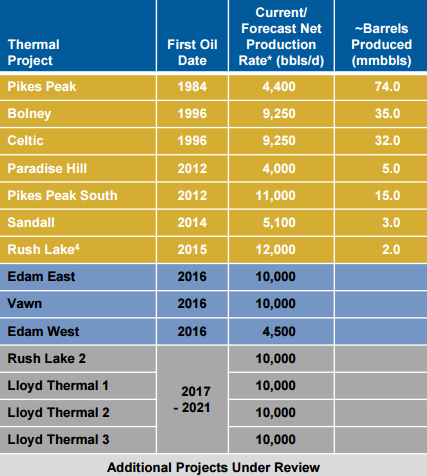

Husky Energy (ticker: HSE) announced today that the company sanctioned the Rush Lake 2 project, a 10,000 barrel per day (MBOPD) modular heavy oil thermal project, and the next phase in the company’s plans to produce 80 MBOPD from such projects by the end of 2016. Rush Lake 2 will be located in Saskatchewan, and will come online in late 2018, according to the company.

Alberta-based Husky has increasingly been focused on increasing production from low capital-cost projects like Rush Lake 2, which is based around a modular design. The modular design and small scale of the projects allows for “a highly standardized and modular approach to development,” increasing savings and boosting efficiencies in engineering, module fabrication, construction and ongoing operations, Husky said in a press release.

“Copy and paste” approach can reduce engineering costs by 2/3

According to a company presentation, Husky’s thermal oil projects take approximately two years to construct, one to three months to reach peak production, and have a production life of 15 years or longer. With operating costs of about $10 per barrel in the first two years of operations, Husky reported operating netback per barrel of $33.52 in the second quarter of 2015 on its thermal projects. The engineering costs alone of projects this size generally run about $40 to $50 million, but Husky has been able to lower costs in that particular area by more than two-thirds through a “copy and paste” approach, a representative at Husky Energy told Oil & Gas 360®.

The company reports that its thermal steam-assisted gravity drainage (SAGD) projects on its Lloydminster acreage allow it to recover more than 50% of the assets in place, allowing the company to realize higher returns.

80 MBOPD by the end of next year

While Rush Lake is not expected to come online until 2018, Husky has three more SAGD projects that it believes will begin production before the end of 2016, bringing the total amount of production from these small-scale thermal projects to approximately 80 MMBOPD.

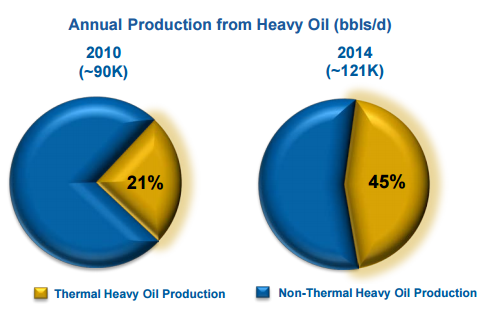

The company’s most recent SAGD project, the original Rush Lake, is currently producing at 3,000 barrels over its nameplate capacity of 10,000 Husky COO Robert Peabody said during the company’s third quarter conference call, bringing its current production from the small-scale thermal projects to 56 MBOPD.

“In a lower for longer world, where oil price is being increasingly determined by the strength in supply, these lower sustaining capital projects become even more strategic,” Husky CEO Asim Ghosh said in a press release in September.

The focus on less capital-intensive projects like its Lloydminster SAGD assets could be a healthy change of pace for Husky, which has an asset intensity – the trailing twelve month production (TTM) times three year finding and development costs divided by TTM cash flow from operations – of 427%, seven times the group median of 60% in EnerCom’s 54-company International E&P Weekly.

While the company’s EBITDA margin of 23% is below the group median of 53%, Husky also maintains a lower net debt to EBITDA margin of 1.3x compared to the group’s median of 1.7x, leaving the company less heavily burdened by debt. Husky’s debt to market cap was just 35% in the week ended November 13, 2015, 19% lower than the group median of 54%.

The company’s production is also the second largest in the EnerCom International group, with TTM production growing 6% to 314.2 thousand barrels of oil equivalent per day (MBOEPD). The only company with larger production in the group of 54 companies is Canadian Natural Resources (ticker: CNQ), whose TTM production as of the week ended November 13, 2015 was 749.7 MBOEPD. Assuming no other increase in production aside from its scheduled SAGD projects, only about 24% of the Husky’s production will come from these small-scale thermal projects, but the company believes they offer strong returns in the current price environment.